What is Debt Financing?

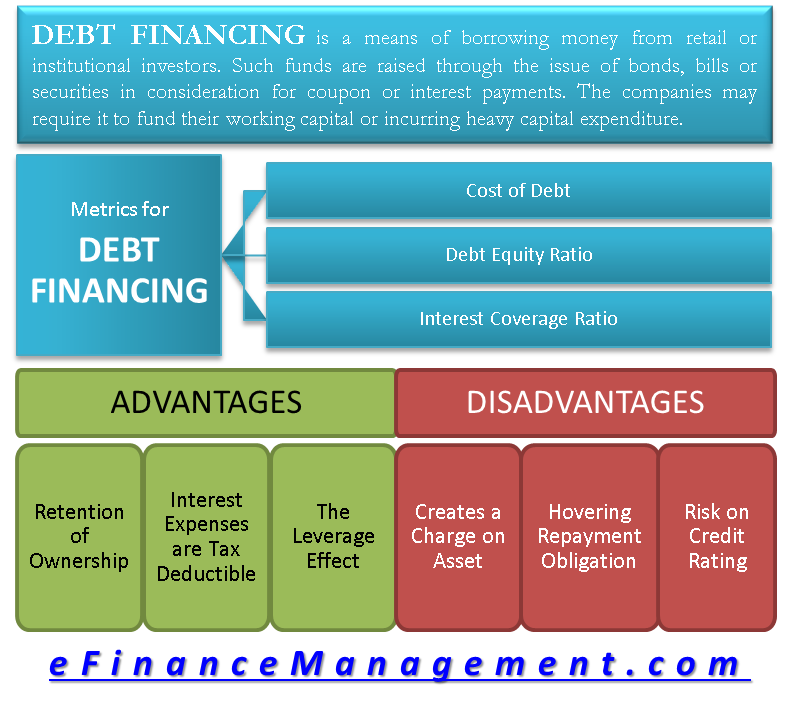

Debt financing is a means of borrowing money from retail or institutional investors. Such funds are raised through the issue of bonds, bills, or securities in consideration for coupon or interest payments. The companies may require debt financing to fund their working capital or incur heavy capital expenditure. This medium of financing is time-bound and comes with several compliance requirements. The funds raised through debt do not form a part of the permanent capital structure of the firm. They are repaid and vanish from the balance sheet on its maturity.

Additionally, most of the banks offering debt are required to be furnished with certain collaterals as security. These are known as secured loans and are extended by creating a charge on the company’s assets. Therefore, companies seeking to raise debt finance are expected to carry assets with healthy valuations in most cases.

Sources of Debt Financing

There are various sources of debt financing such as Loans, Trade Credit, Installment purchases, Asset Based Lenders, Bonds, Factoring & Insurance Companies.

Metrics for Debt Financing

Several tools and analytics are considered while evaluating the health and viability of levered companies. The use of debt adds a new dimension to the firm’s capital structure. Therefore, it is necessary to study the impact of debt in isolation and in conjunction with the company’s entire capital. Below are some of the indicators used while evaluating levered firms.

Cost of Debt

The interest payments made to the bondholders represent the cost borne by the company to raise debt. Interest payments are the true cost of debt finance. Such interest is tax-deductible. Therefore the effective cost of debt is even lower for the companies than the expressed coupon rate. Such cost is expressed in percentage and is determined by the following formula:

Also Read: Sources of Debt Financing

Kd = Interest (1 – Tax Rate)

For example, ABC corporation issues bonds carrying a coupon rate of 10%. The company falls in the 30% tax bracket. Therefore, the effective cost of debt for ABC Corp is computed as below:

Kd= 10%(1-30%)

= 10%* 0.7

=7%

Debt Equity Ratio

It is a financial ratio that expresses the proportion of the creditor’s funds and shareholder’s funds held by the company. This ratio primarily seeks to represent the assets that have been funded by debt and equity, respectively.

