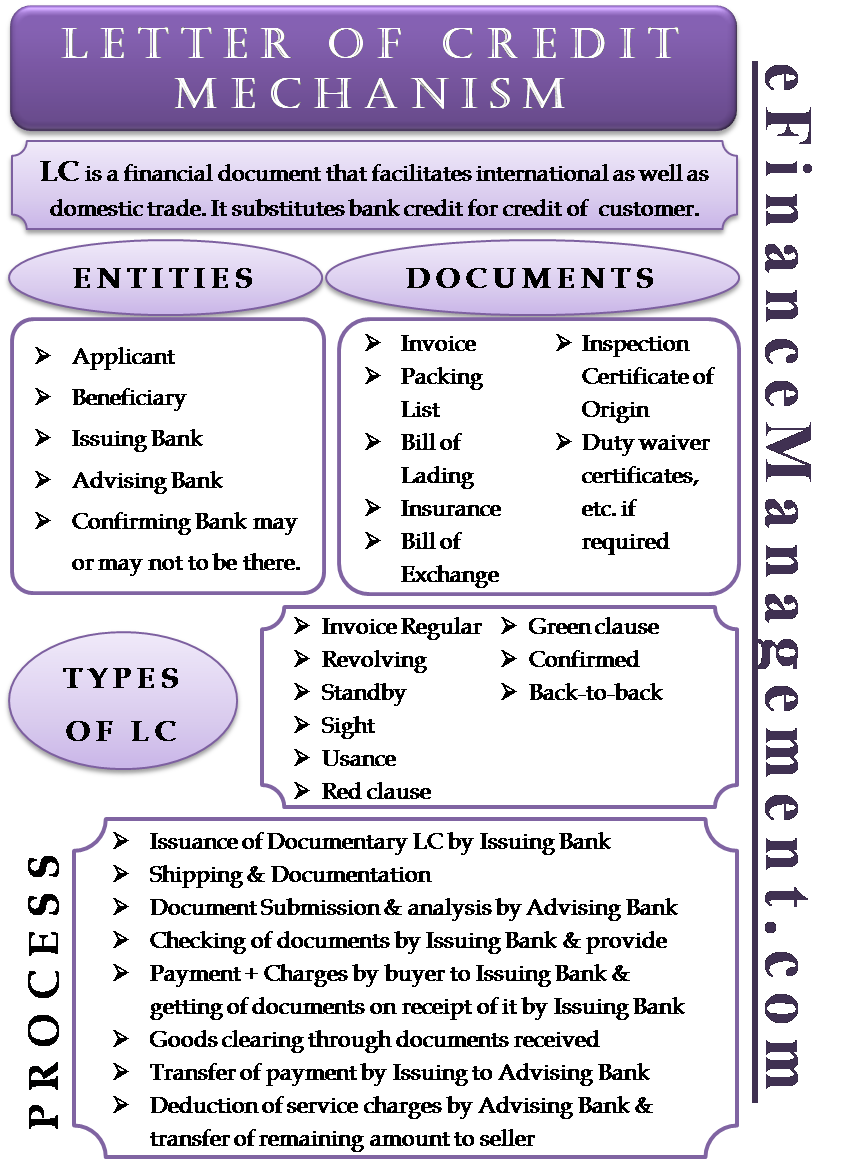

To understand the letter of credit mechanism, it is very important that we first understand what a letter of credit is and why it is used. Once we have a basic idea about LC, we can jump to the letter of the credit process.

International trade is not a new concept in the world. Since the day humans started establishing state boundaries, international trade has been taking place. The industrial revolution in the 18th century saw a rise in international trade, and the availability of various tools gave rise to professionalism in international trade. The letter of credit, as we know, gained popularity in the early 19th century. It is a payment instrument used in cross-border transactions. The basis of this instrument is that the bank becomes a bridge between the buyer and the seller, assuring that both parties fulfill their obligations.

A letter of credit helps establish trust and confidence in conducting business internationally, where the distance from the home country, laws & customs rules of the foreign land, etc., can prove to be a hurdle.

Entities in a Letter of Credit

Firstly, let us understand the basic entities in a letter of credit.

- Applicant – The entity that applies for the letter of credit. This is usually the buyer, i.e., the importer.

- Beneficiary – The entity for whom the letter of credit is issued. On completion of the transaction, the beneficiary receives the payment. This is normally the seller, i.e., the exporter.

- Issuing Bank – This is the bank that issues the letter of credit. This is usually a bank whose branch is located in the applicant’s home country.

- Advising Bank – This is the bank that advises the beneficiary throughout the process of the letter of credit.

These are the four basic entities that are always involved in a letter of credit. There may or may not be the involvement of the following entities depending on the type of letter of credit:

Also Read: Commercial Letter of Credit

- Confirming Bank – This entity is involved only when a letter of credit is a confirmed letter of credit. This is the bank that gives additional confirmation of fulfillment of obligation over and above the guarantee by issuing bank.

Mechanism / Process of a Basic Regular Letter of Credit Transaction

Following is the process of a documentary letter of credit:

A buyer from France decides to buy goods for USD 5000.00 from a seller in Malaysia by documentary letter of credit. The buyer asks his bank, i.e., the issuing bank, to issue a letter of credit in the seller’s name.

- Issuing bank issues a documentary letter of credit in the seller’s name and keeps the seller’s bank as the advising bank.

- The seller manufactures and ships the goods to the buyer and prepares all the documents.

- The seller submits the documents to the advising bank, which checks the documents for discrepancies, and if no discrepancies are found, they send the documents to the issuing bank.

- The issuing bank checks the documents and, if found satisfactory, intimates the buyer of the same.

- The buyer makes a complete payment of USD 5000.00 plus the bank charges to the issuing bank. After receiving the payment, the issuing bank gives the documents to the buyer.

- The buyer clears the goods from the shipping line through these documents.

- The issuing bank transfers the full payment of USD 5000.00 to the advising bank.

- The advising bank deducts its service charge and transfers the remaining payment to the seller.

Thus the transaction is complete.

Documents Required in a Letter of Credit

As mentioned in the process of the letter of credit, the seller should send some documents to the buyer before he receives the payment for the goods supplied. These documents include the following –

- Invoice

- Packing List

- Bill of Lading

- Insurance

- Bill of Exchange

- Inspection certificate/ Certificate of Origin/ Duty waiver certificates, etc. if required

Each letter of credit is unique, and the buyer has the liberty to choose which documents the seller has to submit to complete the transaction. There are some custom laws that make certain documents mandatory, but other documents are optional.

Cost of a Letter of Credit

The issuing bank can charge issuance fees and interest from the applicant for issuing the letter of credit. On the other hand, the advising bank charges their advising fees from the beneficiary.