Financial Leverage

Financial Leverage – Meaning

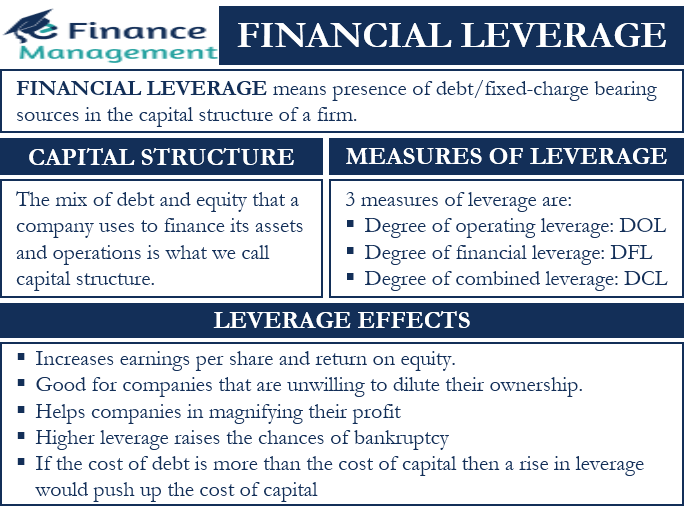

Financial leverage means the presence of debt in the capital structure of a firm. In other words, it is the existence of fixed-charge bearing capital, which may include preference shares along with debentures, term loans, etc. The objective of introducing leverage to the capital is to achieve the maximization of the wealth of the shareholder.

Financial leverage deals with profit magnification in general. It is also well known as gearing or ‘trading on equity.’ The concept of financial leverage is not just relevant to businesses, but it is equally true for individuals. Debt is an integral part of the financial planning of anybody, whether it is an individual, firm, or company. However, in this article, we will try to understand it from the business point of view. But before diving deep into the concept, let’s have a quick look at what capital structure is.

Capital Structure

A company can use debt as well as equity in the form of capital. So, the mix of debt and equity that a company uses to finance its assets and operations is what we call capital structure. Or, we can say capital structure refers to different combinations of debt and equity that a company uses.

To learn more about it, refer to Capital Structure & its Theories. Now, let’s move further.

In a business, debt (short or long term) is acquired not only on the grounds of ‘need for capital’ but also taken to enlarge the profits accruing to the shareholders. Let’s clarify this further. An introduction of debt in the capital structure will not have an impact on the sales, operating profits, etc. But it will increase the share of profit of the equity shareholders, the ROE % (Return on Equity).

Try to understand this with the example below.

Illustration of Financial Leverage

The calculation below clearly shows the effect of having debt in the capital. The table shows two options of financing, one by equity only and another by debt and equity.

| Particulars | Only Equity | Debt + Equity |

| Equity Shares of Rs. 10 Each | 5,00,000 | 2,50,000 |

| Debt @ 12 % | 2,50,000 | |

| EBIT | 1,20,000 | 1,20,000 |

| Interest | 30,000 | |

| PBT | 1,20,000 | 90,000 |

| Tax – 50% | 60,000 | 45,000 |

| PAT | 60,000 | 45,000 |

| No. of Shares | 50,000 | 25,000 |

| EPS | 1.2 | 1.8 |

| ROE | 12% | 18% |

The return on equity (ROE) and the EPS both are higher in the case of debt and equity structure. It shows that the return on equity has increased with the introduction of leverage in the capital structure.

The picture shown in the above illustration does not bring all aspects of leverage. Hence, we shall go further inside to know the reason for having higher EPS and ROE in the case of a levered firm. Let us calculate one more important ratio – ROI (Return on Investment). ROI in both the options is 24% (EBIT / Total Investment = 120000 / 500000).

Now, here we see that the ROI is more than the interest rate charged by the lender, i.e., 12%. This is the reason behind the higher EPS as well as ROE in the case of a levered firm. So, leverage would not always be profitable. The following matrix explains the behavior of levering a firm.

| Favorable | ROI > Interest rate |

| Unfavorable | ROI < Interest Rate |

| Neutral | ROI = Interest Rate |

In the current example, the first situation, i.e. ROI > Interest Rate is true, and that is why the results are favorable as we can see. If the ROI is less than the interest rate, the ROE will decline, and on the other hand, if ROI is the same as the interest rate, it will make no difference.

