Sweat Equity: Meaning

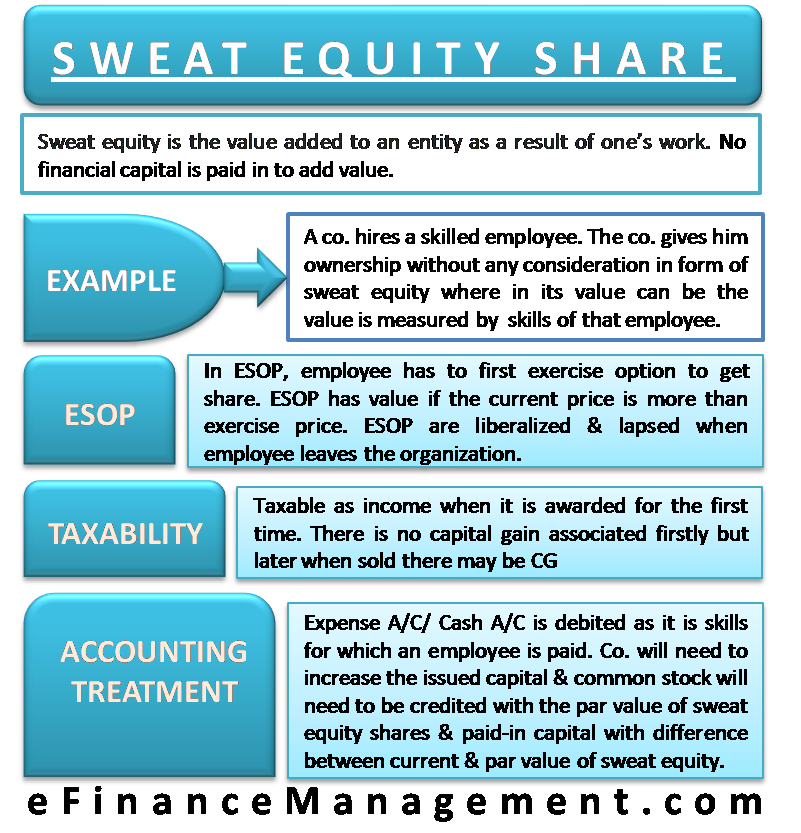

Sweat equity is the value-added to an entity as a result of one’s work. No financial capital is paid in to add value. It can also be understood as the value of human capital one puts into his business. Sweat equity is a good tool for attracting a skilled workforce to your company and retaining them for the long term. As the skilled employee works with an organization, he keeps on adding value to it and hence increasing his sweat equity too. Sweat equity is also relevant in a non-business scenario. When someone is repairing his house or his car, he increases their value by putting in an effort.

In the case of organizations issuing sweat equity, the equity or shares can be issued without any financial consideration or at a discount.

Sweat Equity Example

Suppose an entrepreneur starts his company with an initial capital of USD 10,000. He works in the business for 5 years and eventually sold it off for USD 1,000,000. The value generated by the entrepreneur is USD 990,000, which is due to the work that he put into the business. The value of sweat equity, in this case, is USD 990,000.

Another example can be when a company hires an employee with a certain skill set. The company will give him equity ownership in the business without any financial consideration in the form of sweat equity. The value of sweat equity in such a case can be estimated by measuring the value added by the skill set of that employee.

Sweat Equity Share and ESOP

Companies also give ESOPs for hiring and retaining talent, especially in start-ups. An ESOP is essentially a call option to buy the company’s share at a pre-determined price when the valuation has increased in the future. ESOPs usually come with a vesting schedule where the full award vests in tranches over a long period of time (usually 4-5 years). Once ESOPs are vested to the employee, he has to exercise them in a certain period to reap the benefits. Failing so, the options lapse and are worthless.

Sweat equity is different from ESOP. As opposed to being a call option, sweat equity shares are actual shares that get vested to the employee directly. In the case of ESOP, the employee has to first exercise the option to get the share. ESOP has value if the share’s current price is more than the exercise price of the option. A sweat equity share always has a certain value except when the company goes bankrupt. Companies are usually more liberal in giving ESOP than sweat equity. It’s because ESOPs lapse if the employee leaves the organization before a stipulated period. But sweat equity, once paid, can’t lapse. It’s part ownership of the business and will stay forever unless the employee decides to sell his sweat equity share. The financial exposure to the company is more in cases of sweat equity.

Sweat Equity Taxability

Sweat equity is a form of income. So, it is taxable as income when it is awarded for the first time. There is no capital gain associated with the sweat equity when first awarded. But when it is sold later at a higher value, there might be a capital gains tax associated with it. If the founders award themselves sweat equity, they can avoid the tax by awarding it before the company incorporation. Once the company is incorporated, any sweat equity award is taxable as normal income.

Sweat Equity Accounting Treatment

Sweat equity is paid for the skills and work an employee has put in. It is essentially an expense. If the company maintains expense accounts, sweat equity can be debited from that. Else, it can be debited from cash. The company will need to increase the issued capital by the same amount on the equity side. The common stock will need to be credited with the par value of sweat equity shares and paid-in capital with the difference between the current value and the par value of sweat equity shares.

Continue reading – Equity Share and its Types.