Confirmed Letter of Credit – Meaning

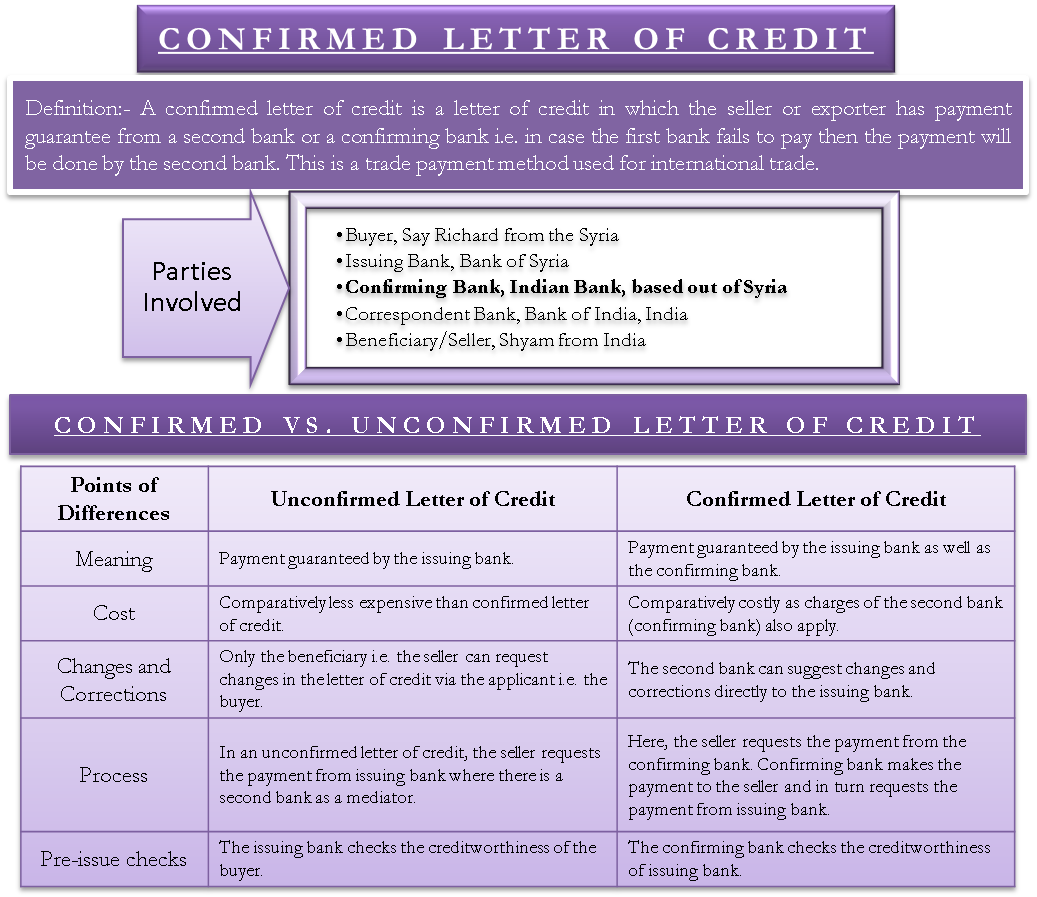

A confirmed letter of credit is a letter of credit in which the seller or exporter has a payment guarantee from a second bank or a confirming bank, i.e., in case the first bank fails to pay, then the payment will be made by the second bank. This is a trade payment method used for international trade.

Why Confirmed Letter of Credit?

The underlying intention of obtaining any type of letter of credit is the sense of security, especially for the seller. In an international transaction, the holder of a letter of credit, i.e., the seller, must be assured that he will get the payment from the issuing bank if he complies with the terms of payment, but this is not always the case. Sometimes, the seller is not sure whether he will receive the payment against his goods or not. This uncertainty can arise from numerous factors such as questionable creditworthiness of issuing bank or political or economic vulnerability associated with the geographical location of the issuing bank. For example, payment of a regular letter of credit from a bank in Syria is questionable as the country has disturbances. In such cases taking a second guarantee, i.e., obtaining a confirmed letter of credit, is a wise decision.

The buyer has to go through the same procedure to obtain the second letter of credit. The buyer has to find a second bank that can give confirmation. In general cases, the second bank is the correspondent bank in the seller’s country.

Parties Involved

There is an involvement of the following parties in this type of LC. One additional party compared to normal LC is confirming or the second bank.

Also Read: Letter of Credit Mechanism / Process

- Buyer, Say Richard from Syria

- Issuing Bank, Bank of Syria

- Confirming Bank, Indian Bank, based out of Syria

- Correspondent Bank, Bank of India, India

- Beneficiary/Seller, Shyam from India

Unconfirmed Letter of Credit

As opposed to a confirmed letter of credit, an unconfirmed letter of credit is the one where there is a guarantee of payment by only one bank, i.e., issuing bank. The involvement of the second bank is simply an intermediary and helps in processing the transaction. There is no additional confirmation or guarantee.

Security of the payment is the sole purpose of using a letter of credit as a means of payment for an international transaction. A regular letter of credit provides this security. So, most letters of credit are unconfirmed letters of credit. It’s only when there is an additional risk that the confirmed letter of credit is used.

Confirmed Vs. Unconfirmed Letter of Credit

Following are the differences between the unconfirmed and confirmed letter of credit –

| Unconfirmed Letter of Credit | Confirmed Letter of Credit | |

| Meaning | The issuing bank guarantees payment. | Payment is guaranteed by the issuing bank as well as the confirming bank. |

| Cost | Comparatively less expensive than the confirmed letter of credit. | Comparatively costly as charges of the second bank (confirming bank) also apply. |

| Changes and Corrections | Only the beneficiary, i.e., the seller, can request changes in the letter of credit via the applicant, i.e., the buyer. | The second bank can suggest changes and corrections directly to the issuing bank. |

| Process | In an unconfirmed letter of credit, the seller requests the payment from issuing bank where there is a second bank as a mediator. | In a confirmed letter of credit, the seller requests the payment from the confirming bank. Confirming the bank makes the payment to the seller and, in turn, requests the payment from issuing bank. |

| Pre-issue checks | The issuing bank checks the creditworthiness of the buyer. | The confirming bank checks the creditworthiness of issuing bank. |

From all this discussion, we can conclude that a confirmed letter of credit is more secure than an unconfirmed letter of credit, but it also has additional costs. The seller shall conduct a cost-benefit analysis to determine whether a confirmed letter of credit is required for a particular transaction. The overall purpose shall be to eliminate unsystematic risk and use a payment method accordingly.

Nicely explained.

thanks

l need more√√√√√

keep it up