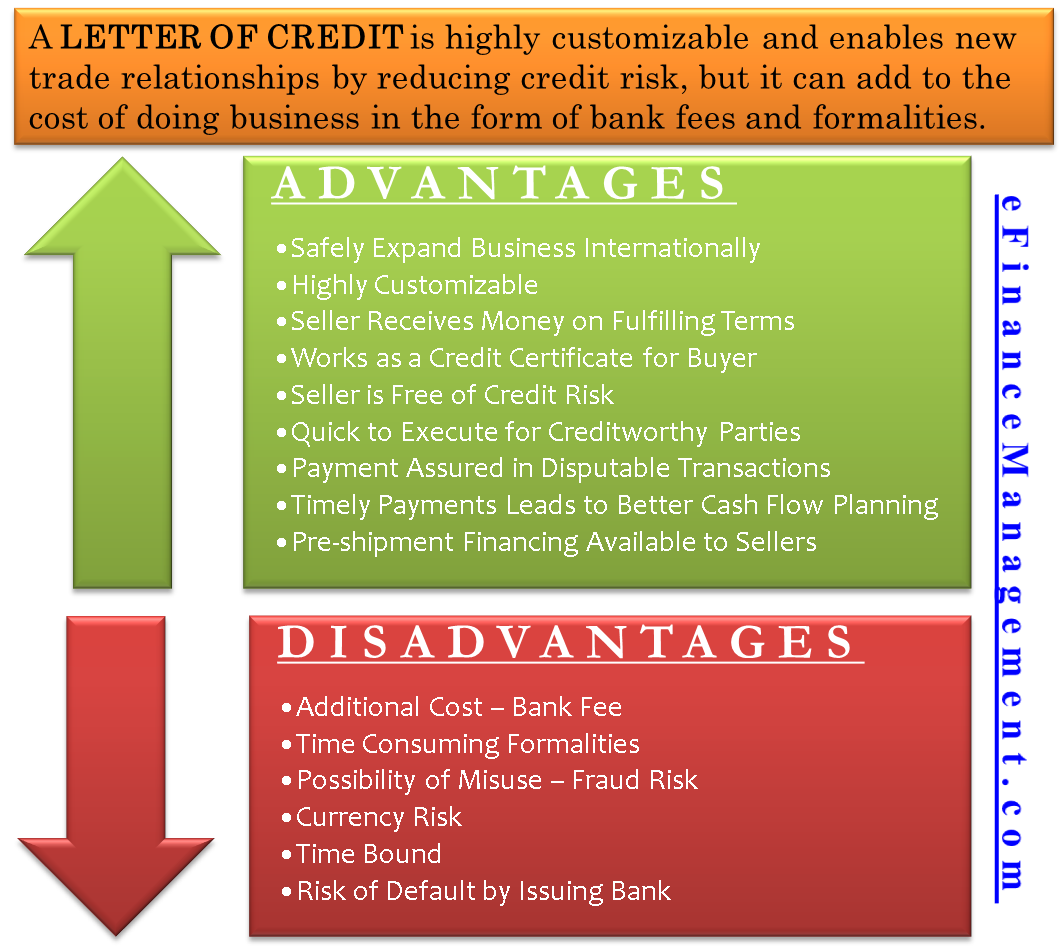

LC is a complex product for new importers & exporters. It’s ideal to check the advantages and disadvantages of a letter of credit (LC) before opting for it. A letter of credit is highly customizable and enables new trade relationships by reducing credit risk, but it can add to the cost of doing business in the form of bank fees and formalities. Let’s see the advantages and disadvantages of letter of credit in details:

Advantages of Letter of Credit

A letter of credit enjoys various advantages in executing an international trade transaction. Some of the major ones are below:

- Advantages of Letter of Credit

- Safely Expand Business Internationally

- Highly Customizable

- Seller Receives Money on Fulfilling Terms

- Works as a Credit Certificate for Buyer

- Seller is Free of Credit Risk

- Quick to Execute for Creditworthy Parties

- Payment Assured in Disputable Transactions

- Timely Payments Leads to Better Cash Flow Planning

- Pre-shipment Financing Available to Sellers

- Disadvantages of Letter of Credit

Safely Expand Business Internationally

A letter of credit gives the trade partners the ability to transact with unknown partners or in newly established trade relationships. It helps in expanding their business quickly into new geographies.

Highly Customizable

A letter of credit is highly customizable. Both the trading partners can put in terms and conditions as per their requirements and arrive at a mutual list of clauses. It can also be customized from one transaction to another with the same trading partners.

