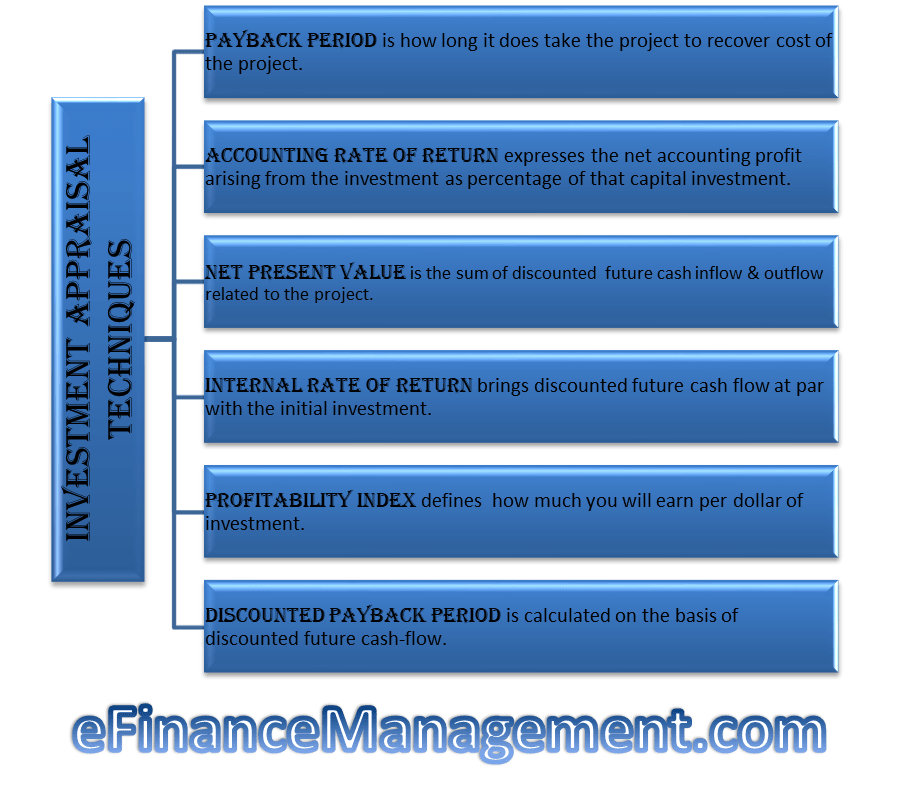

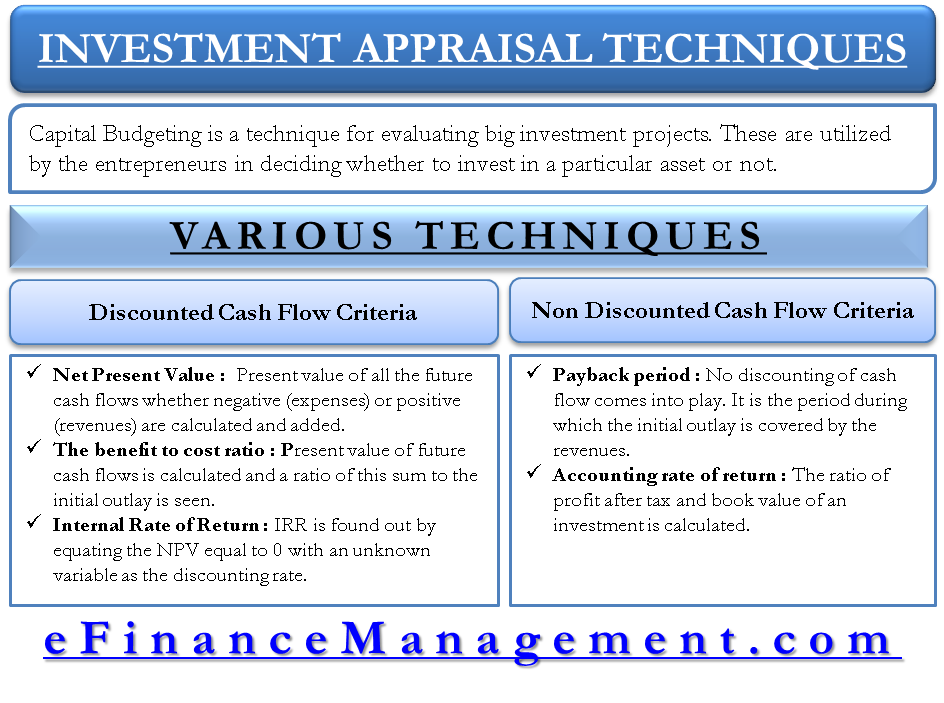

Investment appraisal techniques are also known as capital budgeting techniques. Capital budgeting helps an entity decide whether or not a project would offer the expected returns in the long term. Also, it helps a company to choose the best project when it faces a choice between two or more products. These techniques are payback period, internal rate of return, net present value, accounting rate of return, and profitability index. They are primarily meant to appraise the performance of a new project. Before beginning any new project, the first question that comes to our mind is, “Whether it is viable or profitable? These techniques answer this question very well. Each technique evaluates the project from a different angle and provides a different insight. Let us understand these techniques in brief.

