Equity Kicker

An Equity kicker is a summation of two words, equity, and kicker. Let us go word by word to understand the meaning of these terms.

What is a Kicker?

A Kicker is an extra incentive provided that builds attractiveness and appeal to the investors.

What is an Equity Kicker?

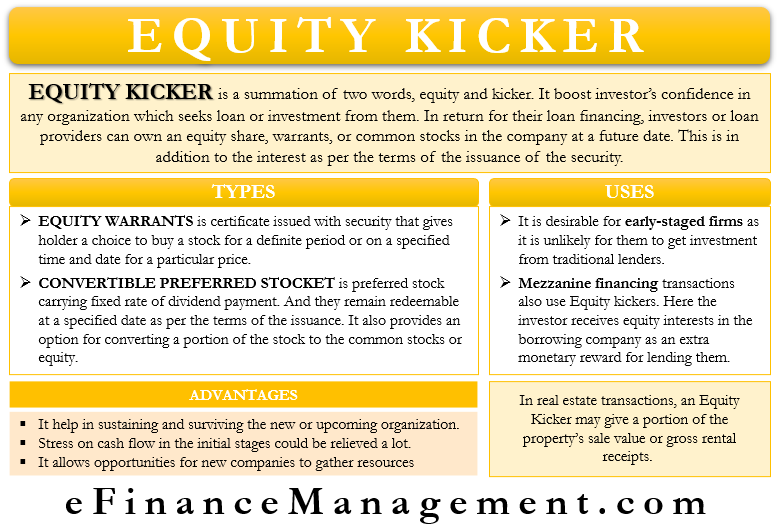

Equity Kickers, likewise called kickers, boost investors’ confidence in any organization which seeks loans or investment from them. In return for their loan financing, investors or loan providers can own an equity share, warrants, or common stocks in the company at a future date. This is in addition to the interest as per the terms of the issuance of the security. The equity kicker helps the borrower get loans at a cheap interest rate and entices the lender to grant loans. Whereas the investors get more return or bigger share in profits by way of becoming equity shareholders. And thereby increasing their overall return on the loans granted. Budding organizations utilize an equity kicker for funding their operations.

Budding organizations and new entrants generally find it hard to draw investors’ interest. Being new in the industry, it is difficult for new firms to gain investors’ trust. Therefore they offer equity kickers to attract investors. On the other hand, the mezzanine investors who anticipate a high-risk level with a proposed borrowing agreement presumably demand equity kickers to neutralize the risk.

Various Types of Equity Kickers

Equity Warrant

It is a certificate issued with security that gives the holder a choice to buy a stock for a definite period or on a specified time and date for a particular price.

Also Read: Sources of Equity Financing

Example – A Company ABC gives 2% equity for every 10 Million of loans granted by the investors. Three investors – R, T, and U – are willing to invest in ABC. Investor R is willing to provide 20 Million, while T and U are ready to contribute 10 Million each. Now, in terms of the Equity warrants, the investors will get equity warrants for 2% of the invested amount. Therefore, R will get equity warrants equivalent to 4% or for 0.4 Million, while T and U will get warrants equivalent to 2%, ie. 0.2 Million each.

Convertible Preferred Stock

Preferred stock carries a fixed rate of dividend payment every year whenever there are profits. And they remain redeemable at a specified date as per the terms of the issuance. To add a kicker, the company can issue Convertible preferred stock that provides an option for converting a portion of the stock to the common stocks or equity. Thus, the convertible tag is the kicker for the investor to subscribe to such stock. This gives a fixed rate of return and allows them to participate and acquire the company’s equity shares at a specified date and a specified price. And thus, it allows the investor to pocket the appreciation in the share prices.

Example – Company ABC may issue a Convertible preferred stock, carrying a yearly dividend of 5%, with a right to convert 10% of the preferred stock into equity at par at the end of 5 years from the date of issue. Three investors – R, T, and U – are willing to invest in ABC. Investor R is willing to provide 20 Million, while T and U are ready to contribute 10 Million each.

Uses of Equity Kicker

Mezzanine Financing

It is a cross of obligation and value financing. Mezzanine financing gives the bank the option to become the equity shareholder of the company under specified circumstances. It happens when the company defaults in payment of interest and principal installments continuously as per the terms of the agreement to the bank. These warrants increment the estimation of the subordinated debt valuation and permit more adaptability when managing bondholders. In mezzanine financing, it occurs after the senior debtors are paid and financing is done to the organization.

Also Read: Equity Financing – When to Use it?

What is in it for Investors?

Despite lending at a low-interest rate as part of the deal, it’s a long-term profit/return source for the investors. They can avail of this equity ownership at a future date when the event occurs. How low or high equity kicker the lender will get depends upon how risky the portfolio is. It can be as meager as 5% or as huge as 50% depending upon the risk involved in the investment and what is mutually agreed upon between the parties at the time of the transaction or issuance of bonds.

Investors or lenders get a fixed rate of interest regularly and a share in the company’s equity. Therefore, the lenders and investors also get the usual dividend as and when they declare being an equity shareholders too. Moreover, over the year, with consistent profit and market prospects, the company’s equity shares may be commanding a premium in the market. Hence, the investors or lenders also get that capital appreciation as part of this deal. Thereby there are 3 types of earnings possibility for an investor in such types of deals – fixed rate of interest on the bond or money lent. Second is the dividend on the equity shares and, finally, the capital appreciation on share prices.

What is in it for Borrowers?

Traditional lenders generally lend to well-established companies. These companies have a sufficiently high cash flow to repay the borrowed money on time. They also have reliable collateral for the loan. And all these comforts are not available with new companies or companies not doing well but seem to have a promising future. Equity Kickers help the new players get a fair chance to compete by getting investments and loans by diluting or sharing a part of the future capital appreciation.

Real Estate Industry and Equity Kicker

Advantages & Disadvantages of Equity Kickers

These equity kickers could immensely help sustain and survive the new or upcoming organization. Thus, the loan installment gets a moratorium or reduces to the extent of the kicker part. This is in addition to the lower interest rates on the money borrowed. Thereby the stress on cash flow in the initial stages could be relieved a lot.

However, on the opposite side, the investors will expect and do merit these kickers because of high uncertainty and risk. And obviously, the company also needs to part with some of its long-term benefits to sustain itself during the initial phase. Hence, it could be a profitable compromise if the funding is of immense importance, multiplying the business prospects overall.

Quiz on Understanding Equity Kicker

This quiz will help you to take a quick test of what you have read here.