A letter of credit is an important financial tool in trade transactions. Trades use the LC to facilitate payments and transactions in both domestic and international markets. A bank or a financial institution acts as a third party between the buyer and the seller and assures the payment of funds on completion of certain obligations. Let us learn about the various types of letter of credit.

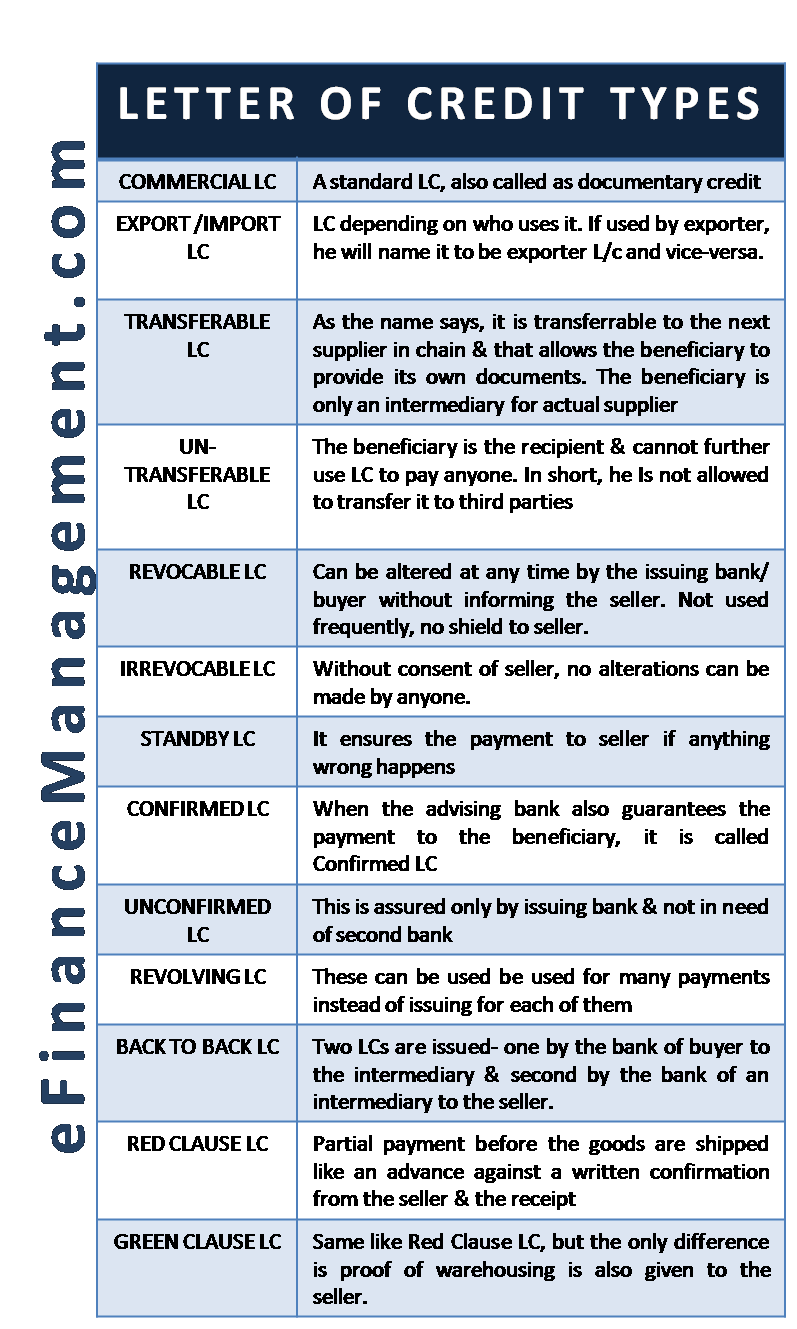

There are various types of letter of credit (LC) that prevails in trade transactions. In this post, we are classifying them by their purpose. They are Commercial, Export / Import, Transferable and Non-Transferable, Revocable and Irrevocable, Stand-by, Confirmed, and Unconfirmed, Revolving, Back to Back, Red Clause, Green Clause, Sight, Deferred Payment, and Direct Pay LC.