These techniques are classified into two parts that are, discounted cash flow techniques and non-discounted cash flow techniques.

Non-Discounted Cash Flow Techniques

Under non-discounted cash flow techniques, future cash flows are not discounted to arrive at their present value. The following two techniques are classified under the head of non-discounted cash flow techniques:

- Payback period

- Accounting rate of return

Payback Period

One of the simplest investment appraisal techniques is the payback period. The payback technique states how long it takes for the project to generate sufficient cash flow to cover the project’s initial cost.

For Example,

XYZ Inc. is considering buying a machine costing $100,000. There are two options Machine A and Machine B. Machine A will generate revenue of $ 50,000, $ 50,000 & $ 20,000 in year 1, year 2 & year 3 respectively while Machine B will generate revenue of $ 30,000, $ 40,000 & $ 60,000 in year 1, year 2 & year 3 respectively.

Also Read: Capital Budgeting Techniques With an Example

Machine A:

| Year | Revenue | Cumulative Revenues |

|---|---|---|

| 1 | 50,000 | 50,000 |

| 2 | 50,000 | 100,000 |

| 3 | 20,000 | 120,000 |

Machine B:

| Year | Revenues | Cumulative Revenues |

|---|---|---|

| 1 | 30,000 | 30,000 |

| 2 | 40,000 | 70,000 |

| 3 | 60,000 | 130,000 |

As per the above example, the payback period is 2 years & 2.5 years for machine A & machine B, respectively. According to the payback period method, machine A will be given preference.

The advantage of payback is that it is very easy to calculate & understand. Even people not from a finance background can easily understand it. But the disadvantage is that it ignores the time value of money & anything that happens after a payback point.

Accounting Rate of Return Method

Accounting rate of return is an accounting technique to measure the profit expected from an investment. It expresses the net accounting profit arising from the investment as a percentage of that capital investment. It is also known as return on investment or return on capital.

The formula of ARR is as follows:

ARR=(Average annual profit after tax / Initial investment) X 100

For Example,

XYZ Inc. is looking to invest in some machinery to replace its current malfunctioning one. The new machine, which costs $ 420,000, would increase annual revenue by $ 200,000 and annual expense by $ 50,000. The machine is estimated to have a useful life of 12 years.

- Depreciation expense per year = $ 420,000/ 12 = $ 35,000

- Increase in average annual profit = $ 200,000 – ( $ 50,000 + $ 35,000) = $ 115,000

- Initial investment = $ 420,000

- ARR = ( $ 115,000 / $ 420,000 ) * 100 = 27.38%

Discounted Cash Flow Techniques

Discounted cash flow (DCF) techniques calculate the present value of cash flows to be received in the future. The following are classified under discounted cash flow techniques:

- Net present value

- Internal rate of return

- Profitability index

- Discounted payback period

Read what are Discounted Cash Flows to get a clear understanding of DCF techniques.

Net Present Value

It is the most popular method of investment appraisal. Net present value is the sum of discounted future cash inflows & outflows related to the project. This method lays importance on the time value of money and is in line with the company’s objective to maximize shareholders’ wealth. Generally, the weighted average cost of capital (WACC) is the discounting factor for future cash flows in the net present value method.

In essence, this method sums up the discounted net cash flows from the investment by the minimum required rate of return & deducts the initial investment to give the ‘net present value.’ The company should accept the project if the NPV is positive.

The formula of NPV ={ + + …….. } – Initial Investment

Where,

CFi = Cash-flow of first period

CFii = Cash-flow of second period

CFiii = Cash-flow of third period

CFn = Cash-flow of nth period

n = No. of Periods

i = Discounting rate

For Example,

XYZ Inc. is starting the project at the cost of $ 100,000. The project will generate cash-flow of $ 40,000 , $ 50,000 & $ 50,000 in year 1, year 2 & year 3 respectively. The company’s WACC is 10%. Find out NPV.

