An IPO Process brings a private company on the platter to potential investors. There are various differences between private and public companies, and the owners and management of the company have to look into multiple aspects, such as the scale of business and the potential to grow. Equity Financing is an intricate and essential part of a company to grow. To achieve a scale from a startup / mid-tier level to come to the level of an IPO is a milestone.

What is IPO?

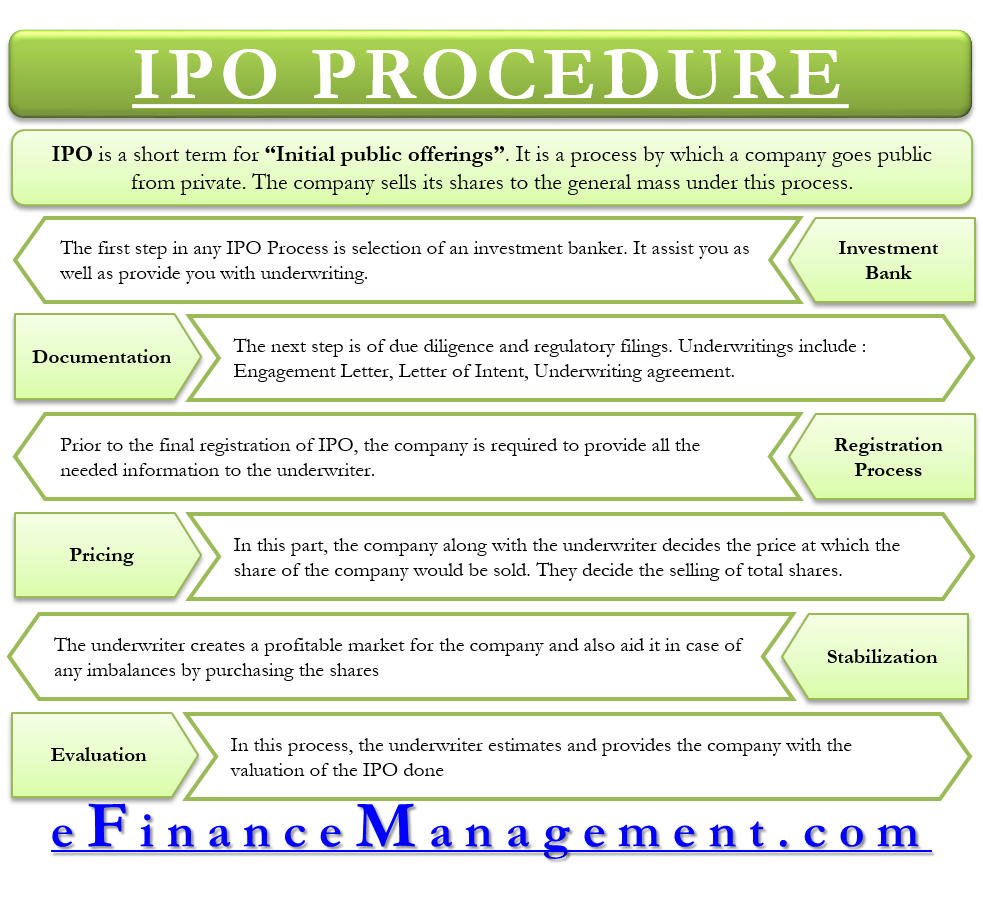

IPO is a short term for “Initial public offerings.” It is a process by which a company goes public from private. The company sells its shares to the general mass under this process. IPO is a sign of the financial stability and prosperity of a company. Going through this process gains the prestige of listing in NASDAQ OR NYSE. A company generally goes for this step to raise funds for various needs of the company, like infrastructural investments, buying of new assets, etc.

This process ranges from 4 to 6 months. All you need is to make your company financially strong and stable enough and then make your way through the process it includes. Below mentioned is the process of Initial Public Offerings.

IPO Process

Following are the mandatory process for a company to go public:

Selection of an Investment Bank

This is the primary step in the IPO process. Although a company can rarely sell its shares on its own, it will result effectively. Hiring an investment bank in this regard is highly recommended. You need it for basically 2 purposes, i.e., assisting you and providing you with an underwriting (essential for IPO). You can seek the help of corporate finance in this matter.

Also Read: Types of Investment Banking Services

It’s well and good if you have a tie-up with an investment bank. But if you want to go for a fresh tie-up with an investment bank, then generally, the criteria looked upon to choose a bank are- Bank’s ratings and reviews, the capability of the bank to fulfill your needs, the expert’s bank has in this regard, to mention a few.

Documentation

After hiring an investment bank, due diligence and regulatory filings are the next steps. There are three ways in which an underwriter can provide you with the underwritings. These are-

Firm’s commitment

In this, the bank purchases all the required shares of a company and now sells them on its own to the public. This method assures the company a fixed amount of funds.

Best Effort’s Agreement

In this, the bank acts only as a mediator/broker. The selling of shares determines the procedure for the company’s fundraising.

Syndicate

In case of high risk or other such factors, not one but many banks do the work of share selling of a company. One bank acts as a lead bank, and the process is done. (Read more about Underwriting Syndicate)

Also Read: Private Placement

Various Underwritings Provided by the Bank

Engagement Letter

One part of it states that the issuing company will incur all the expenses of the process. It doesn’t matter even if the company withdraws from the IPO process at any time. It is also termed as the reimbursement clause. Another is the gross underwriting discount (GUD). Its calculation is as follows:

GUD= sale price of the share by underwriter – purchasing price of a share by the underwriter.

Letter of Intent

This letter includes an agreement between the underwriter and the issuing company. It states- that the company agrees to submit all the required information to the underwriter, and the later shall positively make an agreement with the company. Also, the underwriter gets the overallotment options (greenshoe option) of 15%.

Underwriting Agreement

This is the stage where the IPO underwriter finally purchases all the agreed shares of the company. In other words, this part initiates the selling process of the company’s shares.

Registration Process

Prior to the final registration of IPO, the company is required to provide all the needed information to the underwriter. It also includes the negativities faces by the company. It has 2 sets:

The prospectus

Prospectus of IPO is given to every Institute or individual who buys the shares sold in the IPO.

Private Fillings

This is generally a confidential process done which includes the submission of the information to the SEC for inspection.

Also, read – Shelf Registration.

Pricing

In this part, the company, along with the underwriter, decides the price at which the share of the company would be sold. They decide the selling of total shares. This step begins after the approval of the SEC (Security and Exchange Commission). Then the date is finalized, and a day before it, this step is concluded. Pricing entails both underpriced or overpriced. The later increase the chances of earning more profit.

Note: In the meantime, the company and underwriter prepare a prospectus and go for a roadshow. It is nothing but a way to pitch and bid for the upcoming IPO for better success. And it lasts for 3 to 4 weeks, generally. It greatly influences the pricing of the IPO.

Stabilization

This is the part where the underwriter has a great role. The underwriter creates a profitable market for the company. Also, it aids it in case of any imbalances by purchasing the shares of the company at a price that does not hit the company financially.

Evaluation

This is the final stage of IPO and starts post 25 days of the enforcement of the process. In this process, the underwriter estimates and provides the company with the valuation of the IPO done, i.e., the funds raised by the company or any adversity faced. Financial analysis is what tells you the actual performance of your work.