A letter of credit (LC) is a financial document that facilitates international and domestic trade. It substitutes the bank credit for the credit of the customer. There are two basic types of letters of credit – commercial and standby. The commercial LC is the primary payment mechanism, while the standby LC is a secondary mechanism.

Definition of Letter of Credit

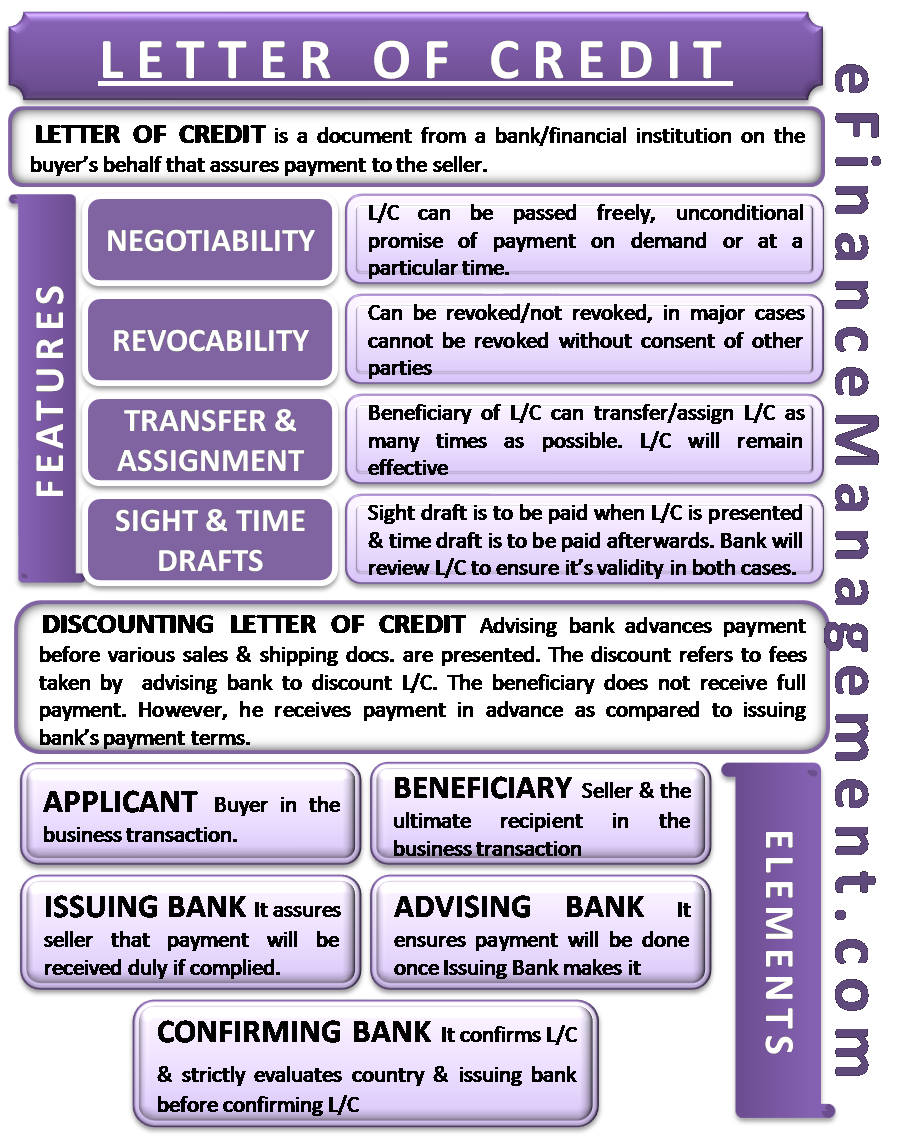

A letter of credit is a document from a third party (with no direct interest in the transaction), mostly a bank or a financial institution, that guarantees the payment of funds for goods and services to the seller once the seller submits the required documents. The bank needs to have certain documents in possession before issuing the LC. This letter is as good as a guarantee to the seller that the payment will be cleared even if the buyer fails to do so—the risk of non-payment shifts from the seller to the bank. Generally, the entire process of a letter of credit also involves another bank that works as an advisor to the seller. The issuing bank authorizes the advisory bank to pay the seller.

