Debentures are a popular method companies use to procure long-term finance for their financial needs. The funds raised through debentures represent the debts, and the holders of the debenture are the creditors of the company. Due to this, the characteristics of debentures are very important. There are various types of debentures that the company can issue. The different characteristics of debenture are the base for their different types.

The debenture is a written instrument that the company sign under its common seal, acknowledging the debt due by it to the debenture holder. The company promises to pay the periodic payment of interest to the holder to use his funds. The company pays the fixed-rate interest to the holder. Debentures have some advantages as well as disadvantages of their own.

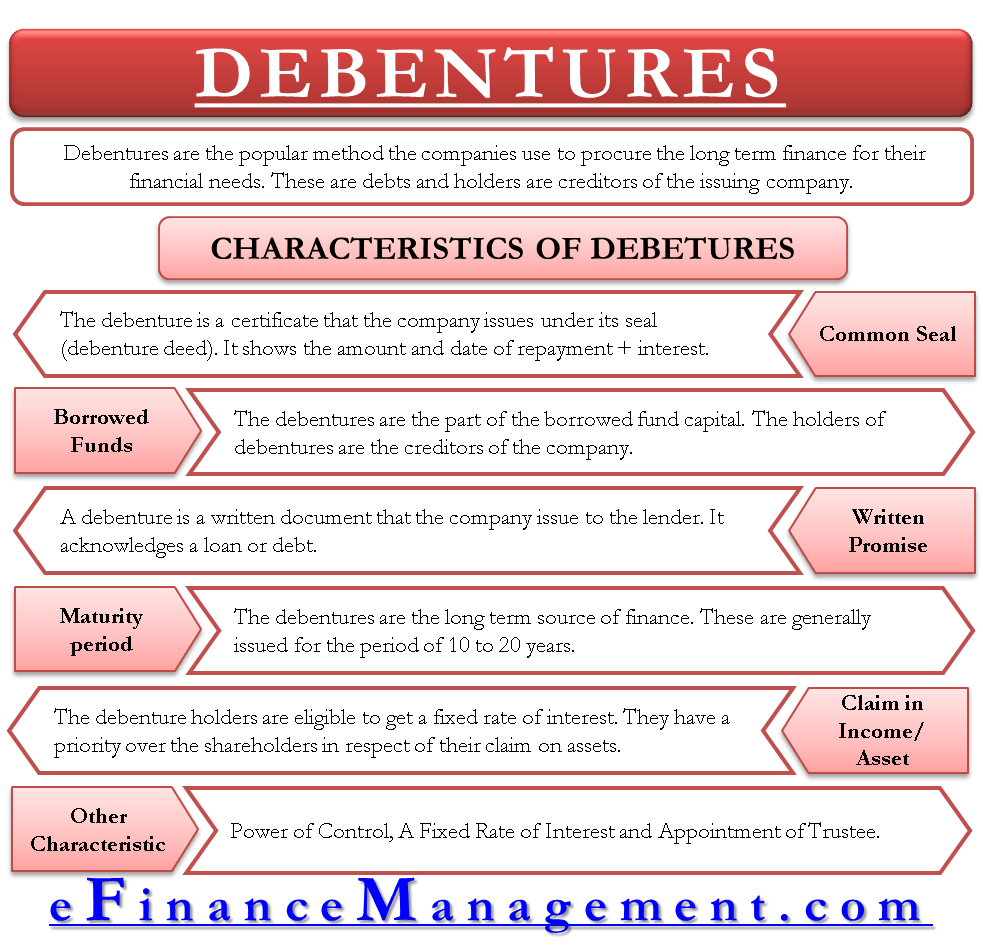

The basic characteristics of debentures are as follows:

Characteristics of Debenture

Various characteristics of debenture are as below:

Written promise

A debenture is a written document that the company issue to the lender. It acknowledges a loan or debt.

Company Seal

The debenture is a certificate that the company issues under its seal (debenture deed). It shows the amount and date of repayment of the debt along with the rate of interest.

Read more about the Issue of Debentures.

Borrowed Funds

The debentures are part of the borrowed fund capital. The holders of debentures are the creditors of the company.

Maturity Period

The debentures are a long-term source of finance. They consist of a long-term pre-set maturity period. Normally, the debentures have a maturity period of 10-20 years and are redeemed at the end of the maturity period. At maturity, the company repays the principal investment amount to the holder. (See Ways to Redeem Debentures for more).

Claim in Income

The debenture holders are eligible to get a fixed rate of interest at the end of every financial year. The debenture holders have a priority of claim in the income of the company. Assume that a company does not have sufficient funds to pay interest on debenture and dividends on preference shares and equity shares. The company will have to pay interest to debentures first, and then with the remaining funds, it can make the other payments. They can legally enforce their rights. They get priority over the equity and preference shareholders.

Read more on How is Debenture different from Bank Loans, Equity Shares, and Bond?

Priority Claim on Assets

The debenture holders also have a priority over the equity and preference shareholders in respect of their claim on assets. These claims arise at the time of liquidation or reorganization of the company. The creditors are entitled to get only the principal amount they had given along with any unpaid interest.

To reduce the risk of losing the principal amount, the debenture holders prefer to secure the loan against the specific asset. However, if the creditors have the trust in the earnings of the company that it will satisfy their claims, they may not ask for the security of the loan. They may accept the debenture without having a specific asset pledged.

The debentures that have a charge against the specific asset are treated as secured creditors and others as unsecured creditors.

No Controlling Power

Debenture holders are the creditors of the company. Therefore, they do not have the power to control the operations of the company. The debenture holders do not have the right to vote to elect the directors and to determine any managerial policy.

Also Read: Types of Debentures

Fixed-Rate of Interest

The rate of interest on debentures is fixed and is paid every financial year. Therefore, investors also call debentures as fixed cost-bearing capital.

Appointment of Trustee

When the company sells a large number of debentures to the general public, then usually, they appoint a trustee. The bank or financial institutions can work as a trustee. They appoint the trustee to ensure the firms that are borrowing will fulfill the contractual obligations.

Continue reading – Debenture Example.

Thank you verymuch for such a nice work.

This is a very nice work