Entrepreneurship is a good idea and is more and more needed in the current situation where jobs are drying up. More so, because in a self-business, you have full control over it, and you become the job provider. However, starting a business is not as easy as finding a job. An entrepreneur needs to take care of many things, including staffing, office, tax, operations, and most importantly, funding. Though there are plenty of sources of finance for startups, not all will suit your business needs. Thus, it is important for entrepreneurs to carefully evaluate all the available sources of finance for startups and then select the right one for their business.

If you are planning to start a business and looking for funds, then to help you select details, below are the best sources of finance for startups.

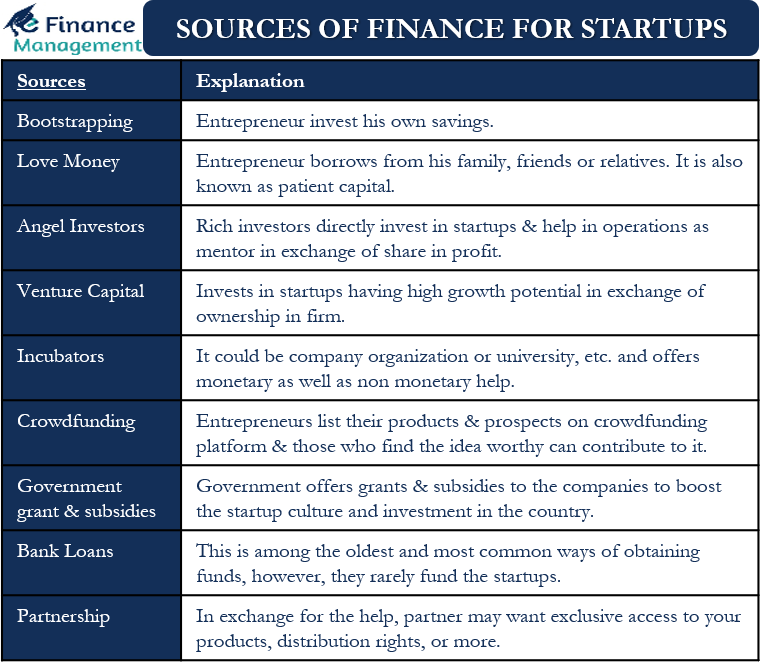

Sources of Finance for Startups

A point to note is that not all sources will meet your business needs. Instead, you will have to evaluate them and decide the best one (or ones) for you. Following are the best sources of finance where one can lay its hands for starting a new business:

Bootstrapping

Bootstrapping means investing from yourself or investing your savings. If you have enough savings to meet the funding requirements of your business, it is the best source of finance. This is because you save on the interest and other limitations that come with most other sources of funds. Moreover, this method is quick as you don’t have to waste time negotiating with banks and other investors. And you may not need to explain and share any secretive aspects with anyone.

Also Read: Angel Investors

Even if you lack enough savings to meet all the funding needs, you can always put the money you have. It would lower your debt burden. Also, investing your own money gives some sort of assurance to other investors.

Love Money

This means taking money from spouses, parents, family, or friends. We also call such type of money as “patient capital.” This is because you generally are in no hurry to pay this money back. Such a source of funds is preferable because your friends or family will be most likely to give you the money interest-free.

However, as the age-old saying goes, one has to keep enough care while managing personal and business relations in such situations. It is often seen that mixing business and personal relations ends up ruining both. So one needs to ensure and make all-out efforts to manage both on a different level and footings to balance both efficiently.

Angel Investors

It is a popular source of finance for startups. Angel investors are basically rich people with loads of investing experience. They directly invest in the startups. These investors generally put their money in the companies that they understand or the companies belonging to their expertise area. Along with providing funds, such investors help startups with their operations. They may also work as a mentor for the startups.

In exchange for their money and other services, angel investors usually ask for a share in the profits and a say in the management. This may limit your decision-making power and, of course, share some of your key working aspects.

Venture Capital

Venture capitalists (VCs) are a company that uses their investors’ money to invest in startups showing high potential for growth. VCs, ask for ownership in the firm in exchange for their funds. The equity they ask for depends on the firm’s valuation. Generally, VCs back tech-based startups that exhibit very high growth potential.

Along with funds, VCs can help the startups with knowledge, industry connections, and guidance. However, they do expect healthy returns once the startup establishes itself and starts making profits. They do want to get a seat on the Board, and any major operating or Capex plans need their buying. (Read more on Venture Funding).

Incubators

An incubator could be a company, organization, or university offering useful resources to startups. These incubators can offer non-monetary help, such as office space, laboratories, marketing, consulting, or money. In exchange for their help, they usually demand equity. The primary objective of the incubators is to incubate and mature the startups so that they can grow.

Government agencies could also be incubators. The primary objective of such incubators is to create jobs, boost investment in the country, encourage startup culture, encourage new technologies that could be of help from a social perspective, etc.

Crowdfunding

This is another growing source of funds for startups and is the product of the internet age. The word crowdfunding is a combination of two words crowd and funding. So, it means getting funding from the crowd or the public. People usually go for this funding route if the product or service they are offering will help the common public or they will be the one using it.

In this, entrepreneurs usually list their products and prospects on a crowdfunding platform with all the details. Those who find the idea worthy can contribute to it. Before going for this route, it is crucial that you know and understand the terms and conditions of the crowdfunding platform.

Government Grants and Subsidies

In several countries, the government offers grants and subsidies to the companies. The objective is to boost the startup culture and investment in the country. Usually, the government offer grants without any condition. And often, these upfront grants or subsidies become a kind of quasi-equity for the project from a funding perspective. Moreover, in most of instances, such grants and subsidies need not be returned as well. However, you can’t use the money for anything other than specific purposes. And, if you do, you can also face fines and penalties, besides the return of money received.

Moreover, these grants and subsidies are available only if startups meet certain criteria. However, these grants and subsidies are not enough to meet all your funding needs. Usually, such grants and subsidies help startups to cover their operating expenses.

Bank Loans

This is among the oldest and most common ways of obtaining funds. Banks, however, usually advance loans to small and medium enterprises. This means they rarely fund the startups. The funding depends upon so many factors and not only on the idea. Hence, it is not necessary that for every good idea, funding will be available. Or, it may agree to finance you only if you come up with a personal guarantee.

Banks or any other financial institution usually fund companies that are already in existence and have sound financials.

Partnership

If you are unwilling to tap the above sources, you can look for a strategic partner. This partner will provide you with funds and share the risk. The partner may be another player in the same industry or in a related industry. In exchange for the help, this partner may want exclusive access to your products, distribution rights, or more.

Private Placement

A private placement is an unregistered process of raising funds. It is beneficial for startups as they do not require to comply with the lengthy registration process.

Final Words

It’s a well-established principle of finance and investments that one should not put all your eggs in one basket. The same is applicable to the funding also. It means you try to get funding also from different sources rather than from one source only. Of course, it depends on the status of the project, quantum of funding requirements, and availability of lenders, minimum funding criteria, etc. Diversification of funding sources may help you in getting a variety of advice, support, and business connections at various levels. This will also help you better weather potential downturns. Moreover, it would also ensure that you do not depend on one source for funds. If you use just one source and if it turns sour, your business existence could be at risk.

Also read – Sources of Finance for Small Business