Formula of NPV = [ $40,000/( 1+0.1)1] + [ $ 50,000 / (1+0.1)2 ] +[ $ 50,000/ (1+0.1)3 ] – 100,000

Net present value = $ 36,363.63 + $ 41,322.31 +$ 37,565.74 – $ 100,000

= $ 115,251.68 – $ 100,000

The net present value of the project is $ 15,251.68.

Here, the net present value of the project is positive & therefore, the project should be accepted.

Internal Rate of Return Method

An internal rate of return is the discounting rate, which brings discounted future cash flows at par with the initial investment. In other words, it is the discounting rate at which the company will neither make a loss nor make a profit. We can also call this rate the yield on investment and the marginal efficiency of capital.

It is obtained by the trial & error method. We can also state that IRR is the rate at which the NPV of the project will be zero. i.e., Present value of cash inflow – Present value of cash outflow = zero.

The management approves an investment or a project if its IRR (internal rate of return) is higher than the cost of capital or the required rate of return.

Profitability Index

The profitability index defines how much you will earn per dollar of investment. The present value of an anticipated future cash flow divided by initial outflow gives the profitability index (PI) of the project. It is also one of the easy investment appraisal techniques.

Suppose the present value of anticipated future cash flow is $ 120,000 & the initial outflow is $ 100,000. Then the profitability index is 1.2. i.e. $ 120,000 / $ 100,000. This means each invested dollar is generating a revenue of 1.2 dollars. If the profitability index is more than 1, the project should be accepted & if it is less than 1, it should be rejected.

If we reduce complications, it is nothing but a different presentation of NPV.

Discounted Payback Period Method

Discounted payback period method is the same as the payback period method. The only difference in discounting payback method is that the payback period is calculated on the basis of discounted future cash flows. In contrast, the payback method is calculated on the basis of future cash flows.

Refer to Capital Budgeting Techniques With an Example for explanation with example.

Frequently Asked Questions (FAQs)

There are two types of investment appraisal techniques:

a) Non-discounted cash flow techniques: payback period and accounting rate of return.

b) Discounted cash flow techniques: Net present value, internal rate of return, profitability index, and discounted payback period.

Internal rate of return or IRR is the discounting rate that discounts the future cash flow at par with initial cash outflow/investment. It is the rate at which the NPV of the investment will be zero.

PV of the anticipated future cash flows / Initial outflow.

I intended to post you this little bit of word to be able to give many thanks over again with the magnificent solutions you’ve provided at this time.

WELL SUMMARISED MATERIAL. THANK YOU

THE EXPLANATION IS WELL DETAILED AND EASY TO COMPREHEND

THUMBS UP FOR THAT

Perfect explaination. All the best

thank you so much summerised in easy word and but i am find WACC Example can you help me please.

Very nice explanation of NPV and IRR

Brief ,simple ,detailed and to the point.thank you so much

Thank u for giving ,Such aWorthwhile and concised material.

well explained simple and great understanding with examples

Short and brief explanation.

Interesting notes

This was very helpful!!

Straight to the point explanation.

easy to understand for beginners.

These notes makes the financial tools for management analysis simple and easy to follow through and understand.

They are brief and straight to the point.

Good material which have help me finish up my proposal seeking finance to construct a mall

Nice one

Thanks Nketiah for visiting our site. We have more content on investment appraisal techniques, you can try other content through our search box.

clear explanations, THANK YOU

Hi,

Thanks for visiting our website.

Thanks the notes are very clear and easy to understand

Well summarized and useful

Thanks

Happy reading!!

XYZ Inc. is considering buying a machine costing $100,000. There are two options Machine A and Machine B. Machine A will generate a net cash inflow of $50,000, $50,000; $ 20,000 in year 1, year 2; year 3 respectively. Machine B will generate net cash inflow of $ 30,000, $ 40,000; $ 80,000 in year 1, year 2; year 3 respectively. Which machine should it buy?

Hi Farhad

The company XYZ Inc. should buy machine A since it has a smaller payback period. Machine A will recover its initial investment in 2 years while machine B will require 2.5 years to recover the same.

Also, if the company has other details such as the cost at which the initial investment has been obtained, it can use other techniques of capital budgeting.

We recommend reading our detailed article on techniques of capital budgeting along with the examples for more clarity.

This must be informed with additional data about the machines’ useful life, and running costs. For example, if both machines have identical running costs and equal useful life of 10 years each, and returns stabilize at year 3 values, then machine B will be the better project.

Well explained when all other project complications are removed and the focus is only on financial appraisals.