Equity share is a primary source of finance for any company giving investors rights to vote, share profits, and claim assets. In the world of finance and investment management, ‘equity share’ is a big word, and we frequently use it in every following discussion. We call it stock, ordinary shares, or shares; all are the same.

Explaining equity shares on a page or a bunch of pages is very difficult. Let us still try to define it in as a summarized manner as possible.

Usually, a company is started with equity finance as its first source of capital from the owners or promoters of that company (founder’s stock). After a certain level of growth, there is a requirement for more capital for further growth. The company then finds an investor in the form of friends, relatives, venture capitalists, mutual funds, or any such small group of investors and issues new equity shares to these investors.

A point comes where the company reaches a very high level and requires enormous capital investment for business growth. An Initial Public Offer (IPO) is the offer of shares that the company makes to the general public for the first time. And Follow-up Public Offer (FPO) is the offer company makes in the future to the public. Other than these, there are various other sources of equity financing. But let us first work on our basics and try to understand various terms related to equity shares.

You may like watching the Video PPT of the content.

Equity Shares

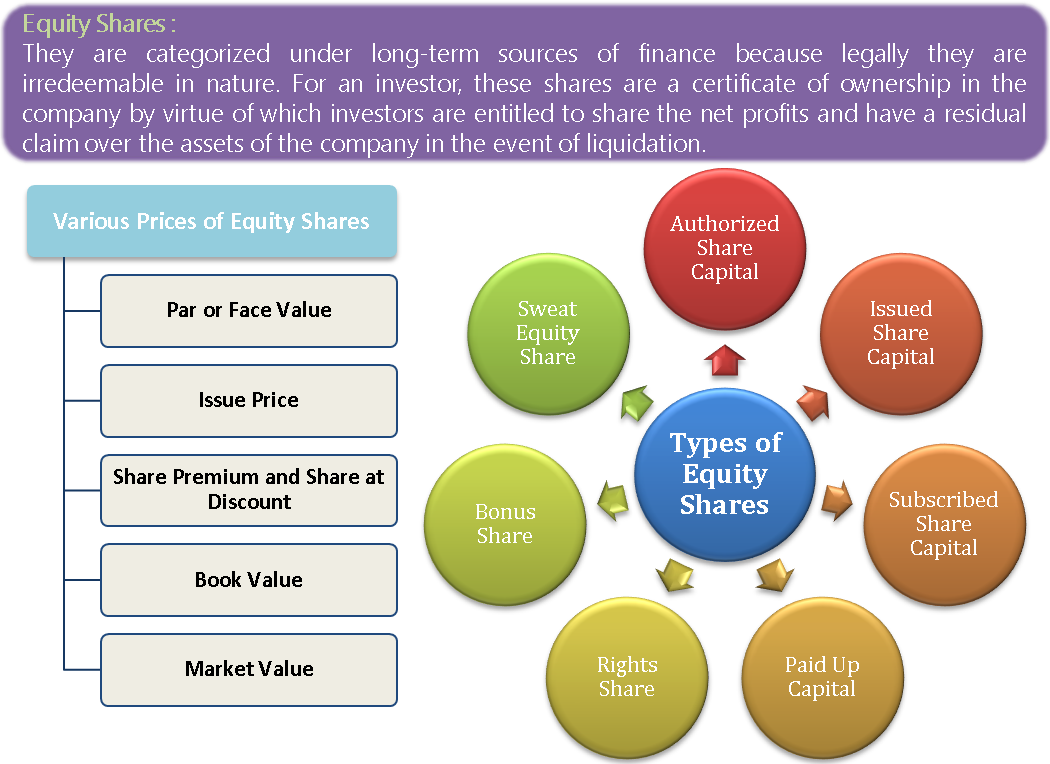

They fall under the long-term sources of finance– category because, legally, they are irredeemable. If a company redeems its equity shares, it indicates that the company is going for the process of liquidation. For an investor, these shares are a certificate of ownership in the company by virtue of which investors are entitled to share the net profits and have a residual claim over the company’s assets in the event of liquidation. Investors have voting rights in the company, and their liability to the company is limited to the amount of issue price of the equity stock.

Types of Equity Shares

There are various classes of shares (equity) dependent on multiple things. Let’s discuss them.

Authorized Share Capital

It is the maximum amount of capital that a company can issue. Companies can increase it from time to time by altering their memorandum.

Issued Share Capital

It is part of the authorized capital that the company offers to investors.

Subscribed Share Capital

Subscribed share capital is that part of issued share capital that an investor accepts and agrees upon.

