Back-to-Back Letter of Credit Definition

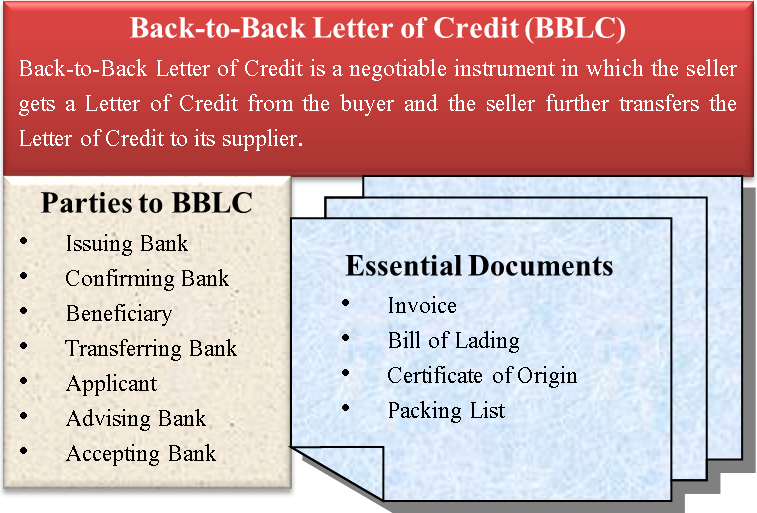

A back-to-back letter of credit is a financial instrument used in international trade to facilitate transactions between a buyer and a seller. It involves the use of two separate letters of credit to ensure payment and delivery of goods or services. In simple words, the seller first receives the Letter of Credit from the buyer to ensure timely payment, and further, the same seller hands over the Letter of Credit to someone from whom he buys goods or materials. There are various advantages and disadvantages of a Letter of Credit. Let us take an example under the concept of a Back-to-Back Letter Of Credit.

Example of Back-to-Back Letter of Credit

ABC Electronics in the United States wants to purchase electronic components from XYZ Manufacturing in India. However, XYZ Manufacturing requires payment upfront before they can begin production.

- Back-to-Back Letter of Credit Definition

- Example of Back-to-Back Letter of Credit

- Parties to BBLC

- Procedure for Back-to-Back Letter of Credit

- Essential Documents Required for Letter of Credit

- Contents in a Back to Back LC Format

- Advantage of Back to Back Letter of Credit

- Risks under Back to Back LC

- Payment Clause in Back-to-Back Letter of Credit

- Example of Payment in Back-to-Back Letter of Credit

- Conclusion

- Frequently Asked Questions (FAQs)

To facilitate the transaction, ABC Electronics approaches its bank, Bank A, to issue a letter of credit on their behalf. Bank A issues the first letter of credit to XYZ Manufacturing, which guarantees payment to XYZ Manufacturing once they fulfill certain conditions, such as providing the electronic components.

Simultaneously, XYZ Manufacturing, as the seller, needs to purchase raw materials from a supplier, PQR Materials, also in India. To secure the necessary raw materials, XYZ Manufacturing approaches its bank, Bank B, and uses the first letter of credit from Bank A as collateral to obtain a second letter of credit from Bank B.

Also Read: Transferable Letter Of Credit

With the second letter of credit in hand, XYZ Manufacturing can now present it to PQR Materials as a guarantee of payment once they deliver the required raw materials.

Once PQR Materials fulfills its obligations and delivers the raw materials to XYZ Manufacturing, XYZ Manufacturing can then fulfill its obligations to ABC Electronics by producing and delivering the electronic components.

Upon successful completion of the transaction, Bank A pays XYZ Manufacturing based on the compliance of the terms and conditions specified in the first letter of credit. XYZ Manufacturing, in turn, uses the payment received to fulfill its payment obligations to PQR Materials.

In this example, the back-to-back letter of credit arrangement enables ABC Electronics to secure the delivery of electronic components from XYZ Manufacturing and provides assurance to XYZ Manufacturing that they will receive payment once they fulfill their obligations to PQR Materials.

Also Read: Commercial Letter of Credit

Parties to BBLC

- Issuing Bank

- Confirming Bank

- Beneficiary

- Transferring Bank

- Applicant

- Advising Bank

- Accepting Bank

Procedure for Back-to-Back Letter of Credit

Upon getting the instructions from the customer, the issuing bank agrees to issue a Letter of Credit, which is transferable to the first beneficiary. This means that the first beneficiary can transfer the letter of credit to its customer, third party, or secondary beneficiary. The transferring bank, i.e., the bank issuing the letter of credit, shall issue a “Transferred Letter of Credit.” The “Transferred Letter of Credit” looks identical to the original Letter of Credit. The first beneficiary holding the original Letter of Credit gives the “Transferred Letter of Credit” to the secondary beneficiary.

Essential Documents Required for Letter of Credit

- Invoice

- Bill of Lading

- Certificate of Origin

- Packing List

Contents in a Back to Back LC Format

-

Beneficiary Details: The back-to-back LC will specify the name, address, and contact information of the beneficiary (seller) who will receive payment.

-

Amount: The specific amount of money involved in the transaction will be mentioned in the back-to-back LC, indicating the payment to be made to the beneficiary.

-

Time Validity: The back-to-back LC will indicate the validity period during which the payment is to be made to the bank. This indicates the deadline by which the required documents must be presented.