Debt Equity Ratio = Debt Funds / Shareholders Funds

A lower debt-equity ratio is always more preferable to a higher one. It indicates that the firm has not subjected itself to huge interest commitments and can operate sustainably with the plowing back of its own profits. However, being a 100% unlevered firm also has setbacks. It indicates that the firm is not harnessing the full potential of its increased profitability. A firm with no debt at all will not be able to pass on the benefit of increased earnings to its shareholders. It is, therefore, necessary to arrive at the right mix of debt that serves the exact needs of the organization.

Interest Coverage Ratio

The interest coverage ratio states the number of times the earnings are able to pay for the interest expenses. This ratio is a demonstration of the operational efficiency of the company. It seeks to depict the ease and flexibility with which the company will be able to pay for the interest expenses out of its revenue. A high coverage ratio is considered to be the most ideal. Banks and financial institutions prefer a sufficiently high coverage ratio before extending any credit.

Also Read: Debt Ratio

Interest Coverage Ratio = EBIT (Earnings before Interest & Tax)/Interest

For example, Ribbon Inc reports Total Earnings of USD 2 million for the current year. Such earnings are before providing for interest or tax expenses. Its interest expenses for the same period amount to USD 900,000. Therefore its interest coverage multiple is (USD 2,000,000/ USD (900,000) 2.22. This multiple indicates that Ribbon Inc earns more than twice its interest expenses.

Banks do not prefer corporations with a coverage ratio equal to or less than 1 since they are not even able to cover the interest expenses.

Advantages of Debt Financing

Retention of Ownership

One of the foremost benefits of debt funds is that they do not lead to dilution of ownership. Timely interest payments and repayment of the principal amount are the only requirements for a loan grant. Neither the shareholders nor the management is threatened by loss of control or ownership over the company.

Interest Expenses are Tax Deductible

While computing the total income, interest payments are allowed as a deduction. Consequently, they serve as an effective tax-saving tool. Consequently, the net cost of debt servicing incurred is even lower than that stipulated in terms of the loan. Therefore, debt financing is one of the cheapest means of obtaining funds.

The Leverage Effect

Effective use of debt enables the firm to increase profitability for the shareholders. Equity and retained earnings are relatively costlier sources of funds due to their high opportunity costs. Therefore when the firm employs cheaper funds viz debt financing into high yielding projects, it is able to generate greater earnings for the shareholders. Thus, the use of outside funds leaves the firm with sufficient cash flows even after servicing the cost of debt. The result is a significantly higher EPS.

Disadvantages of Debt Financing

Creates a Charge on Assets

The majority of loans are only granted against security. Security is typically a valuable asset, such as properties or plants required to be mortgaged. The amount of loan granted is a predetermined percentage of the value of such assets. Thus the assets do not remain free for use in the way the firm wishes.

Hovering Repayment Obligation

Strict covenants accompany debt financing, which must be complied with at any cost. The firm is required to service the debt without fail. The company is under a heavy obligation to repay the loan even if the project funded by the debt has crashed. Failing to comply with the stipulations results in grave consequences- the bank may sell off the mortgaged assets to recover its debt. Heavily mortgaged companies may also run into insolvency.

Risk on Credit Rating

While debt financing in the right proportions may benefit greatly, it may prove to be hazardous when overindulged. Companies with more than optimal debt are often classified as risky. An already highly leveraged company ranks poorly on the credit score. Banks shall not find such companies viable anymore. Shareholders would also shun away from such firms due to the high risk involved. An abnormally high debt thus blocks all channels for the flow of funds, ultimately choking the organization.

RELATED POSTS

- How to Choose Right Source of Finance for Your Small Business?

- Leveraged Finance – Meaning, Effects, and More

- Debt Capacity – Meaning, How to Assess and More

- Cost of Debt Capital for Evaluating New Projects – Yield to Maturity

- Net Debt – What It Is, How To Calculate It And What It Tells?

- Debt vs Equity