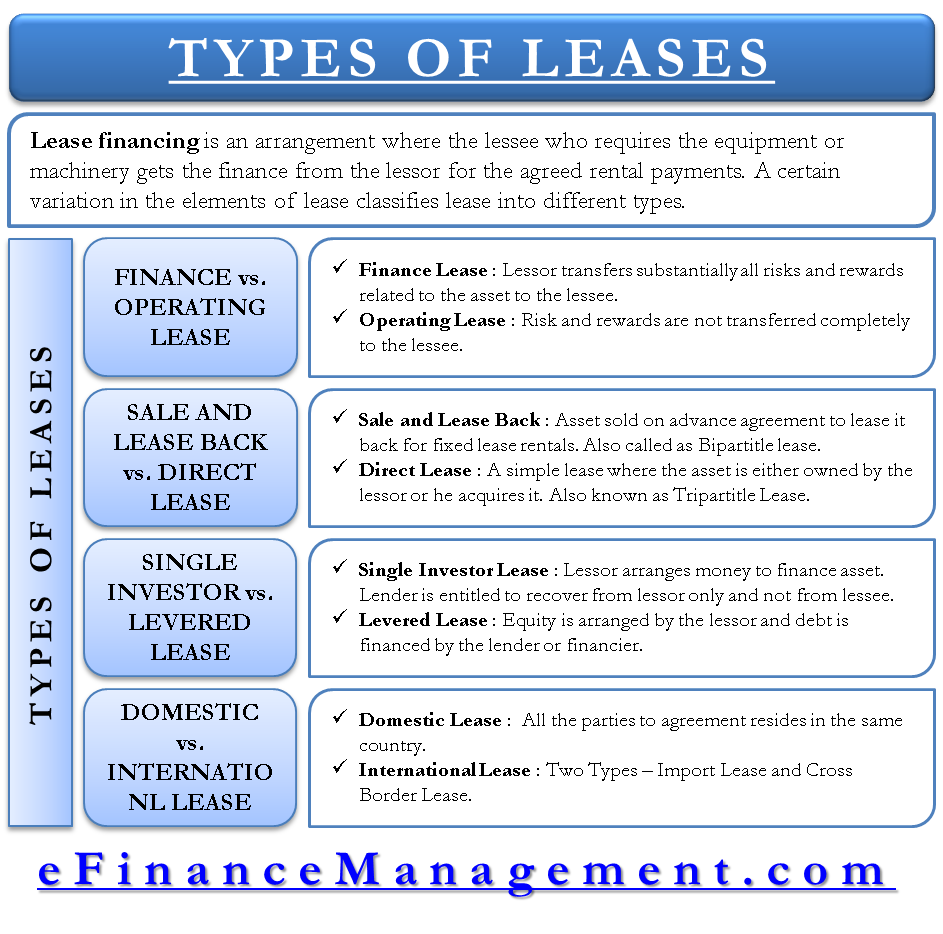

Leases are classified into different types based on the variation in the elements of a lease. Very popularly heard leases are – financial and operating leases. Apart from these, there are the sale and leaseback and direct lease, single investor lease and leveraged lease, and domestic and international lease.

A lease is an important financing option for an entrepreneur with no or inadequate money to finance the initial investment required in plant and machinery. The lessor finances the asset or equipment in a lease, and the lessee uses it in exchange for fixed lease rentals. In other words, lease financing is an arrangement where the lessee who requires the equipment or machinery gets the finance from the lessor for the agreed rental payments. Such a kind of lease is called a finance lease. There are many such arrangements, and hence, there are many types of leases. Let us have a look at the different kinds of the lease.

A certain variation in the elements of lease classifies lease into different types. Such elements are as follows:

- The degree of ownership risk and rewards transferred to the lessee.

- No. of parties involved

- Location of the lessor, lessee, and the equipment supplier

- The lessor and the lessee

Here, risk means the chance of technological obsolescence, and reward refers to the cash flow generated by the use of the equipment and the residual value of the equipment.

Read What is a lease to know more about the lease.

Types of Leases

Based on the above dimensions, leases are classified into two parts.

Lease Classification:

- Leases for Business

- And, Leases for home (house)

Leases For Business

Finance Lease and Operating Lease

A finance lease is also known as a Full Payout Lease. It is a type of lease wherein the lessor substantially transfers all the risks and rewards related to the asset to the lessee. Generally, the ownership is transferred to the lessee at the end of the asset’s economic life, and the lease term is spread over the major part of the asset life. Here, a lessor is only a financier. An example of a finance lease is large industrial equipment.

