Definition of Transferable Letter of Credit

A transferable Letter of Credit is a credit facility in which the first beneficiary has the right to pass on the available credit to another party, i.e., the secondary beneficiary. This is possible only when the Letter of Credit is marked as transferable by the issuing bank upon the instructions of the buyer or the importer of goods.

Let us under the concept in simple words:

Concept of Transferable Letter of Credit

There are four parties involved in it. The parties are the first beneficiary, secondary beneficiary, final buyer, and the bank. The middlemen/exporter, i.e., the first beneficiary, is one who receives an order from the final buyer. The middlemen are always in shortage of money. So, he requests the final buyer for a Transferable Letter of Credit. If the final buyer finds it valuable to engage in the foreign transaction, he will request his bank to issue an Irrevocable Transferable Letter of Credit. Now the first beneficiary can purchase the raw materials from the supplier to manufacture goods. Instead of making a cash payment, the middlemen can pay their supplier by giving him the Transferable Letter of Credit. Here the supplier becomes the secondary beneficiary.

Let us understand it with the help of an example.

Example of Transferable Letter of Credit

Kira Ltd, a German company, places an order with Sim Ltd., an American company. Sim Ltd. requests Kira Ltd to issue a Transferable Letter of Credit so that it can avail credit facility from its supplier on the basis of such letter of credit. Kira Ltd. requests its bank to issue a Transferable Letter of Credit. In this scenario, if the bank refuses to issue a Transferable Letter of Credit, Sim Ltd. cannot further avail of credit facilities. However, if the bank agrees to the request of Kira Ltd., Sim Ltd. can issue the Transferable Letter of Credit to its supplier, i.e., the secondary beneficiary.

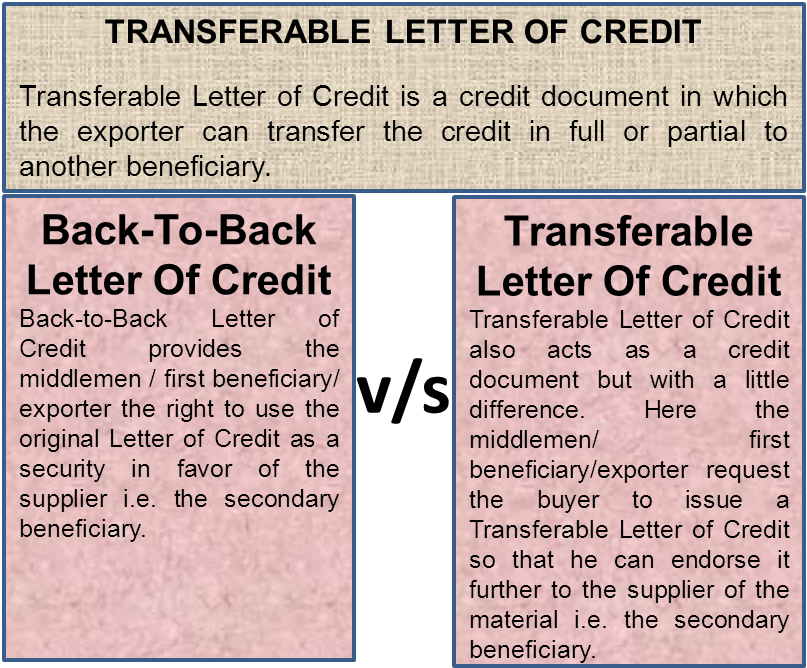

Often there is confusion between the concept of this letter with a Back-to-Back Letter of Credit. Let us understand the difference between the two different types of letters of Credit:

Also Read: Types of Letter of Credit (LC)

Transferable Letter of Credit vs. Back-To-Back Letter of Credit

A Back-to-Back Letter of Credit acts as an alternative to a Transferable Letter of Credit. It provides the mediators/first beneficiary/exporter the right to use the original Letter of Credit as a security in favor of the supplier, i.e., the secondary beneficiary.

On the other hand, it also acts as a credit document but is slightly different. Here the mediators / first beneficiary/exporter request the buyer to issue a Transferable Letter of Credit so that he can endorse it further to the supplier of the material, i.e., the secondary beneficiary. If the Letter of Credit is not transferable, it cannot be handed over to the supplier.

Non-Transferable Letter of Credit

A non-transferable letter of credit is exactly the opposite of a Transferable Letter of Credit. In a Non-Transferable Letter of Credit, the bank refuses to allow the transfer of credit to any other beneficiary other than the first beneficiary. Thus, it cannot be transferred to any party, and only the exporter/mediators/first beneficiary can claim the credit for it.

Conclusion

It has become an important credit facility tool for businesses. It promotes international trade. With a Transferable Letter of Credit, the exporter gets the opportunity to expand its business and avail of the credit facility with its suppliers. With the rate at which the world economies are growing, tools like Transferable Letters of Credit promote trade among nations. Going forward Transferable Letter of Credit shall form an integral part of the business.

Read Types of Letter of Credit to know more about various other types.

Sir,

Discounting facility available with Transferable LC? Please clarify

Hi can a transferable lc be issued with a validity of 365 days.