-

Seller’s Bank Details: The back-to-back LC will include the details of the seller’s bank, including their name, address, and contact information.

-

Payment Mode: The mode of payment, such as sight payment or deferred payment, will be mentioned in the back-to-back LC.

-

List of Documents: The back-to-back LC will specify the documents that must be presented by the beneficiary to claim payment. This typically includes commercial invoices, transport documents (e.g., bills of lading), insurance certificates, packing lists, and other relevant documents.

-

Notifying Address: The back-to-back LC will mention the address of the advising bank that will notify the beneficiary of the LC.

-

Description of Goods: The LC will include a detailed description of the goods or services being traded, specifying the quantity, quality, and any specific requirements.

-

Confirmation Order from a Local Bank: If the back-to-back LC is confirmed, it means that a local bank adds its own payment guarantee to the LC, providing further assurance to the beneficiary.

Advantage of Back to Back Letter of Credit

Flexibility in sourcing

A back-to-back letter of credit allows the seller (first beneficiary) to source goods or services from a secondary beneficiary, providing flexibility in fulfilling the buyer’s requirements. This enables the seller to access a wider range of suppliers and manufacturers, including those located in different countries, thereby expanding their options for procurement.

Risk mitigation

Back-to-back letters of credit help mitigate risks for all parties involved. The buyer (applicant) is assured that the seller will fulfill their obligations to the secondary beneficiary, ensuring the timely delivery of goods or services. The seller, in turn, is protected as they receive payment once they fulfill their obligations to the secondary beneficiary. This arrangement reduces the risk of non-performance or non-payment.

Security for all parties

Back-to-back letters of credit provide security for all parties involved in the transaction. The buyer has confidence that the seller will fulfill their obligations, the secondary beneficiary is assured of payment upon completing their part of the transaction, and the banks issuing the letters of credit act as intermediaries to ensure the transaction proceeds smoothly.

Risks under Back to Back LC

- The risk is that the buyer (first beneficiary) fails to make payment to the seller (secondary beneficiary) under the original LC. This could occur due to various reasons such as financial difficulties, insolvency, or dispute between the parties.

- The risk is that the seller (secondary beneficiary) fails to fulfill its obligations under the secondary sales contract, such as delivering the goods or providing the services as per the agreed terms and conditions.

- The risk that the supplier or subcontractor (secondary beneficiary) fails to deliver the goods or services within the specified time frame, resulting in delays or disruptions in the buyer’s (first beneficiary’s) production or project timeline.

Payment Clause in Back-to-Back Letter of Credit

When the first beneficiary transfers the original LC to the secondary beneficiary, it is assumed that the payment has been made to the first beneficiary of the transaction when LC is presented at the bank. However, suppose partial payment is made to the secondary beneficiary in such a case. In that case, the original beneficiary has the right to present the invoice and draft to the bank after the secondary beneficiary has presented the documents.

Example of Payment in Back-to-Back Letter of Credit

Suppose Xion Ltd. has handed over Noble Ltd. a Back-to-Back LC. Noble Ltd. approaches the bank to claim its payment that was due from Xion Ltd. The original LC was issued for $ 15,000, but the payment due to Noble Ltd was only $ 10,000. Here the bank will require not only the original LC but also a written request to hand over the specified amount. Bank requires the original LC to endorse it further by writing the amount due and the name of the party. LC being a negotiable instrument can be endorsed further. After making the payment to Noble Ltd, the bank shall issue a document suggesting the payment made to the party of the original LC and the amount due on it.

Conclusion

Letter of Credit has become an important tool for reducing business risk and speeding up the cash flow cycle. It facilitates business to trade at ease. It can be endorsed multiple times as a negotiable instrument, making it the most flexible payment tool. Back-to-Back Letter of Credit facilitates payments to subcontractors. The first beneficiary can transfer the LC in favor of the secondary beneficiary, assuring payment to the supplier. This helps the business to continue its functions smoothly.

Read Types of Letter of Credit to know about its various other types.

Frequently Asked Questions (FAQs)

The specific documents required in a back-to-back letter of credit transaction depend on the terms and conditions of the letters of credit and the nature of the transaction. Typically, documents such as invoices, shipping documents, packing lists, and certificates of origin are required to support the transfer of goods or services.

Yes, back-to-back letters of credit are widely accepted and used in international trade, particularly in situations where the seller needs to procure goods or services from a secondary beneficiary to fulfill the buyer’s requirements.

Really such a knowledgable article.

Thanks for posting please kept it up and make more on the letter of credit articles.

Really helpful..Thanks

DEAR SIR,

HOW TO TAKING THIS BACK TO BACK LC ACCOUNTING PROCEDURE LET ME KNOW PL.

thanks a lot for your valuable article .you should continue the process.

Real back to back’s don’t get “transferred” to a second beneficiary. A Back to Back Letter of credit is an instrument that has the backing of a letter of credit. Buyer issues an L/C in favor of a Seller. The Seller now uses this letter of credit as collateral to issue a new letter of credit to the Supplier. Back to Back’s can be congruent (Mean that they use the same documents of the original L/C or incongruent ( completely different documents) in order to do this type of transaction you will need a facilitator. The most difficult part of doing Back to Back Letters of Credit is to find a bank that understands the transaction and is capable of handle the documentation. Anyone will transfer a letter of credit.