Revocable Letter of Credit – Meaning

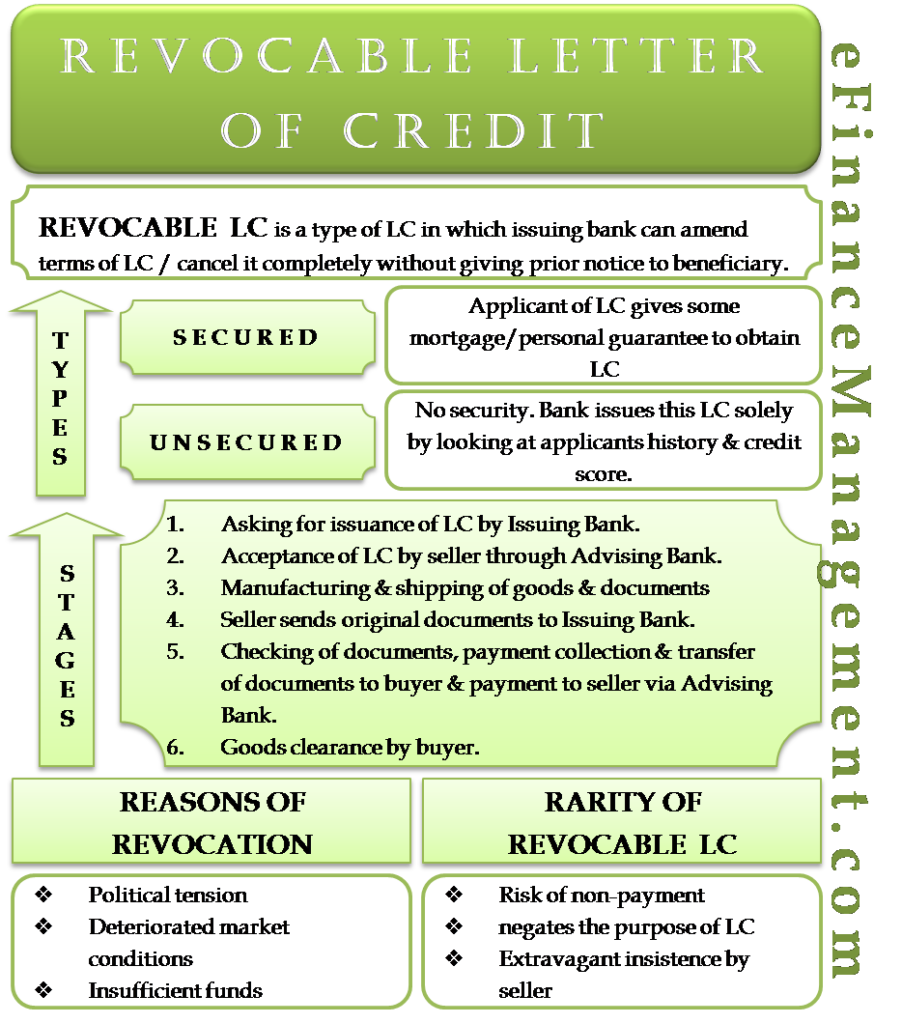

A revocable letter of credit is a type of letter of credit in which the issuing bank can amend the terms of the letter of credit or cancel the letter of credit completely without giving prior notice to the beneficiary.

Reasons Why a Bank Revokes a Letter of Credit

There are many reasons why the issuing bank decides to revoke this letter of credit.

Firstly, there are adverse circumstances, such as political tension, deteriorated market conditions, etc., due to which the bank is incapable of honoring the terms of the letter of credit. There are high chances of the letter of credit being revoked by a bomb-hit bank in Afghanistan.

Secondly, there is a possibility that the issuing bank doesn’t have sufficient funds to honor the letter of credit, in which case it cancels the letter of credit. For example, after the 2008 financial crisis, Merrill Lynch filed for bankruptcy. It may revoke all its revocable letter of credit in such a condition.

Types of Revocable Letter of Credit

The following are the two types:

Secured Revocable Letter of Credit

The applicant’s assets secure this letter of credit. In other words, the applicant of the letter of credit has given some mortgage security or personal guarantee to obtain the letter of credit.

Also Read: Letter of Credit

Unsecured Revocable Letter of Credit

This letter of credit does not carry any security. The bank has issued this letter of credit solely by looking at the applicant’s history and credit score.

It is important to note that whether it be secured or unsecured, the banker always has the choice to revoke any revocable letter of credit.

Stages at which the Issuing Bank can Revoke the Revocable Letter of Credit

The process of the letter of credit can be divided into the following stages.

- The buyer agrees to buy the goods from the seller and agrees to pay through a letter of credit. The buyer asks the issuing bank to issue a letter of credit.

- Issuing bank issues this letter of credit and sends it to the seller via the seller’s advising bank. The seller accepts it.

- The seller manufactures and ships the goods and prepares shipping documents.

- Then, the seller sends the original documents as per the terms of the letter of credit to issuing bank.

- The issuing bank checks the documents, collects payment from the buyer, and gives the documents to the buyer. Furthermore, it makes the payment to the seller via an advising bank.

- The buyer clears the goods from the shipping line.

The issuing bank can amend or cancel the letter of credit anytime at stage – 3, stage – 4, and stage – 5. The bank can ask to amend the terms of the letter of credit, terms such as asking for an additional document, changing the expiry date of the letter of credit, etc. Also, the issuing bank can refuse to act as a mediator for payment and refuse to pay. In this case, the seller has to collect the payment directly from the buyer. It becomes the seller’s responsibility.

Rarity of Revocable Letter of Credit

A revocable letter of credit is extremely rare. This is because of many reasons. Firstly, it is vulnerable to the risk of non-payment. In fact, it actually negates the purpose of a letter of credit.

Additionally, no bank will confirm a revocable letter of credit. Thus sellers insist that the issuing bank issues an irrevocable letter of credit.