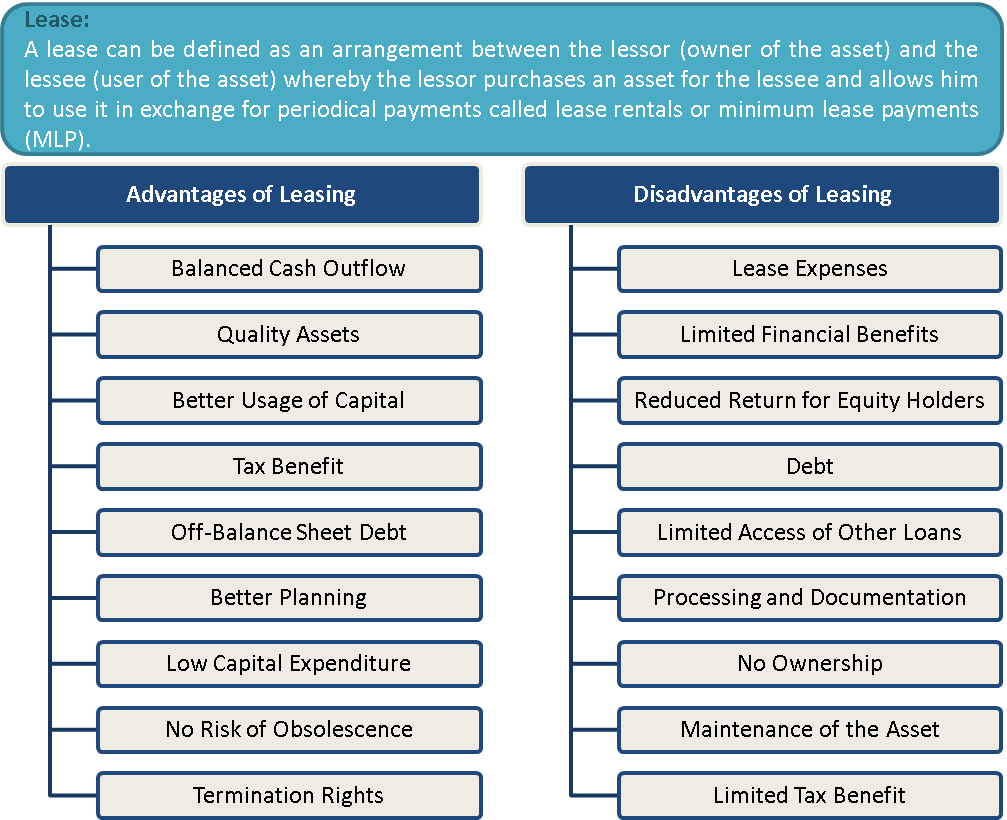

Leasing is becoming a preferred solution to resolve fixed asset requirements vs. purchasing the asset. While evaluating this investment, it is essential for the owner of the capital to understand whether leasing would yield better returns on capital or not. Let us have a look at the advantages and disadvantages of leasing:

What is a Lease or Leasing?

A famous quote by Donald B. Grant says, “Why own a cow when the milk is so cheap? All you really need is milk and not the cow.” This quote influences the concept of Lease. We can compare ‘milk’ with the ‘rights to use an asset’ and ‘cow’ with the ‘asset’ itself. Ultimately, a person who wants to manufacture a product using machinery can get to use that machinery under a leasing arrangement without owning it.

A lease can be defined as an arrangement between the lessor (owner of the asset) and the lessee (user of the asset). Whereby the lessor purchases an asset for the lessee and allows him to use it in exchange for periodical payments. These payments are called lease rentals or minimum lease payments (MLP). Leasing is beneficial to both parties for availing tax benefits or doing tax planning. It is becoming the most preferred source of asset financing.

At the conclusion of the lease period, the asset goes back to the lessor (the owner) in the absence of any other provision in the contract regarding compulsory buying of the asset by the lessee (the user). There are four different things possible post-termination of the lease agreement.

Also Read: Buy Vs Lease

- The lessee renews the lease perpetually or for a definite period of time.

- The asset goes back to the lessor.

- The asset comes back to the lessor, and he sells it off to a third party.

- Lessor sells to the lessee.

Purpose of Leasing

The purpose of choosing a lease can be many. Generally, the structure of the lease is for the following reason:

Benefits of Taxes

The tax benefit is available to both the parties, i.e., Lessor and Lessee. Lessor, being the asset owner, can claim depreciation as an expense in his books. And therefore get the tax benefit. On the other hand, the lessee can claim the MLPs, i.e., lease rentals, as an expense and similarly achieve tax benefit.

Avoid Ownership and thereby Avoiding Risks of Ownership

Ownership is avoided to avoid the investment of money into the asset. It indirectly keeps the leverage low, and hence opportunities for borrowing money remain open for the business. A Lease is an off-balance sheet item.

Advantages of Leasing

Balanced Cash Outflow

The biggest advantage of leasing is that cash outflow or payments related to leasing are spread out over several years, hence saving the burden of one-time significant cash payments. This helps a business to maintain a steady cash-flow profile.