The commercial LC has been used for ages to facilitate the process of payment in domestic as well as international trade like import and export LC. In fact, its usage will increase with the development of the global economy. All international letters of credit are governed by the regulatory body of the International Chamber of Commerce under the Uniform Customs and Practice for Documentary Credits.

Features of Letter of Credit

Since the LCs have been in use for centuries and there is a uniform regulatory code for the letters of credit, there are certain characteristics that are standard and are present uniformly in all letters of credit:

Also Read: Types of Letter of Credit (LC)

Negotiability

The LC is usually considered a negotiable instrument and can be passed freely as money among various parties. It obligates the issuing bank to pay the money to the beneficiary and any other bank nominated by him. However, the LC is considered negotiable only when it includes an unconditional promise of payment on demand or at a particular time.

Revocability

The LC can be either revocable or irrevocable. The issuing bank can revoke or modify a revocable letter of credit at any time without notification. In such a scenario, the advising bank will not confirm the LC. However, the use of revocable LC is very rare. An irrevocable LC is the most commonly prevalent as it is not modifiable or revokable without the agreement of all the parties in the transaction.

Transfer and Assignment

The beneficiary of the letter of credit can transfer or assign the LC as many times as possible. The LC will remain effective.

Sight and Time Drafts

The letter of credit demands payment through two features: sight or time draft. A sight draft is paid when the LC is presented, and the time draft is paid after a certain duration of time. The bank will review the LC to ensure that it is valid in both cases.

Also read – Letter of Credit Example

Elements of a Letter of a Credit

The LC is understood better if all the following elements or terms of it are known:

Applicant

The buyer/applicant is the one who buys the goods or services.

Beneficiary

The seller of the goods and services is the ultimate payment recipient in the business transaction. The beneficiary needs to provide all the required documents for the LC to be processed.

Also Read: Commercial Letter of Credit

Issuing Bank

The issuing bank assures the beneficiary that the payment will be paid duly if all the documents presented comply with the stipulations stated in the LC. The issuing bank also needs to examine the documents submitted by the beneficiary. It is absolutely liable to pay once all the terms and conditions in the LC are complete.

Advising Bank

The advising bank advises the beneficiary and helps him use the LC. It pays the beneficiary once the issuing bank makes the payment. It also has the responsibility to send the required documents to the issuing bank. The advising bank has no obligation to pay if the issuing bank is unable to pay the beneficiary.

Confirming Bank

The confirming bank confirms the LC and assumes the same obligation as the issuing bank. The confirming bank is typically the advising bank. The conforming bank strictly evaluates the country and the issuing bank before confirming the LC.

Discounting of Letter of Credit

A beneficiary can get the letter of credit discounted to be paid earlier. The advising bank advances the payment before the various sales and shipping documents are presented. The discount refers to the fees taken by the advising bank to discount the LC. The beneficiary does not receive the full payment. However, he receives the payment well in advance compared to the issuing bank’s payment terms.

Conclusion

The letter of credit is a helpful tool to ensure smooth trade transactions. However, it is in the interest of the parties to be fully aware of the technicalities, advantages, and disadvantages of the letter of credit. The rules of the LC are not intuitive and need careful understanding before making further commitments.

People often get confused between the terms letter of credit and buyer’s credit, but for better understanding and concept clarity, you can visit our article Letter of Credit Vs. Buyers Credit.

Some other suggested articles:

LC is explained in the most simplest ,clear and very easy way.

Your notes were very helpful… God bless you

Your explanation is very clear and direct. Thank you for the knowledge you shared.

Hi Hadiza,

Thanks for sharing your experience with us.

Keep reading