Imagine a company that wants to give its shareholders a special bonus, like a thank-you for investing in the company. But instead of using its own profits, the company borrows some money to give this bonus. This clever financial move is called “dividend recapitalization.” It’s like the company is taking a loan to share some extra money with its investors. In this explanation, we’ll break down what dividend recapitalization is, why companies do it, and what good and not-so-good things can happen because of it. It’s a bit like a puzzle piece in the big picture of how businesses handle their money.

What is Dividend Recapitalization?

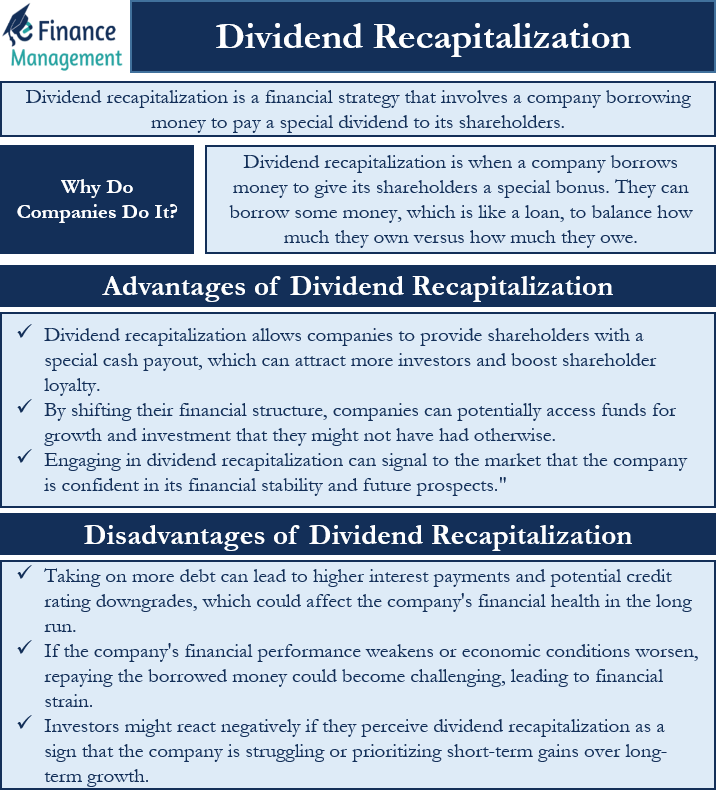

Dividend recapitalization is a financial strategy that involves a company borrowing money to pay a special dividend to its shareholders. It’s a bit like a company taking out a loan to give its investors an extra bonus. This special dividend is on top of any regular dividends the company might already be paying. The company uses the borrowed funds to make this special payment to its shareholders.

Why Do Companies Do It?

Companies choose to engage in dividend recapitalization for a variety of reasons. One common reason is to reward their shareholders without using their own profits. This can make the shareholders happy and show that the company values their investment. Additionally, companies might use this strategy to adjust their financial structure. By taking on debt, they can change the balance between equity (ownership) and debt in their overall finances.

Advantages of Dividend Recapitalization

Shareholder Rewards

Dividend recapitalization is a smart way for companies to offer their shareholders an extra cash reward. This can actually make more people interested in investing in the company and make the current investors feel even more loyal.

Financial Flexibility

When companies change the way they manage their money through dividend recapitalization, it might help them get money for growing and investing in new things. Without this strategy, they might not have been able to get that extra cash.

Confidence Signal

Companies that use dividend recapitalization are telling the world that they feel really sure about their money situation and how things will go in the future. This can make other people trust them more and think positively about the company’s future.

Disadvantages of Dividend Recapitalization

Increased Debt

Taking on more debt can lead to higher interest payments and potential credit rating downgrades, which could affect the company’s financial health in the long run.

Risk

If the company’s financial performance weakens or economic conditions worsen, repaying the borrowed money could become challenging, leading to financial strain.

Market Reaction

Investors might react negatively if they perceive dividend recapitalization as a sign that the company is struggling or prioritizing short-term gains over long-term growth.

In essence, dividend recapitalization is a financial move that comes with both benefits and risks. It’s a way for companies to reward their investors while managing their financial structure. Understanding its implications can provide insights into how businesses make strategic financial decisions to balance immediate returns with long-term stability.

Also Read: Recapitalization

Example of a Dividend Recapitalization

Let’s consider the hypothetical case of Company XYZ and Private Equity Firm ABC:

- Private Equity Firm ABC acquires Company XYZ with a combination of equity and debt. They put up their own capital and also borrow a significant amount from lenders to finance the acquisition.

- After the acquisition, Company XYZ experienced strong growth and improved financial performance. The company’s earnings and cash flows have increased significantly over a few years.

- Due to its improved financial performance, Company XYZ pays down a substantial portion of the debt it initially took on to facilitate the acquisition. This improves the company’s overall financial stability and creditworthiness.

- With Company XYZ’s increased cash flows and reduced debt, Private Equity Firm ABC decided to undertake a dividend recapitalization. In this scenario, they structure the recapitalization by borrowing additional funds using the company’s improved creditworthiness. This new debt is typically raised at a lower interest rate compared to the initial acquisition debt.

- The proceeds from the new debt are used to pay a special dividend to Private Equity Firm ABC. This dividend payment is made to the private equity firm as a return on their initial equity investment. Essentially, the private equity firm is extracting some of the value created by Company XYZ’s growth.

- This dividend recapitalization allows Private Equity Firm ABC to recoup a portion of its initial investment while still retaining ownership of Company XYZ. The company’s financial structure remains intact, but the private equity firm has effectively taken out some of the value in the form of cash.

Frequently Asked Questions (FAQs)

Companies use dividend recapitalization for various reasons. It can reward shareholders without using company profits, adjust the balance between equity and debt in their finances, and signal confidence in their financial stability and future prospects.

Dividend recapitalization allows companies to reward investors while strategically managing their financial structure. By offering an additional dividend and adjusting their equity-to-debt ratio, companies attempt to maintain a balance between providing shareholder value and ensuring long-term financial stability.

The success of a dividend recapitalization hinges on the company’s ability to manage the increased debt, sustain its financial performance, and navigate market reactions. Positive factors include strong financial health, sustainable growth, and favorable economic conditions. Negative factors could involve deteriorating performance, economic downturns, and market skepticism about the company’s motives.

Regular dividends are periodic payments made by a company to its shareholders from profits. Dividend recapitalization involves borrowing money to pay an additional, one-time dividend. Unlike regular dividends, which are typically funded from profits, dividend recapitalization introduces debt into the equation to distribute the special dividend.