Meaning of Structured Notes

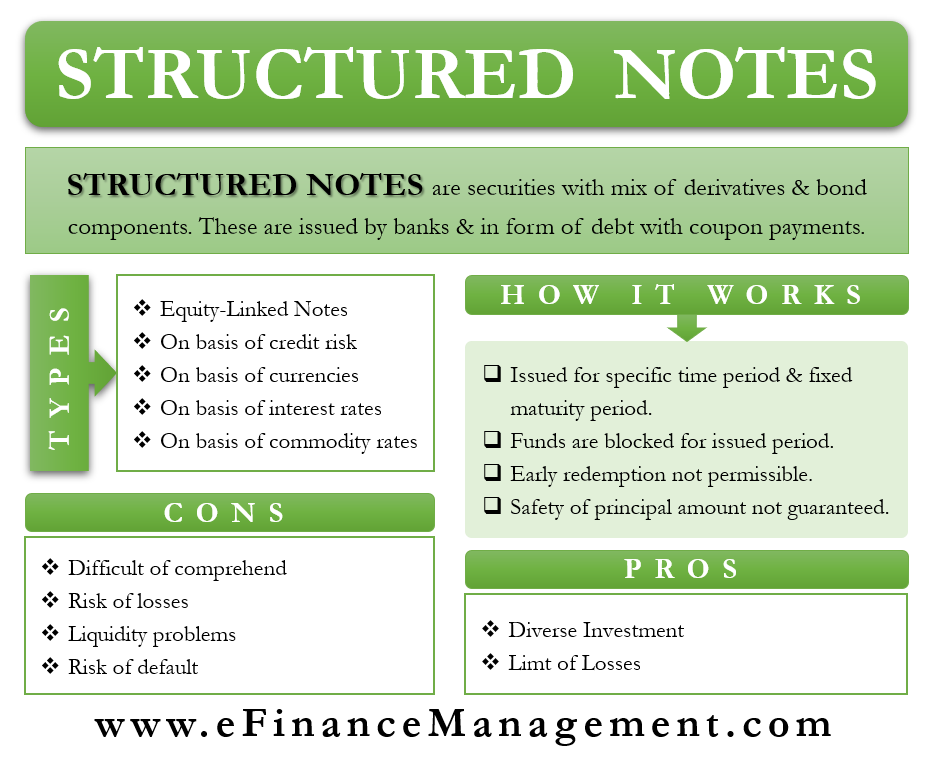

Structured Notes are securities with a mix of derivatives and bond components. They are hybrid in nature and are tailor-made for investors according to their levels of risk tolerance. These are a type of medium-term notes. Such securities help investors with little to moderate risk appetite to invest in high to medium risk assets. Also, they don’t have to fear losing their entire investment in case the investments in high-risk assets backfire. Banks generally issue such notes. These notes are in the form of debt, and coupon payments are made to the investors over the period of their investment.

Structured notes perform on the basis of the performance of their underlying/linked assets. Also, their features vary as per the composition of those financial instruments and assets. These assets may comprise stocks, bonds, commodities, or even currencies and rates of interest. Or even it can be linked to the inflation rate or indices. The major chunk of investments under such notes is in safe assets like bonds, so the investors have little risk of losing that portion of their money. The derivative portion is usually small, generally around 20% of the total investment or even lesser. These derivatives portion are the risky component and are speculative but can result in big profits for the investors.

How do Structured Notes Work?

Structured notes are issued for a particular time frame and have a fixed maturity period. This means that an investor should be ready for the blockage of his investment amount for a particular time period or the issue period. Early redemptions are generally not permissible and may carry heavy costs with them. Also, usually, there is no guarantee for the safety of the principal amount. Hence, it is the call of the investor to invest in it or not.

Modern technology and the advent of many financial advisors and intermediaries have made it possible for general investors to invest in such options. Because of their high risk-high return nature and involvement of a large sum of money, earlier, only institutional investors and high net-worth individuals used to invest in structured notes. However, now ordinary investors looking for better than the standard or normal return also have an opportunity to earn high returns if certain market conditions are met. For example, the issuer can exercise the call and put options to make heavy profits if the conditions are favorable. The investors get a share in these profits and gain from their investments.

