Meaning

A revolving letter of credit is a single letter of credit that covers multiple transactions over a long period of time. It is very specific in the way that it is used for regular shipments of the same commodity between the same buyer (importer) and the seller (exporter). This letter of credit is issued only once for a certain period of time or a certain number of transactions. It avoids the need for repetitive arrangements to open a new letter of credit for every transaction.

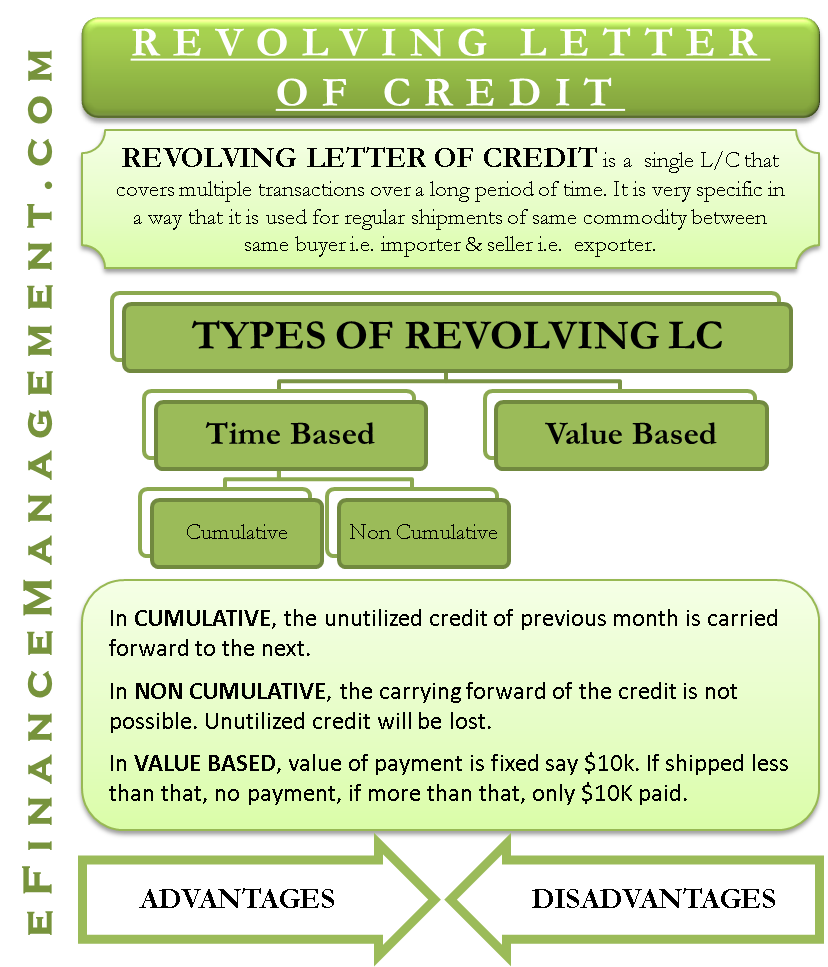

Types of Revolving Letter of Credit

The revolving letter of credit can be further subcategories into two – One is based on time, and the other is based on value. Let’s understand each in detail. Following are the two types of revolving letters of credit:

Revolving Letter of Credit-Based on Time

This letter of credit is based on time; a specific amount (payment) is allowed to be drawn within a defined period of time. Let’s understand with an example.

Example – Mr. Cho from China is a manufacturer of ball pens and is a regular supplier to Mr. Will, who is based in the UK. They decide to have a transaction with a revolving letter of credit. On January 1, 2018, Mr. Will obtains a revolving letter of credit of USD 60,000.00 to be drawn each month by USD 10,000.00 for the next 6 months in the name of Mr. Cho.

Also Read: Types of Letter of Credit (LC)

Following is the line of transactions –

| Month | Transactions on the part of Mr. Cho | Payment through revolving letter of credit |

| January 2018 | Goods worth USD 10,000.00 manufactured and shipped | Payment received USD 10,000.00 |

| February 2018 | Goods worth USD 3,000.00 manufactured and shipped | Payment received USD 3,000.00 |

| March 2018 | Goods worth USD 4,000.00 manufactured and shipped | Payment received USD 4,000.00 |

| April 2018 | Goods worth USD 12,000.00 manufactured, but the shipping of only USD 10,000.00 was allowed. So goods of USD 10,000.00 were shipped, and the remaining goods were kept in stock. | Payment received USD 10,000.00 |

| May 2018 | Goods worth USD 8,000.00 manufactured and goods worth USD 10,000.00 shipped (USD 8000.00 in May + USD 2000.00 in April) | Payment received USD 10,000.00 |

| June 2018 | Goods worth USD 10,000.00 manufactured and shipped | Payment received USD 10,000.00 |

| End of June 2018 | Revolving letter of credit expired |

Further, a revolving letter of credit based on time can be of two types as follows –

Cumulative

In a revolving LC based on time, if it is the cumulative type, the previous unused L/C limits can be used in future months. In the previous example, if Mr. Cho doesn’t ship any goods in the month of May 2018, then he can ship goods worth USD 20,000.00 in the month of June 2018.

