Financial accounting and management accounting are two terms we often hear in the financial world. Although both are branches of accounting, they are completely different in their function and scope. In this article, let’s discuss in detail the differences between the two, beginning with their broad meaning.

What is Financial Accounting?

Financial accounting is the systematic recording of financial transactions to prepare financial statements that show the position of a business at the end of a period. External stakeholders, mainly investors, creditors, etc., use this information to judge the financial health of the company and take informed decisions.

What is Management Accounting?

On the other hand, management accounting assists an organization in making internal decisions. This accounting is useful for top-level managers like the CEO, CFO, and middle-level managers that include the General Manager, HR, etc. It is often confidential and limited to the company’s management, and it is utilized by management in bringing efficiency and effectiveness to the organization’s operations.

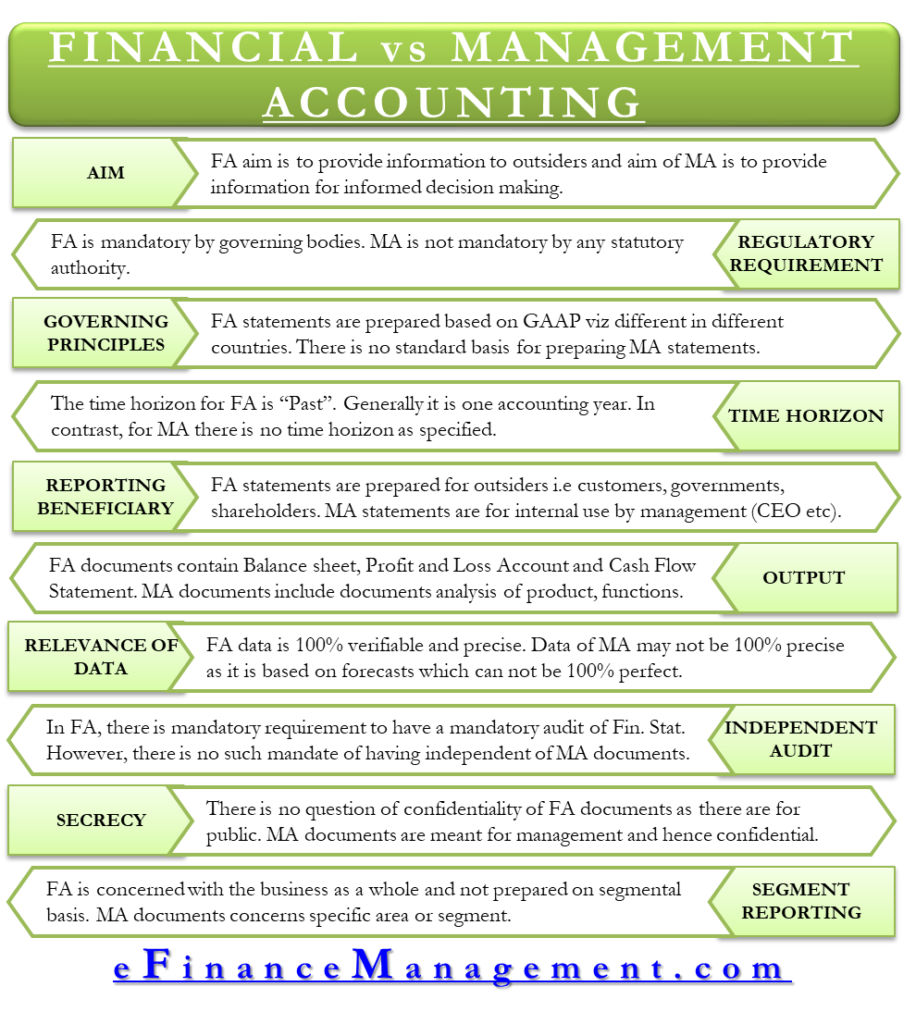

Difference between Financial Accounting and Management Accounting

| Points of Difference | Financial Accounting | Management Accounting |

Aim |

The main aim is to provide information to outside parties to make informed decisions. Outside parties include creditors, investors, customers, etc. | Generally, management accounting information is meant for management to make informed business decisions. |

