Financial Management

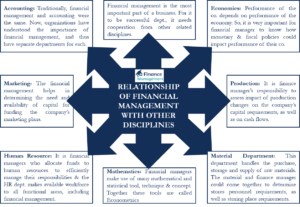

Financial management is a technique for managing funds effectively, whether it is a corporation or an individual. The main objective of financial management is growth maximization. Financial management has different implications for corporations and individuals. For corporations, it is meant for effective procurement and utilization of funds. On the other hand, for individuals, it is meant to manage their earnings in order to have good financial health and stability in the future.

The word ‘Financial Management’ is a combination of two crucial words in the business environment viz. ‘Finance’ and ‘Management.’ ‘Finance’ means funds; therefore, financial management refers to funds management. It is a technique of planning, sourcing, and investing funds in the most effective manner.

Broadly speaking, financial management is nothing but the planning of expenditures and incomes to ensure financial stability. Financial stability implies the availability of sufficient money at the time of requirement. It is a key concern to be addressed for many entities. Entities may include corporations (for sourcing and investments of funds), individuals (planning for future expenditures and incomes), government (utilizing the public money in a most efficient manner), and non-profit organizations (planning of funds required for activities to be undertaken), etc.

Financial management can be broadly classified into two levels –

Corporate Financial Management

Corporate finance deals with the financial decisions taken by a company to achieve its financial and other goals. Financial decisions involve procurement of funds and utilization of funds. The expected outcome of the activity of ‘Procurement of Funds’ is not only limited to the acquisition of required funds for business but it should be ensured that it is acquired at the lowest possible costs (interest or dividends expectations etc.), risks (repayment of funds creating bankruptcy risk) and dilution in control (dilution of shareholding and thereby control over the company).

On the other hand, ‘Utilization of Funds’ entails the employment of funds at the right place to ensure the highest returns possible, which are at least more than the cost of funds. It also needs to ensure that there are no idle funds to incur costs unnecessarily.

But, before deciding on how to procure funds and where to utilize them, there is a big question before managers, and that is whether to maximize the profit or wealth of shareholders. This means deciding what should be the objective of the company.

Personal Financial Management

Personal finance deals with monetary decisions required at the individual level. It involves evaluating the requirements of money in terms of ‘quantum’ and ‘time’ and then planning for earnings, expending, saving, budgeting, and investing of money to achieve financial stability and health. It does not mean earning more money, but it means utilizing the earned money to satisfy all the requirements in the best possible manner. The ultimate aim of personal financial management is to ensure the balance between earnings and incomes. The main components of personal finance are insurance, tax planning, loans like home loans and personal loans, retirement planning, social security, banking, etc.

Continue reading – 9 Attributes Of Effective Management.