Paid Up Capital

It is part of the subscribed capital for which the investors have paid. Normally, all companies accept complete money in one shot, and therefore issued, subscribed, and paid capital becomes the same. Conceptually, paid-up capital is the amount of money a company invests in the business. It is also known as contributed capital.

Apart from the above, other types of shares (equity) also exist.

Rights Shares

Right shares are those that a company issues to its existing shareholders. The company issues such kinds of shares to protect the ownership rights of the existing investors.

Bonus Shares

When the company issues shares to its shareholders in the form of a dividend, we shall call them bonus shares.

Sweat Equity Share

Sweat equity shares are issued to exceptional employees or directors of the company for their exceptional job in terms of providing know-how or intellectual property rights to the company.

Also Read: Types of Equity Investments

Treasury Stock

Treasury stock means the share that the company has bought back. Read Treasury Stock Vs Common Stock to understand what are treasury shares and how these are different from common shares.

Price Terminology Related to Equity Shares

The following are the various terms used to determine different prices of equity shares:

Par or Face Value

Par or face value is the value of shares that we record in the books of accounts. It is also termed the legal capital in the books of accounts of the company.

Issue Price

This price is the price at which a company offers its shares to investors.

Share/Security Premium

When the issuance of shares is at a price higher than face value, we shall call this excess amount a security premium.

Share at Discount

On the contrary to the above, when the issuance of shares is at a price lower than face value, we call this deficit amount as share issued at discount.

Book Value

The book value of equity shares, also known as “shareholders’ equity” or “net assets”, represents the residual value of a company’s assets after deducting its liabilities. In other words, it is the total amount of assets that would remain if all the company’s debts were paid off. The formula to calculate the book value is:

| Book Value of Equity Shares = (Paid-up Capital + Reserves and Surplus – Any Loss) / The total number of equity shares of the company |

Market Value

In the case of companies listed on stock exchanges, the market value of the equity share is the price at which they are currently sold in the market. The other term for it is market capitalization. It may happen that stock market value and value as per fundamental principles differ. Because there are a number of sentiments that affect the stock market value.

Fundamental Value

The fundamental value of equity shares, also known as “intrinsic value“, is an estimate of the true value of a company’s shares based on its underlying financial and economic factors. This value is determined by analyzing the company’s financial statements, business model, industry trends, management team, and other relevant factors that may affect its future earnings and growth prospects.

How do Equity Shares Work?

When talking about equity shares, there are two angles. One is the investing angle, wherein the investor invests in equity shares, and the second is the financing angle where a company accepts the finance in the form of equity. Therefore, it is very important to determine on what basis a person is evaluating equity shares – an equity investment or an equity financing option.

Refer to our following article to learn about the advantages and disadvantages from both angles.

- Financing Angle: Benefits and Disadvantages of Equity Finance

- Investor Angle: Benefits and Disadvantages of Equity Shares Investment

Frequently Asked Questions (FAQs)

Equity in stocks is a long-term source of finance for any company, where the investors get shares as a certification of ownership in the company. These investors are entitled to the voting right, share in the net profits and residual claim on the assets of the company at the time of liquation of the company

Authorized share capital.

Issued share capital.

Subscribed share capital.

Paid-up capital.

Right shares.

Bonus shares.

Sweat equity shares.

Rights shares or right issue refers to the shares issued to the existing shareholders. These shares protect the ownership rights of the existing investors.

Quiz on Equity Share and its Types

This quiz will help you to take a quick test of what you have read here.

IT’S SIMILARLY SO GOOD

Very usefull for me .I was finding information about equity shares. So it give me a very usefull Knowledge.thnks to all creaters

Thanks for giving full information about the equity shares

Thanksss giving info.abt shares

Thanks for the info !!

Simply brief and exhaustive at the same time. So much value packed into so little space. Wonderful piece.

thanks for information about equity share

Nice Article. Here is some information about Stockholder’s equity.

A good and clear information on equity share. MANY THANKS

Thank you. Got to learn simple words.

What’s up, always I used to check weblog posts here early in the break of day, since I love to find out more and more.

Business angels are wealthy individuals who invest in high growth businesses in return for a share in the business.

Between Equity and Debenture which one is the cheapest source of long-term finance

Thank for the information! This information will help beginners to understand what truly equity market is and what are the types of equity shares available. the explanation was easy to understand

Thanks for the information very helpful content for the beginners and students. Very nice article very thanks

It was really amazing and gave me a lot of information

Hi Shubham

Keep visiting