Quality Assets

While leasing an asset, the ownership of the asset still lies with the lessor, whereas the lessee just pays the rental expense. Given this agreement, it becomes plausible for a business to invest in good quality assets which might look unaffordable or expensive otherwise.

Better Usage of Capital

Given that a company chooses to lease over investing in an asset by purchasing, it releases capital for the business to fund its other capital needs or to save money for a better capital investment decision.

Tax Benefit

Leasing expenses or lease payments are considered as operating expenses and hence, of interest, are tax-deductible.

Off-Balance Sheet Debt

Although lease expenses get the same treatment as interest expenses, the treatment of lease is different from debt. Leasing is classified as an off-balance sheet debt and doesn’t appear on the company’s balance sheet.

Better Planning

Lease expenses usually remain constant over the asset’s life or lease tenor or grow in line with inflation. This helps in planning expenses or cash outflow when undertaking a budgeting exercise.

Low Capital Expenditure

Leasing is an ideal option for a newly set-up business, given that it means lower initial cost and lower CapEx requirements.

No-Risk of Obsolescence

For businesses operating in the sector where there is a high risk of technology becoming obsolete, leasing yields great returns and saves the business from the risk of investing in a technology that might soon become outdated. For example, it is ideal for the technology business.

Termination Rights

At the end of the leasing period, the lessee holds the right to buy the property and has a termination option for the leasing contract, thus providing flexibility to the business.

Disadvantages of Leasing

Lease Expenses

The treatment of lease payments is as expenses rather than as equity payments towards an asset.

Limited Financial Benefits

If paying lease payments toward land, the business cannot benefit from any appreciation in the value of the land. The long-term lease agreement also remains a burden on the business as the agreement is locked and the expenses for several years are fixed. In a case when the use of an asset does not serve the requirement after some years, lease payments become a burden.

Reduced Return for Equity Holders

Given that lease expenses reduce the net income without any appreciation in value, it means limited returns or reduced returns for an equity shareholder. In such a case, there is no achievement of the objective of wealth maximization for shareholders.

Debt

Although a lease doesn’t appear on a company’s balance sheet, investors still consider long-term leases as debt and adjust their valuation of a business to include leases.

Limited Access to Other Loans

Given that investors treat long-term leases as debt, it might become difficult for a business to tap capital markets and raise further loans or other forms of debt from the market.

Processing and Documentation

Overall, entering into a lease agreement is a complex process and requires thorough documentation and proper examination of an asset being leased.

No Ownership

At the end of the leasing period, the lessee doesn’t become the asset owner though quite a good sum of payment is being done over the years towards the asset.

Maintenance of the Asset

The lessee remains responsible for the maintenance and proper operation of the asset being leased.

Limited Tax Benefit

For a new start-up, the tax expense is likely to be minimal. In these circumstances, no added tax advantage derives from leasing expenses.

Conclusion

To summarize, lease finance is appropriate for an individual or business which cannot raise money through other means of finance like debt or term loans because of the lack of funds. The business or lessee cannot even arrange the down payment money to raise debt. The lease works best for him. On the other hand, the lessor, who wants to invest his money efficiently, becomes the financier for the lessee and earns the interest.

To take an informed decision regarding the use of various types of lease finance, we may have a look at the comparison of lease finance with other forms of finance.

Suggested readings:

- Lease Finance vs. Term Loan

- Lease Finance vs. Installment Sale

- Lease Financing Vs. Hire Purchase

- Buy vs Lease

- Lease vs Rent

Frequently Asked Questions(FAQs)

A lease is an arrangement between the lessor (owner of the asset) and the lessee (user of the asset). The lessor purchases the asset and allows the lessee to use it in exchange for the periodical payments called lease rentals for a definite period.

A.Lease payments are tax-deductible.

B. Lease payments are treated as an expense.

C. It is a complex process and requires documentation.

A. Lease payments are tax-deductible.

a) It provides reduced returns for equity shareholders.

b) It is a complex process that requires thorough documentation and examination of the asset.

c) The lessee does not have the ownership rights of the assets.

So helpful, thanks

Leasing for the long-term is not an ideal way to go ahead. You can use this for a year, maximum. I will suggest you to do the same even if you are into property sale and lease back scenario where you only lose the ownership status right after the deal is over.

Great work, Thank you

the cool

great

I really enjoy examining on this website, it has got good goodies.

Nobody has given the correct answer. I wanted to know whether the lump sum paid by the lessee during agreement has to be repaid after the expiry of the lease term?. U ppl why stressing about logic words. Tell about payment, not about something else.

Apr 19 onwards the accounting Standard has been changed for Lease. So it now Balance sheet items.

there is no way the money can be returned to the lessee as he/she has been using the property for some financial gains and the payments he/she makes is just an appreciation for using the property at hand

Please let me know whether the lessee can claim the building proerty after termination of long term lease agreement of 20-25 years?

Thanks, Jyoti for visiting our site and raising the query. Jyoti you would agree and need to see what is the actual content of the Lease Arrangement, what is the terms and conditions. The same needs to be followed.

Of course, in a longer-term lease usually, there is an option with the Lessee to take the ownership of the property after paying the pre-decided amount or amount to be decided as per the formula explained in the arrangement.

So, the lease agreement is the only guiding document to decide whether it is possible or not.