- Types of Letter of Credit

- Commercial LC

- Export/Import LC

- Transferable LC

- Un-transferable LC

- Revocable LC

- Irrevocable LC

- Standby LC

- Confirmed LC

- Unconfirmed LC

- Revolving LC

- Back to Back LC

- Red Clause LC

- Green Clause LC

- Sight LC

- Deferred Payment LC

- Discounting the Letter of Credit

- Direct Pay LC

- Inland LC

- Mixed Payments Letter of Credit

- Third-Party Letter of Credit

- Conclusion

- Frequently Asked Questions (FAQs)

Types of Letter of Credit

There are various types of letter of credit in trade transactions. Some of these are classified by their purpose. The following are the different types of letters of credit:

Commercial LC

The commercial LC is the most basic form of an LC. It is a standard LC, also called a documentary credit. In a commercial LC, the importer issues the LC with the exporter as the beneficiary. The issuing bank transfers it to the advising bank, which then makes payment to the exporter upon presentation of the necessary documents and proof on meeting the terms and conditions as set out in the purchase document/agreement.

Also Read: Letter of Credit

Export/Import LC

The same LC becomes an export or import LC depending on who uses it. The exporter will term it as an exporter letter of credit, whereas an importer will term it as an importer letter of credit.

Transferable LC

A letter of credit that allows a beneficiary to further transfer all or a part of the payment to another supplier in the chain or any other beneficiary is a transferable LC. This generally happens when the beneficiary is just an intermediary for the actual supplier. Such LC allows the beneficiary to provide its own documents but transfer the money further.

Un-transferable LC

An untransferable letter of credit doesn’t allow the transfer of money to any third parties. The beneficiary is the only recipient of the money and cannot further use the letter of credit to pay anyone.

Revocable LC

A revocable LC is an LC that issuing bank or the buyer can alter at any time without any notification to the seller/beneficiary. Such types of letters are not in use frequently as the beneficiary is not provided any protection.

Also Read: Commercial Letter of Credit

Irrevocable LC

It is an LC that does not allow the issuing bank to make any changes without the approval of all the parties.

Standby LC

A standby letter of credit assures the payment if the buyer does not pay. After fulfilling all the terms under SBLC, if the seller proves that the promised payment was not made. In this situation, the bank will pay the seller. In a nutshell, it does not facilitate a transaction but guarantees payment. It is quite similar to a bank guarantee.

Confirmed LC

Although a commercial LC transfers the creditworthiness from the importer to the issuing bank, there is still a chance that even the issuing bank is unable to make the payment. So, the exporter can seek additional protection by getting confirmed LC where the advising bank also ensures the payment. This is primarily to avoid the risk of non-payment from the first bank. It will add to the cost of doing business for the exporter.

Unconfirmed LC

A letter of credit that is assured only by the issuing bank and does not need a guarantee from the second bank. Mostly the letters of credit are the unconfirmed letter of credit.

Revolving LC

When a single LC is issued for covering multiple transactions in place of issuing a separate LC for each transaction is called a revolving LC. There can be multiple withdrawals from the LCs till it reaches the pre-set limit. They can be further classified into Time Based (Could be Cumulative or Non-Cumulative) and Value-Based. Such LCs are usually for the long term and are not transaction-dependent.

Back to Back LC

Back-to-back LC is an LC that commonly involves an intermediary in a transaction. There are two letters of credit, the first issued by the bank of the buyer to the intermediary and the second issued by the bank of an intermediary to the seller.

Red Clause LC

In a red clause letter of credit, the beneficiary can request an advance payment of the agreed-upon amount by presenting the receipt and writing an undertaking that the shipping documents will be delivered on an agreed-upon date.

Green Clause LC

Green clause LC is similar to the red clause LC, with an additional requirement of presenting the proof that the goods that were about to ship are now in the warehouse.

Sight LC

A sight letter of credit that demands payment on submitting the required documents. The bank reviews the documents and pays the beneficiary if the documents meet the conditions of the letter.

Deferred Payment LC

A normal LC requires the payment to the exporter upon submission of the necessary proofs and documents for complying with the shipment terms and conditions. On the other hand, a deferred LC gives some time to the importer after the receipt of the goods or commencing the shipment before he is required to pay the amount. It is beneficial in an established working relationship where the importer can only get funds for payment after he has started selling his goods. This is one kind of credit transaction in the normal course of business. However, secured through a proper LC. It is also known as Usance LC.

Discounting the Letter of Credit

As per the deferred payment clause, the exporter may need cash before the payment date. In this case, the advising bank can pay the amount on which they agree to the exporter after deducting a discounting fee before the actual payment by the importer. We can also call such an arrangement ‘discounting the letter of credit‘. In this case, the advising bank can pay the amount on which they agree to the exporter after deducting a discounting fee before the actual payment by the importer. And depending upon the relationship and credentials, the payment can even be before the shipment or before the production starts for that order.