Also Read: Notes Payable

Often, the investors get a “protection” that protects them from declining prices of the underlying assets if so happens. The investors get an assurance that they will get their principal amount back and may not likely lose heavily.

What are the Types of Structured Notes?

Equity-Linked Notes

The return on such notes depends upon the performance of underlying equity. It may be a single share or a combination of multiple stocks or may even have an alignment with an equity index.

At the time of maturity, the investors may also get an option to get stock in place of their principal amount. This arrangement is only available if the terms and conditions at the time of issue state so.

On the basis of Credit Risk

The basis of returns on such notes is the occurrence of a credit-related event such as insolvency or loan defaults. Changes in the market value of collaterals may also affect the returns on such notes. The higher the credit risk, the greater the return from those notes will be.

On the basis of Currencies

Structured notes may also be dependent upon the performance of underlying currency or a bunch/basket of currencies such as US Dollars, Yen, etc.

On the basis of Interest Rates

The return of structured notes can also depend on the prevalent floating interest rate. The returns will hence depend upon the monetary policy of the Central bank of the respective country. With an increase in interest rates, the returns on the structured notes will go up and vice-versa.

On the basis of Commodity Rates

The return on such notes may also depend upon rates of commodities or commodity indices.

Advantages of Structured Notes

The Structured Notes have a number of advantages, some of which are:

Diverse Investments

Structured Notes have a diversified investment portfolio and hence offer exposure to a wide variety of investment assets with limited risk. Along with the investment in safe havens such as bonds, these notes also have investments in much riskier derivatives. An average investor can make good profits through these derivatives, even though he would shy away from investing in such assets directly himself.

Limit to Losses

Structured notes may have a “protection clause” that can limit the losses of an investor. There may be a downside capping to the losses, thus providing security and stability to one’s investments. Generally, they offer higher returns than the other regular forms of investments.

Limitations of Structured Notes

Structured notes have a number of limitations as well.

Difficult to Comprehend

Structured notes may involve lots of complications and in-depth knowledge of the underlying assets on the part of the investors. Such notes invest in complex derivatives. An investor requires good knowledge of their workings and payoff so that he can assess the risk he is getting into. Of course, like any other investments which have a linkage or relate to an underlying asset that moves with time, the exact payoff prediction in advance for such investments is difficult.

Risk of Losses

The Structured notes come with substantial market risk. In case of under-performance of the derivatives portion of the investments, the investors can suffer heavy losses. Investors may lose even their principal amount in case of notes without principal protection.

Investors have to tread very cautiously as they have to consider the issuer’s credit risk. Also, investors have to bear the credit risk of counterparties to the issue, i.e., of the parties where the issuer further invests.

Liquidity Problem

Structured notes are not liquid in nature. Their trading in the markets cannot be done easily and freely. Also, they have a lock-in period. Disposing of them before maturity may prove costly for the investor, sometimes at a loss or discount. Also, the investor may find it difficult to sell such notes at short notice. He may have to rely on open markets for doing so before the maturity period and hence, may suffer losses.

Risk of Default

There is a high default risk in the case of structured notes, even if the underlying assets and derivatives perform well. In case the issuer of these notes, generally a bank, goes insolvent or is unable to repay back the investors, the entire investment amount can be lost. Therefore, an investor should consider the option of buying the bonds and derivatives directly in which the notes plan to invest before investing in the Structured Notes.

Even with these limitations and complexity, they are slowly gaining popularity and are prevalent in the Financial Industry. The important reasons for that are that it gives an opportunity to diversify the investments beyond the traditional avenues. And secondly, it does provide for earning a higher than the normal return commensurate with the risk.

Frequently Asked Questions (FAQs)

Structured notes are securities with a combination of derivatives and bond components, tailored to help investors with little risk appetite invest in high to medium risk assets.

1. These have a diversified investment portfolio and hence, offer exposure to a wide variety of investment assets with limited risk.

2. It may consist of a ‘protection clause’ that may help investors in limiting their losses.

1. These are difficult to comprehend.

2. In case of under-performance of the derivatives portion of the investments, the investors can suffer heavy losses.

3. Illiquid in nature.

4. High default risk