Definition of Standby Letter of Credit

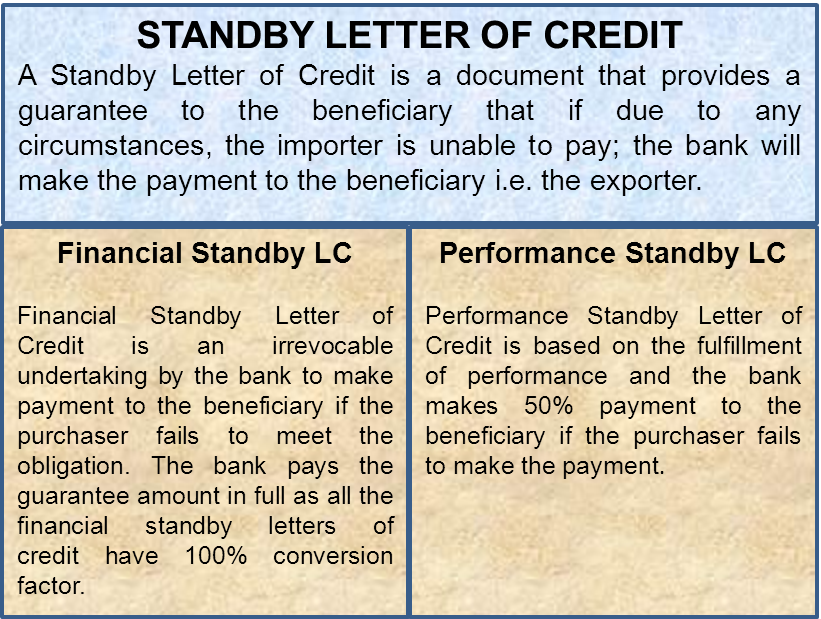

A Standby Letter of Credit is a document that provides a guarantee to the beneficiary that, if due to any circumstances, the importer is unable to pay, then the bank will make the payment to the beneficiary, i.e., the exporter.

Let’s try to understand the concept of a Standby Letter of Credit with the help of the following example.

Example of Standby Letter of Credit

Niya Ltd., an exporter from India, received an order to supply goods to John Ltd., an American company. Niya Ltd. wants an assurance from John Ltd. that it will make timely payment for the goods. Obliging to the request of Niya Ltd., John Ltd. issued a Standby Letter of Credit in favor of Niya Ltd. In this case, if, due to any circumstances, John Ltd. fails to make the payment to Niya Ltd., the Indian company can claim the credit on the Standby Letter of Credit. Thus, the Standby Letter of Credit assures the exporter that he will be paid for the export of goods.

The concept of a Standby Letter of Credit is often confused with a Letter of Credit. However, there are some differences between the two:

Standby Letter of Credit vs. Letter of Credit

A Letter of Credit is a credit document used to make payment to the beneficiary upon fulfilling contractual obligations. However, a Standby Letter of Credit is a standby payment mode that the beneficiary can only use when the purchaser fails to make the payment for any reason.

For a detailed explanation of the differences, please read: Standby Letter of Credit vs. Letter of Credit

Types of Standby Letters of Credit

A Standby Letter of Credit comes in two types:

- Financial Standby Letter of Credit

- Performance Standby Letter of Credit

Let’s look at the meaning of each type.

Financial Standby Letter Of Credit

A Financial Standby Letter of Credit is an irrevocable undertaking by the bank to make a payment to the beneficiary if the purchaser fails to meet the obligation. The bank pays the guaranteed amount in full, as all financial standby letters of credit have a 100% conversion factor.

Also Read: LC Vs. SBLC

Performance Standby Letter of Credit

A Performance Standby Letter of Credit is an irrevocable obligation by the bank to pay the beneficiary upon the failure of the purchaser to fulfill any contractual obligations. A Performance Standby Letter of Credit is based on the fulfillment of performance, and the bank makes a 50% payment to the beneficiary if the purchaser fails to make the payment.

There is another special type of letter of credit called a Revolving Letter of Credit. This is similar to a Standby Letter of Credit, but there is a small difference, as will be explained below.

Revolving Letter of Credit

A Revolving Letter of Credit is a special type of Letter of Credit that facilitates long-term business contracts between exporters and importers. A Revolving Letter of Credit involves contracts covering multiple shipments or purchases over a long duration of time.

Conclusion

A Standby Letter of Credit addresses the growing need for international transactions. The exporter of goods always wants to be assured that his payment will be made in a timely manner. If his payment is not made for any reason, he must have an alternative source from which to recover his money. A Standby Letter of Credit acts as that alternative source. It gives confidence to both parties involved in international trade. Businesses are expected to utilize a Standby Letter of Credit at an increasingly higher rate in the coming years.

Also, read LC Vs. SBLC

Thanks very much for the formula it works

can the SBLC be revolving ?

can the SBLC be revolving ?

yes. it can be. check following post.

https://efinancemanagement.com/sources-of-finance/revolving-letter-of-credit