Regulatory Requirements |

It is a mandatory requirement for every public organization to disclose its financial statements. Thus, they are governed by accounting standard boards, companies’ laws & government. | It is at the discretion of management. There is no mandatory requirement for its maintenance, but institutes like CIMA, ICWAI, etc., still provide some frameworks and formats. |

Governing Principles |

Financial accounting statements are prepared based on ‘Generally Accepted Accounting Principles (GAAP).’ This GAAP is different for different countries with more or less the same features. | There is no standard basis for preparing management accounting statements, and hence, they are designed based on the requirements of the management team. |

Time Horizon |

The time horizon for financial accounting is ‘past, and generally, it is one accounting year. | It has no specific time horizon, but the main focus is on estimating the future using the past data. |

Reporting Beneficiaries |

It is prepared for outside or external parties, such as shareholders, suppliers, customers, government, banks, etc. | Reports prepared here are helpful to internal parties like CEO, directors, promoters, higher-level managers, etc. |

Outputs |

Financial accounting reports consist of profit and loss statements, balance sheets, and cash flow statements. | Management accounting reports are the monthly, weekly, or yearly analysis of products, geographies, functions, etc. |

Relevance & Precision of Data |

Data of financial accounting are 100% verifiable and precise. Here, everything has evidence to support it. | Data of management accounting isn’t necessarily 100% verifiable. So, the data should be relevant, timely, and logical. For instance, sales can’t be forecasted perfectly. |

Independent Audit |

Independent audit of financial accounting reports is mandatory in most countries. For instance, CPA conducts such audits in the USA, and CA conducts such audits in India. | There is no specific requirement for an independent audit. But, management, at its discretion, can take the initiative to conduct an independent audit for the sake of efficient & effective management. |

Confidentiality |

Financial accounting statements are publicly published and meant for the public only. So, there is no question of confidentiality. | Management accounting statements are meant for management & confidentiality of the statements is the key concern as they contain business secrets. |

Segment Reporting |

It is concerned with the whole business & it is an end in itself. Accounting standards in some countries bind companies to do such reporting in defined formats. | It is concerned with a specific area or segment for their analysis. Hence, segments may be a product line, geography, manufacturing unit, etc. |

Perspective |

It has a historical perspective. | It has a futuristic perspective. |

Nature of Input Information |

Information required for financial accounting statements is financial in nature. | Both financial and non-financial information is utilized in preparing management accounting reports. |

Also read – Cost Accounting and Management Accounting

Frequently Asked Questions(FAQs)

A. It is not mandatory by any statutory authority.

B. MA statements are for internal use by management.

C. It has no specific time horizon.

D. All of these.

D. All of these.

The principal reason for preparing managerial accounting reports is to inform the management about the health of the business and suggests improvements to make informed decisions.

Following are the external users of accounting information:

a) Suppliers.

b) Customers

c) Shareholders.

d) Government.

e) Banks.

f) Investors

A. There is no specific requirement for an independent audit.

B. Management accounting statements are required for public use only.

C. It uses both financial and non-financial information.

B. Management accounting statements are required for public use only.

Wonderful lecture at its best.

This blog post still appears on Google top 10 when you search “Differences between Management Accounting and Financial Accounting”. Don’t you think “Profit and loss account” in number 6 should be changed to “Statement of Comprehensive Income” and “Balance sheet” to “Statement of Financial Position”

Thanks.

Thanx

Cost management accounting is what we call management accounting?

Hi Yusuf,

Glad you visited our site. I think your question can be well attended with the following post on our site.

Cost Accounting and Management Accounting

Answers here are sound and clear

Thank.

Keep visiting.

I am new to the field of accounting and the information shared here helped me get a clear difference between these two concepts.

Thank you