Non-Cumulative

In a revolving letter of credit based on time, if it is the non-cumulative type, then the previous unused L/C limits cannot be used in future months. In the previous example, if Mr. Cho doesn’t ship any goods in the month of May 2018, he is still allowed to ship only goods worth USD 10,000.00 in the month of June 2018. The USD 10,000.00 unused limit of May 2018 becomes void.

Revolving Letter of Credit-Based on Value

The second type of revolving letter of credit is based on value. An amount and validity for the letter of credit are set in this, and the seller has to work on these criteria.

Let’s extend our previous example and make it a revolving letter of credit in relation to value. Other things same on January 1, 2018, Mr. Will obtains a revolving letter of credit of USD 60,000.00 to be drawn each month by USD 10,000.00 for the next 6 months in the name of Mr. Cho.

Also Read: Commercial Letter of Credit

Here even though the letter of credit looks the same, the line of transactions will be different as follows:

| Month | Transactions on the part of Mr. Cho | Payment through revolving letter of credit |

| January 2018 | Goods worth USD 10,000.00 manufactured and shipped | Payment received USD 10,000.00 |

| February 2018 | Goods worth USD 3,000.00 manufactured but can’t ship as the value of the transaction must be USD 10,000.00 | No payment |

| March 2018 | Goods worth USD 4,000.00 manufactured but can’t ship as the value of the transaction must be USD 10,000.00 | No payment |

| April 2018 | Goods worth USD 12,000.00 manufactured, but the shipping of only USD 10,000.00 was allowed. So goods of USD 10,000.00 were shipped, and the remaining goods were kept in stock. | Payment received USD 10,000.00 |

| May 2018 | Goods worth USD 8,000.00 manufactured, and goods worth USD 10,000.00 (USD 8000.00 in May + USD 2000.00 in previous months) were shipped. | Payment received USD 10,000.00 |

| June 2018 | Goods worth USD 10,000.00 manufactured and shipped | Payment received USD 10,000.00 |

Thus, the revolving letter of credit is a good payment instrument when the transactions are long-term in nature. It helps avoid the procedural hassle and cost of issuing a regular letter of credit for every transaction.

Benefits

The prime benefit of the revolving letter of credit is saving a lot of time and energy for all the three parties, i.e., Bank, Importer, and Exporter. The arrangement should be clear and long-term between the buyer and the seller.

Disadvantages

If there is any dispute between the buyer and seller before completing the whole transaction, the time, energy, and cost involved in acquiring the LC could be lost.

Read Types of Letter of Credit to know about its various other types.

Quiz on Revolving Letter of Credit

Good initiative Sanjay! Very informative

Thanks, Joel,

You will keep receiving. Your genuine feedback is most welcomed.

This is a very interesting article!

Thank you for making this. its very informative!

Very educating.i need more write ups on LC and BC

Tks

Well explained & shared. Thank you!

Thank you so much for excellent explanation along with numerical example and advantages and disadvantages as well. All the best for more and more articles

Thanks a lot. Very well explained and it can be easily understood by the non-finance person also.

WELL DONE SANJAY, MOST INFORMATIVE and useful for all businesses

Thanks a lot. Its very well explained and its easily to understood

Thanks alot dear.

Clearly explained with examples.

Thanks a lot

Dear Mr. Sanjay Bulaki Borad,

My name Omar Aljufry, residing in Saudi Arabia, came to know about you thru the internet as the founder & CEO of eFinance Management. and that you are passionate about keeping and making things simple and easy.

I would like to advise you that we are expecting to receive REVOLVING DOCUMENTARY LETTER OF CREDIT, we have quoted the prices for big quantities, the buyer advised us that they will establish RDLC, we are afraid that they establish the RDLC for the first two shipments and then disappear, thus taking advantage of the low price given to them of the big quantities they ordered.

I want your piece of advice, how to make the RDLC binding on the customer for the whole quantity, is there any clause or additional conditions to be inserted/mentioned in the RDLC MT700, please advice.

Your reply will be highly appreciated.

Dear Mr. Omar. Prima facie it is not possible to bind him for all the shipments thru RDLC because

1. RDLC would have the upper limit as well as the time period.

2. In fact, the amount wd be limited to the equivalent of one shipment only which revolves again for the second shipment.

3. The moment you try to bind him for the entire shipment, the entire shipment value has to appear in the LC and there the bank needs to agree to extend that much of credit to the party establishing it, and the next question of margin money for this amount of LC.

4. The only alternative seems to be the LC for the whole value.

Another possibility if that is acceptable to you is to enter into a legal contract with the party and then on that strength you supply and then follow the legal recourse in case of any delay or default.

Thanks for the query. Do hope we have been able to clarify the matter to your satisfaction. Thanks