Seller Receives Money on Fulfilling Terms

A letter of credit makes the issuing bank independent of the trading partners’ obligations and any disputes arising out of those obligations. The bank has to check whether the documents submitted by the beneficiary satisfy the terms and conditions specified in the letter of credit, and pay the full amount.

Also Read: Import and Export Letter of Credit

Works as a Credit Certificate for Buyer

A letter of credit transfers the credit-worthiness from the importer or buyer to the issuing bank. The importer can do multiple transactions at the same time when he is backed by an established and larger institution such as a bank.

Seller is Free of Credit Risk

A letter of credit is safer for the seller or exporter in case the buyer or importer goes bankrupt. Since the creditworthiness of the importer is transferred to the issuing bank, it is the bank’s obligation to pay the amount as agreed in the letter of credit. Thus, a letter of credit insulates the exporter from the importer’s business risk.

Quick to Execute for Creditworthy Parties

A letter of credit is quick to execute. As per the initial terms and conditions, the seller or exporter has to present the proof of material type and quantity along with the shipping documents supporting his claim that the goods have been shipped. The advising bank will verify the documents and give the full payment.

Payment Assured in Disputable Transactions

In the case of a dispute between the trading partners, the exporter can withdraw the fund as agreed upon in the letter of credit and resolve the disputes later in court. The beneficiary’s right to the full amount is described in the phrase ‘pay now, litigate later by the courts.

Also Read: Letter of Credit Example

The importer cannot hold or deny the payment to the exporter by raising objections on the quality of goods because the bank needs to see the documents satisfying the shipping terms and conditions as put in the letter of credit.

Timely Payments Leads to Better Cash Flow Planning

A letter of credit provides certainty to the amount and timing of the exporter’s cash flows. He can plan his financing needs well in advance, which reduces his risk.

Pre-shipment Financing Available to Sellers

The exporter can avail of pre-shipment financing against a letter of credit. This helps him in plugging the financing gaps if any.

Disadvantages of Letter of Credit

As with any financial instrument, even a letter of credit has disadvantages, as listed below:

Additional Cost – Bank Fee

A letter of credit adds to the cost of doing business. Banks charge a fee for providing this service, and it can increase steeply if the parties want to put some additional features.

Time-Consuming Formalities

The required documentation and formalities may be more in a letter of credit. This may also add to the cost of doing business.

Possibility of Misuse – Fraud Risk

A letter of credit has complex governing rules and some notorious buyers or sellers can misuse it to take advantage of it.

A letter of credit poses a material fraud risk to the importer. The bank will pay the exporter upon looking at the shipping documents and not the actual quality of goods. Disputes can arise if the quality is different from what was agreed upon.

Currency Risk

A letter of credit also carries forex risk. There will be an agreed-upon currency in the letter of credit. At least one of the parties will have a different currency than that, and hence they will face a risk due to currency fluctuations. It can also work in favor.

Time-Bound

A letter of credit has an expiration date, and therefore the exporter has a time limit within which he will have to deliver the goods by all means. At times, this haste creates a mess.

Risk of Default by Issuing Bank

A letter of credit essentially transfers the credit-worthiness from the importer to the issuing bank. So, if the issuing bank defaults, there is still a payment risk to the exporter. Though the exporter can avoid it if the advising bank guarantees the payment, that will add to the cost of the letter of credit.

Quiz on Advantages and Disadvantages of Letter of Credit

Hey, I’m really glad I have found this information. Today bloggers publish just about gossips and net and this is actually irritating. A good web site with exciting content, this is what I need. Thank you for keeping this web-site, I’ll be visiting it. Do you do newsletters? Can not find it.

Hey, I am so happy I found your site, I really found you by accident, while I was looking on Digg for something else, Regardless I am here now and would just like to say thanks for an incredible post and all-round enjoyable blog (I also love the theme/design), I don’t have time to read through it all at the moment but I have saved it and also included your RSS feeds, so when I have time I will be back to read more, Please do keep up the fantastic work.

Hi to everybody, it’s my first pay a visit of this web site; this web site consists of amazing and in fact good material in favour of readers.

Aw, this was an incredibly nice post. Finding the time and actual effort to create a superb article.

I’m really enjoying the design and layout of your website. It’s very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a developer to create your theme? Outstanding work!

whoah, this blog is wonderful I like studying your articles. Keep up the great work! You recognize, a lot of persons are searching round for this info, you can help them greatly.