Direct Pay LC

A letter of credit where the issuing bank directly pays the beneficiary and then asks the buyer to repay the amount. The beneficiary may not interact with the buyer.

Inland LC

An inland letter of credit is of use in domestic trade transactions, where both the buyer and seller are from the same country. It is used for transactions in the home country. The other term for it is the ‘domestic letter of credit.’

Mixed Payments Letter of Credit

Such LCs can have multiple payment terms as well as multiple payment modes. For example, 50% of the payments happen on sight. Another 25% of payments occur after 30 days of shipment. And the remaining 25% of payments will happen on receipt of the shipment.

Third-Party Letter of Credit

The applicant issues the LCs for the beneficiary while the third party makes the actual transaction. Basically, transacting parties and the beneficiary can be different in such types of LCs.

Conclusion

As mentioned above, a letter of credit can be of various types depending on its purpose. It is in the interest of both the buyer and the seller to understand all the different types thoroughly and then pick the one which serves the purpose completely.

Frequently Asked Questions (FAQs)

Types of LC: commercial LC, export/import LC, transferable LC, un-transferable LC, revocable LC, irrevocable lc, standby LC, confirmed LC, unconfirmed LC, revolving LC, back-to-back54 LC, red clause LC and green clause LC, sight LC, and deferred payment LC, and direct pay LC

There are four parties in LC- the beneficiary/seller, the buyer/applicant, issuing bank, and the advising bank.

A revolving LC is a single LC that is used for multiple transactions over a long period of time. It helps to avoid issuing separate LC for each transaction. It is used for the regular shipment of the same commodity between the same buyer and the seller.

The sight LC refers to the document that acts as verification for the payment. The payment is issued on the submission of these documents. The bank reviews these documents and pays the beneficiary only if the submitted documents meet the condition of the letter.

good to have it

This types of information always helps us to all export / import business.

Apni ki back to back lc ar kaj korin

Thanks for your help. You put your effort to assist the people who work with foreign trading.

Helped a lot,

Thank you! Helped a lot!

Thanks a lots

Genuine proper information about the above explanation

Well presented and a good read.

It’s very simple language you have explain the LC and types of LC.

This is a good understanding of the letter of credit thanks a lot

Just check if you are talking about

Sight Letter of Credit

or

Usance Letter of Credit

It’s very simple language you have explain the LC and types of LC so thanks a lot

Hello sir, I would like to understand, suppose if i take the order from company X who is doing a project for company Y. I supply materials and raise invoice on company X. But is that possible that company Y can open an LC on behalf of company X and make payment directly to me based on the transaction documents between company X and me? How feasible to have this type of transaction in LC? Is there a way in LC? Kindly advise

Refer transferrable LC. This is possible. Example import of solar panel by EPC contactor (company X/importer) for solar power project to be setup for company Y. However in transferrable LC the goods cannot change and complication of pricing difference if any between the value of import and the value of supply has to be addressed suitably/mutually agreeable.

Here company Y is ultimate buyer and owner of the solar power project (which shall include solar panel as one off the component of the project which was imported by the EPC contractor (X) wherein contract for setup of project was given by Y to X.

Thanks. It was an insightful content as far as the letter of credit is concerned.

Can L/C be issued in the name of Individual? For example Beneficiary name: Ronald Dsouza

Yes, Why not? You just need to satisfy the bank norms.

can you Pls rtefer any article (perfer to UCP 600 or any athenticated) regarding L/C can be issued to any individuals name. Like mentioned above??

you are truly a good webmaster. The website loading velocity is amazing. It sort of feels that you’re doing any distinctive trick. Also, The contents are masterpiece. you have done an excellent job on this topic!

Can we utilize various types of LC together like :

Irrevocable Letter of Credit

Revolving LC will be used 100,00/M for 12 months

Deferred Payment LC -Payment with 30 days after Shipment date

I got good info from your blog.

Hello,

Could you please let me have the sample letter/template of how to inform an exporter/seller (goods) that our method payment is by Letter of Credit.

Thanks

Helpful

Learned a lot about LC from your site

Can a buyer issue revolving LC that is confirmed, irrevocable & transferable to the seller?

Is there any LC named open LC ?

It is a good article.

Is this the same as special credit on finance to international trade

What is UPass LC ????

Hi,

thank you very very much, this is very helpful and useful

Sir, thanks for above info, please also elaborate discounting of LC.

Hi Faisal,

You can visit this post for knowing about Discounting of LC.