Also Read: Types of Equipment Leases

On the contrary, risk and rewards are not transferred completely to the lessee in an operating lease. The lease term is very small compared to the finance lease, and the lessor depends on many different lessees for recovering his cost. Ownership, along with its risks and rewards, lies with the lessor. Here, a lessor is not only acting as a financier, but also provides additional services required in the course of using the asset or equipment. An example of an operating lease is a music system leased on rent with the technicians.

Sale And Lease Back and Direct Lease

In the sale and leaseback arrangement, the lessee sells his asset or equipment to the lessor (financier) with an advanced agreement of leasing back to the lessee for a fixed lease rental per period. It is exercised by the entrepreneur when he wants to free his money, invest in the equipment or asset, to utilize it at the whatsoever place for any reason.

On the other hand, a direct lease is a simple lease where the asset is either owned or acquired by the lessor. In the former case, the lessor and equipment suppliers are the same person, called ‘bipartite lease.’ In a bipartite lease, there are two parties, and in the latter case, there are three different parties, viz. equipment supplier, lessor, and lessee. And it is called a tripartite lease. Here, the equipment supplier and lessor are two different parties.

Single Investor Lease and Leveraged Lease

There are two parties in a single investor lease – lessor and lessee. The lessor arranges the money to finance the asset or equipment through equity or debt. The lender is entitled to recover money from the lessor only and not from the lessee in case of default by a lessor. Lessee is entitled to pay the lease rentals only to the lessor.

Also Read: Difference Between Lease and Finance

On the other hand, Leveraged lease has three parties – the lessor, lessee, and the financier or lender. Equity is arranged by the lessor, and the lender or financier finances debt. Here, there is a direct connection of the lender with the lessee and, in a case of default by the lessor. The lender is also entitled to receive money from the lessee. Such transactions are generally routed through a trustee.

Domestic and International Lease

When all the parties to the lease agreement reside in the same country, it is called a domestic lease.

The International lease is of two types – Import Lease and Cross-Border Lease. When the lessor and lessee reside in the same country, and the equipment supplier stays in a different country, the lease arrangement is called an import lease. When the lessor and lessee live in two different countries and no matter where the equipment supplier stays, the lease is called a cross-border lease.

Combination Lease

Combination Lease offers features of both financing or capital lease and Operating Lease. This is a customization form of leasing. One of the simple examples of a combination lease is a capital lease that carries a clause for cancellation.

Leases For Home

Sub Lease

A sublease is a rental agreement where the original lessee(tenant) rents out the premises to another person called the sub-tenant or sub-lessee. The new tenant gets few rights as the sub-lessee. The actual tenant (lessee) can only give those rights to the new tenant (sub-lessee), which he has gained from the original landlord (lessor). He cannot pass on more rights of use on the property. The rent flow is from the sub-lessee to the lessee and the lessor/owner. The risk of rent is always mainly borne by the lessee. If the sub-lessee cannot make full or timely payment to the original lessee, the lessor is still entitled to his timely rents, and the lessee bears the risk.

Modified Gross lease

A modified gross lease, also referred to as a modified net lease, finds a middle ground between a gross lease and a net lease.

Some of the building or property expenses are borne by the tenant. At the same time, the remaining is maintained by the landlord, with no single party responsible for all the operating costs. For instance, we can consider this: The tenant may pay CAM costs in a modified gross lease. In contrast, the landlord may take up taxes and insurance.

Gross Lease

A Gross lease is the simplest form of a lease. In this format, the lessee agrees to pay the lessor a flat fee at a regular interval, for instance, monthly. The lessor takes care of any and every expense associated with the property. The rate charged does not change, and it is a rent agreement in which the cost of keeping up the rented asset, including its protection and charges, is borne by the lessor. Gross lease rental is usually higher than the net lease rental as the lessor would have factored in different types of expenses in the rentals that are being charged.

Triple Net Lease

A triple net asset is the most commonly used type of lease for commercial and even some residential estates. Here the tenant will pay for everything from rent, property taxes, insurance, and common area maintenance and repair expenses (also known as CAMS – Common Area Maintenance Items). Hiring regular staff and maintenance help can also be part of this – e.g., receptionist, lobby attendant, etc.

Others

Various other types of leases include:

Nice post..