Leverage Effects

Going through the following points will help in understanding the effects of leverage (both positive and negative):

Advantages of Leverage

- It helps boost liquidity as the company gets funds in the form of debt.

- Growing firms need more funds to grow their operations. Thus, taking on leverage could help them to magnify their profit.

- Taking on more leverage is good for companies that are unwilling to dilute their ownership.

Disadvantages of Leverage

- If a firm takes on too much leverage, it could result in financial issues.

- There are cases when a firm with too much leverage makes a decision that it otherwise wouldn’t take. For example, if a firm has too much cash due to leverage, then to use these funds, it may invest in assets that aren’t needed.

- A company with more leverage means more debt. This, in turn, means an obligation to pay interest in time, irrespective of the company’s financial position. Such obligations could even lead to bankruptcy.

Effect on Cost of Capital

Too much leverage can have an adverse impact on the cost of capital as well. If the cost of debt is more than the total cost of capital, then a rise in leverage would push up the cost of capital. And, if the cost of debt is less than the total cost of capital, then taking on more debt reduces the cost of capital.

Leverage Effect on ROE

Leverage has a similar impact on ROE as it does on net income. If the sales are rising, then higher leverage would boost the ROE. Similarly, when sales are dropping, higher leverage would accelerate the drop in ROE as well.

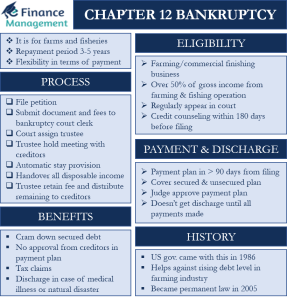

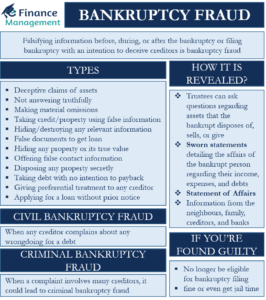

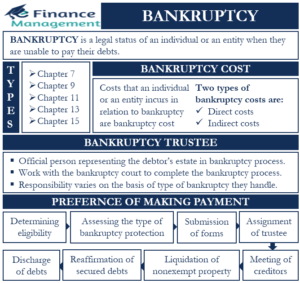

Bankruptcy

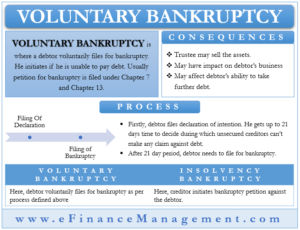

Higher leverage raises the chances of bankruptcy. This is because higher leverage means more borrowing, as well as more interest commitments. This raises the chances of failure to honor the interest commitments. And, if the conditions aren’t favorable, it may even result in bankruptcy.

Measures of Leverage

Measuring the impact of leverage means quantifying how much risk a business is experiencing due to its current capital structure. We can say that measuring the leverage shows how a company’s fixed and variable costs can affect profitability. There are three measures of leverage, and these are:

- Degree of Operating Leverage (DOL)

This measure shows how the changes in ROA (Return on Assets) impact the profitability of a firm. It primarily measures the operational risk. Or how sensitive a firm’s operating income is to the change in revenue. The formula to calculate this is:

| DOL = (% change in operating income) / (% change in units sold). |

- Degree of Financial Leverage Effect (DFL)

A firm with more debt in its capital structure is considered riskier. This is because such companies would have more fixed commitments in the form of interest payments. Such firms are more operationally leveraged as well. The formula to calculate DFL is:

| DFL = (% change in net income) / (% change in operating income) |

- Degree of Combined Leverage (DCL)

As the word suggests, it is a combination of both the above leverages – operating and financial. So, we can say that it tells about a company’s overall state of leverage. It considers all financial and operational leverages to quantify a company’s overall business risk. Following is the formula to calculate DCL:

| DCL = (% change in net income) / (% change in units sold) |

Read about the Types of Leverage in detail.

Measures of Financial Leverage

There are various measures of Financial Leverage

- Debt Ratio: It is the ratio of debt to total assets of the firm, which means what percentage of total assets is financed by debt.

- Debt Equity Ratio: It is the ratio of debt to the equity that signifies how many dollars of debt is taken per dollar of equity.

- Interest Coverage Ratio: It is the ratio of profits to interest. This ratio is also represented in times. It represents how often the interest is the available profit to pay it off. The higher such ratio, the higher the interest-paying capacity. The reciprocal of it is income gearing.