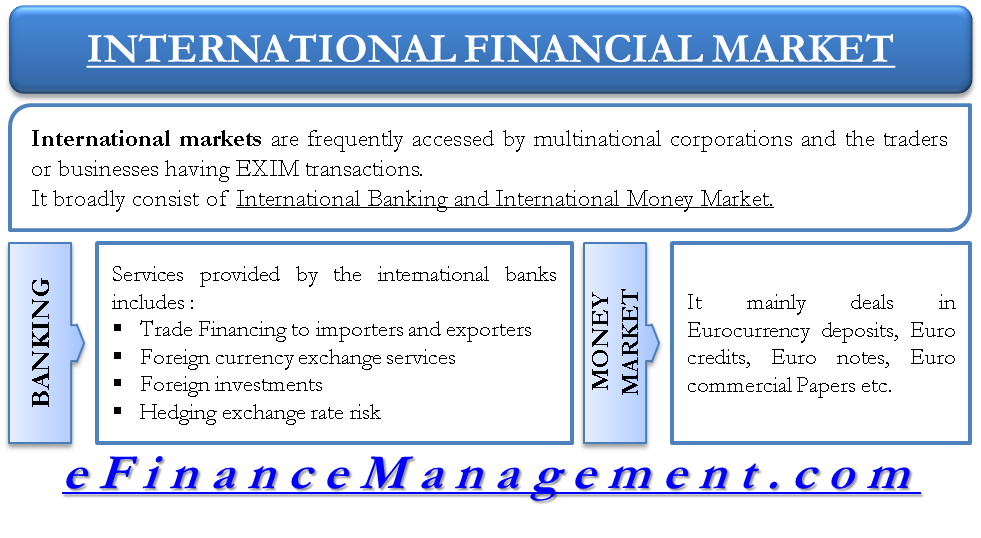

International financial markets consist of mainly international banking services and international money markets. The banking services include the services such as trade financing, foreign exchange, foreign investment, hedging instruments such as forwards and options, etc. International banks provide all these banking services. The international money market includes the Eurocurrency markets, Euro credits, Euro notes, Euro commercial paper, etc.

International financial markets, as we saw, can broadly be classified into international banking and international money market. Multinational corporations access the international markets more than anybody else. Traders or businesses having import and export transactions also have frequent access to these markets.

International Banking

International banking is quite different from domestic banking. As there are several services that international banks provide as per the requirement of the international environment. The following are such services:

Trade Financing

Importers and exporters require various trade financing services. An importer importing goods from outside may wish to open a letter of credit to the exporter from another country. The importer is unknown to the exporter, so the deal is routed through the banks.

Also Read: Forex Market Participants

Documentary collection is another way in which the exporter of goods provides the bank with all the documents required for releasing the goods under shipment. The importer gets these documents only after the bank receives payment.

A trader who is not in a place to invest a lot of money into his debtors can avail of factoring and forfaiting services. Under this service, the trader hands over his accounts receivables into a bank or third party’s hand for collection. The trader effectively sells his debtors at a discount and frees his money.

Foreign Exchange

International businesses have frequent transactions in foreign currencies and therefore have payables or receivables in those currencies. To close such transactions, the businesses need foreign exchange, international banks, and institutions provide. These institutions have their bid and ask rates for currency buying and deposits. They buy or accept currencies at a bid price that is less than the ask price at which they sell. These banks have the privilege to trade foreign exchange in international markets.

Foreign Investments

We all know that the banks are no more doing traditional banking. They have a gamut of services to be provided to their clients both domestically and internationally. Foreign investment is one of such services that multinational banks offer to their clients. Since these banks have their presence in many countries, they are in a better position to provide consulting services to their clients for their investing requirements.

Also Read: Foreign Exchange

Hedging Exchange Rate Risk

It is a known fact that dealing in foreign currency is risky. The reason for the risk is: the prices of currencies are very fluctuating. The price at which a deal is struck may not remain constant till all the transactions are over. It is the situation where hedging plays an important role. With the help of hedging instruments such as forwards and options, risks can be mitigated, and planned profits may be attained. Such instruments are the contracts that lock the currency prices on a particular day in the future.

International Money Market

The international money market mainly deals in Euro currency deposits, Euro credits, Euro notes, Euro commercial papers, etc. All these involve foreign currencies. Eurocurrency deposits are deposits of foreign currency in a bank that is in a country different from the country of that foreign currency. An Indian depositing US dollars in a Chinese bank in China is a Eurocurrency deposit.

Euro credits are loan that extends to corporations in a currency other than the home currency. These are generally short-term to medium-term loans and are extended by a syndicate of banks because the quantum of loans is too big, and the risk cannot be assumed just by one bank.

Likewise, the other money market instruments include euro notes, euro commercial papers, etc.

The international financial market is a more prominent market available for multinational and other domestic companies. When a growing business reaches international heights, it has a lot of services that international banks and financial institutions can offer. These markets provide a business with a platform to take their businesses to a different height.

Other markets included in international financial markets are the international equity market, international bond market, foreign exchange market, international credit market, etc.

Thanks Sanjay this blog helped in understanding the concepts as well as preparing answers for assignments as well. Keep up the good work!