Zero Based Budgeting

Zero-Based Budgeting Meaning and Definition

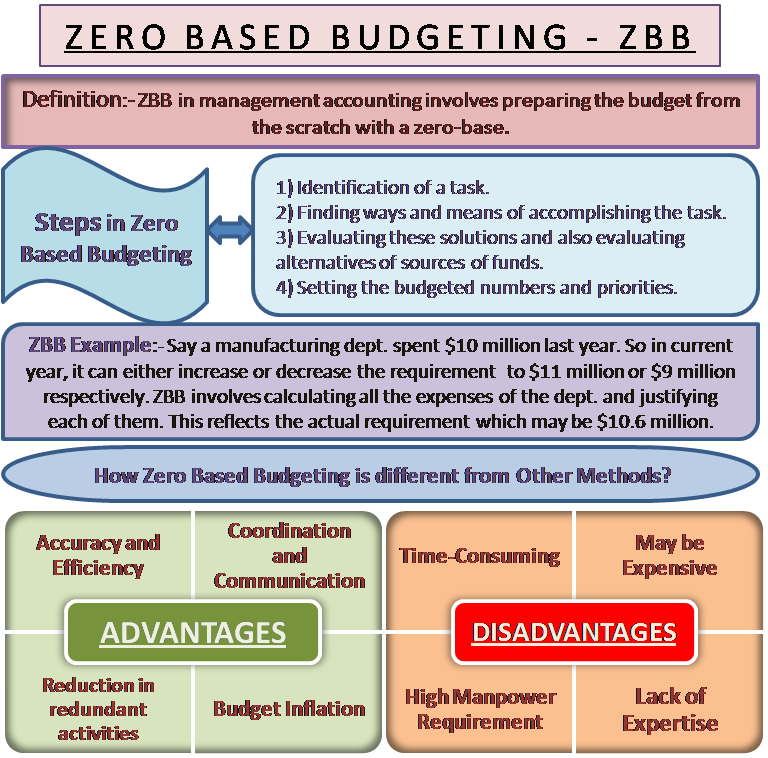

Zero-based budgeting in management accounting involves preparing the budget from scratch, that is, with a zero-base. It involves re-evaluating every line item of the cash flow statement and justifying all the expenditures a department will incur.

Thus, the definition goes as “a method of budgeting whereby all the expenses for the new period are calculated on the basis of actual expenses that are to be incurred and not on the differential basis which involves just changing the expenses incurred taking into account change in operational activity.” Under this method, every activity needs to be justified, explaining the revenue that every cost will generate for the company.

Contrary to traditional budgeting, in which past trends or past sales/expenditures are expected to continue, zero-based budgeting assumes that there are no balances to be carried forward or there are no expenses that are pre-committed. In the literal sense, it is a method for building the budget with zero prior bases. It emphasizes identifying a task and then funding these expenses irrespective of the current expenditure structure.

Zero-Based Budgeting Steps

1) Identification of a task

2) Finding ways and means of accomplishing the task

3) Evaluating these solutions and also evaluating alternatives of sources of funds

4) Setting the budgeted numbers and priorities

To understand the Steps in Zero Based Budgeting, an example is given below to understand how it works.

Zero-Based Budgeting Example

Let us take an example of a manufacturing department of a company ABC that spent $ 10 million last year. The problem is to budget the expenditure for the current year. There are multiple ways of doing so:

- The board of directors of the company decides to increase/decrease the expenditure of the department by 10 percent. So the manufacturing department of ABC Ltd will get $ 11 million or $ 9 million, depending on the management’s decision.

- The company’s senior management may decide to give the department the same amount as it got in the previous year without hiring more people in the department, or increasing production, etc. This way, the department ends up getting $ 10 million.

- Another way is, as, against the traditional method, management may use zero-based budgeting in which the previous year’s number of $ 10 million is not used for calculation. Its application involves calculating all the expenses of the department and justifying each of these. This reflects the actual requirement of the manufacturing department of company ABC, which may be $ 10.6 million.

How Zero-Based Budgeting is different from Other Methods

To have a clear understanding, it is necessary to understand the key differences between zero-based budgeting and other methods of budgeting.

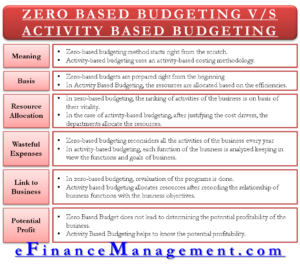

- Zero Based Vs. Activity-Based Budgeting

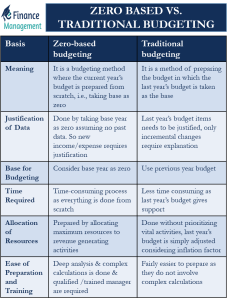

- Zero Based Vs. Traditional Budgeting

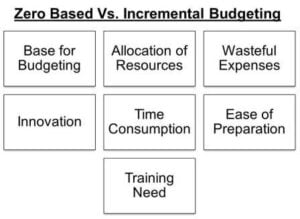

- Zero Based Vs. Incremental Budgeting

Having understood the calculation, let us move to some of its advantages and disadvantages, as stated below:

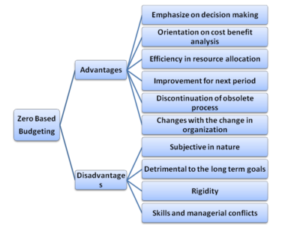

Zero-Based Budgeting Advantages

The following are the Advantages of zero-based budgeting:

- More accurate than other methods as this method is not just an arbitrary changes to previous year’s budget but considers inflation and relook at the cash flow and operation costs of every department.

- This helps in the efficient allocation of resources (department-wise) as it does not look at the historical numbers but looks at the potential of the department.

- It leads to the identification of opportunities and more cost-effective ways of doing things by removing all the unproductive or redundant activities.

Zero-Based Budgeting Disadvantages

The following can be disadvantages of zero-based budgeting:

- It is time-consuming as every time it had to start from scratch.

- It can be costly as more skills and expertise is required.

Conclusion: Zero-based budgeting aims at reflecting true expenses to be incurred by a department or a state (in the case of budget-making by the government). Although being time-consuming, this is a more appropriate way of budgeting. At the end of the day, it is a company’s call as to whether it wants to invest time and manpower in the budgeting exercise to provide more accurate numbers or go for an easier method of incremental budgeting.

Must read Budgeting for other types of budgeting