Venture Funding Definition

Venture funding is a funding process in which the venture funding companies manage the funds of the investors who want to invest in new businesses which have the potential for high growth in the future. The venture capital funding firms provide the funds to start-ups in exchange for the equity stake. Such a startup generally possesses the ability to generate high returns. However, the risk for venture capitalists is high.

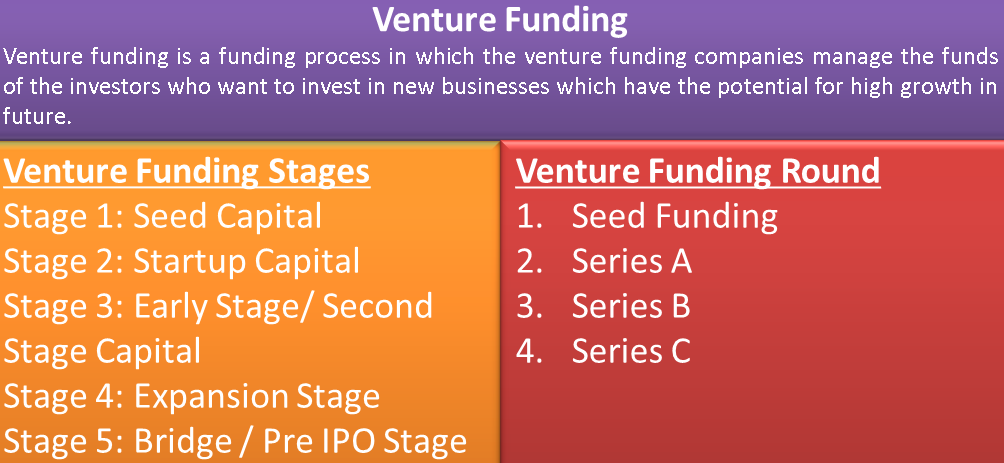

Venture Funding Stages

There are five stages of venture funding. They are as follows:

Stage 1: Seed Capital

In this first stage of venture funding, the venture or the startup company in need of the funds contacts the venture capital firm or the investor. The venture firm shall share its business idea with the investors and convince them to invest in the project. The investor or venture capital firm shall then conduct research on the business idea and analyze its future potential. If the expected returns in the future are good, the investor (Venture capitalist) shall invest in the business.

Stage 2: Startup Capital

Startup capital is the second stage of venture funding. If the venture is able to attract an investor, the idea of the business of the venture is brought into reality. A prototype product is developed and fully tested to know the actual potential of the product. Generally, a person from the venture capital firm takes a seat in the management of the business to monitor the operations regularly and keep a check that every activity is done as per the framed plan. Suppose the idea of the business meets the requirement of the investor and has sufficient market in the trial run. In that case, the investor agrees to participate in the future course of the business.

Stage 3: Early Stage / Second Stage Capital

After the startup capital stage comes the early/first/second stage capital. In this stage, the investor significantly increases the capital invested in the venture business. The capital increase is mainly towards increasing the production of goods, marketing, or other expansion, say building a network, etc. A company with a higher capital inflow moves towards profitability as it is able to reach a wide range of customers.

Stage 4: Expansion Stage

This is the fourth stage of venture funding. In this stage, the company expands its business by way of diversification and differentiation of its products. This is possible only if the company is earning good profits and revenue. To reach up to this stage, the company needs to be operational for at least 2 to 3 years. The expansion gives the venture new wings to enter into untapped markets.

Stage 5: Bridge / Pre IPO Stage

This is the last stage of venture funding. When the company has developed a substantial share in the market with its products, the company may opt for going public. One main reason for going public is that the investors can exit the company after earning profits for the risks they have taken all the years. The company mainly uses the amount received by way of IPO for various purposes like mergers, elimination of competitors, research and development, etc.

Venture Funding Network Alliance

Venture Funding Network Alliance (VFNA) is a non-profit organization that is engaged in arranging funds for small business enterprises. VFNA is a partnership among various non-profit organizations, big companies, and government agencies. The alliance is formed to fasten the growth rate of businesses and strengthen the linking chain between the vendor, investor, and contractors. It brings together all the ventures, investors, advisors, other financial resource providers, etc., in the same place to help the diverse business enterprise. VFNA solves the major problems the ventures face, like lack of capital access and other financial services.

Venture Funding Rounds

Venture Funding Rounds is phased capital inflow into the business by the investors. Investors are always eager to invest in a business that gives higher returns and has future growth potential. Based on the maturity levels of the business, investors invest the money. The fund rounding is divided into various phases, which are seed funding, series A, B, and C. Let us understand the terms in brief:

Seed Funding

Seed funding is the initial stage, where the startup needs the funds to conduct research and development of the product. The interested investors provide the capital to the company after conducting the feasibility study. The company develops the product for the target audience with seed capital.

Series A

Series A funding round is the phase when the company offers its ownership stake in the form of stock to the external investor in return for funds. The investors invest money after checking the progress made with the seed capital, the market share the company can capture, the quality of the team, and the risk associated. In series, A financing major motive is to conduct market research and development along with the decision for a full-fledged launch of the product into the market.

Series B

Series B funding phase is done to fight the competition in the market, to improve the economies of scale, to increase the market share, etc. The investment is made after checking the performance of the company and future potential based on industry growth. The company’s main aim is to earn good profits with the funds invested in this phase.

Series C

Series C is the last round of the venture funding phase. In this stage, the investors invest the money if the company has achieved success and bright future prospects. The company uses the funds for increasing the market share, mergers, and acquisitions introducing new products into the market, etc.

Conclusion

Venture Funding is an important source of financing for the new startups with new ideas. Venture funding supports startups and new ideas that otherwise would have gone to waste. It helps the growth of companies that have huge potential and revenue-generating ability. Without venture funding companies, many innovative products we use in our lives might not have come into existence. Hence, venture funding acts as a backbone for new ventures.

Read more on the Advantages and Disadvantages of Venture Capital.

Good