A commercial letter of credit is the most common type of letter of credit in usage. In fact, it is commonly known as a regular letter of credit.

Global trade is rising and brings difficulties for all the parties involved. The major difficulties include each country’s different laws, different customs rules, and different languages. Also, a major problem is not being able to know a foreign buyer or a seller personally. Therefore, it becomes difficult to judge credibility. It has become essential to have a common tool that gives security to both the buyer and the seller. This is where the letter of credit comes into the picture.

Letter of credit is a payment term used for international trade. By availing of a letter of credit, the buyer knows that he will receive the goods he is paying for, and the seller is sure that he will receive the payment against his supply.

There are many types of letters of credit; in today’s post, we are going to discuss the commercial letter of credit:

Commercial Letter of Credit – Definition

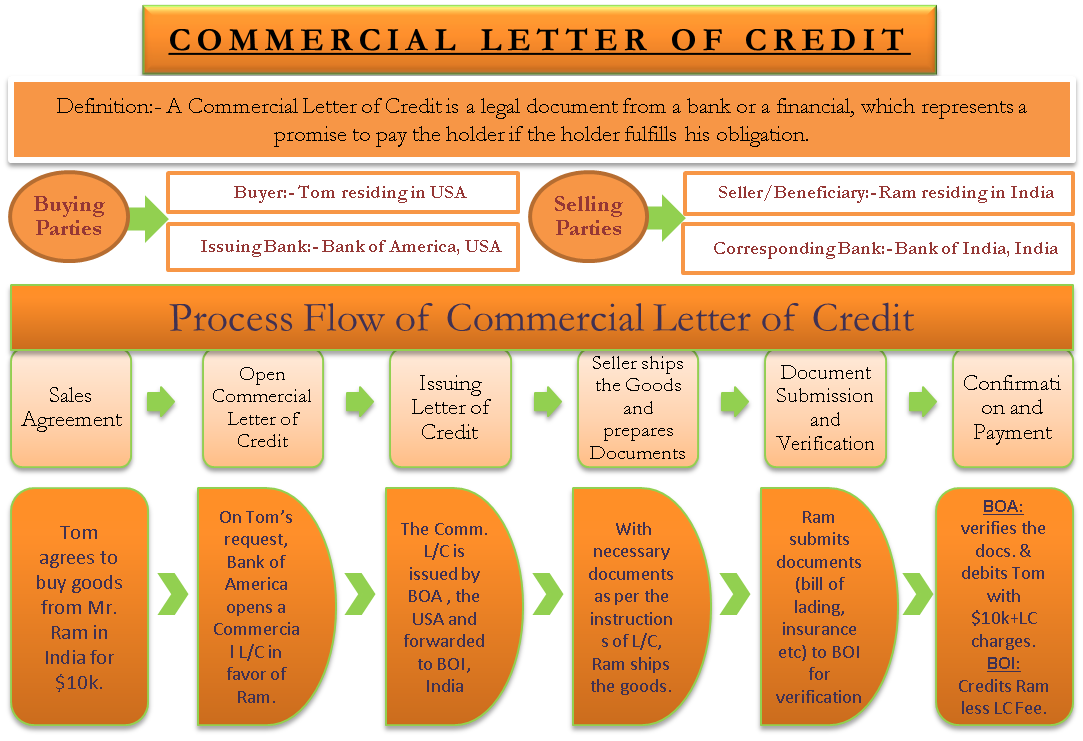

A commercial letter of credit is a legal document from a bank or a financial institution. It represents a promise to pay the holder if he fulfills his obligation. Sellers in international transactions often require a guarantee of payment. This guarantee comes from the bank in the form of a letter of credit. If the buyer fails to make payment against his purchases, the bank will cover the full or remaining amount of the purchase.

Also Read: Letter of Credit

Commercial Letter of Credit Process with Example

Let us understand the process flow of a letter of credit with an example.

There are four parties involved in a commercial letter of credit as follows –

- Buyer – Tom resides in the USA

- Issuing Bank – Bank of America, the USA

- Correspondent Bank – Bank of India, India

- Beneficiary/Seller – Ram residing in India

Step 1: Sales Agreement

On 1st January 2018, Mr. Tom from the USA agrees to buy goods worth USD 10,000.00 from Mr. Ram in India. During the negotiations, it was agreed that payment would be made in a commercial letter of credit.

Step 2: Opening Instructions

Mr. Tom requests Bank of America to open a letter of credit of USD 10,000.00 in favor of Mr. Ram. The Bank of America checks Mr. Tom’s creditworthiness and completes the required formality to issue a letter of credit for this transaction.

Step 3: Issuing Letter of Credit

On 8th January 2018, The Bank of America issues the requested letter of credit that expires 90 days from the date of issue and forwards it to the corresponding bank, i.e., Bank of India. The corresponding bank is usually located in the country where the seller resides; in our example, it is in India. Bank of India will authenticate the letter of credit and send it to Mr. Ram.

It is necessary that Mr. Ram exports the goods and submits the required documents before the expiry of the letter of credit. If not, then the bank of America has no obligation to pay if Mr. Tom doesn’t.

Also Read: Types of Letter of Credit (LC)

Step 4: Seller Ships the Goods and Prepares Documents

On 1st March 2018, Mr. Ram ships the goods to Mr. Tom and prepares the required shipping documents as per the instructions of the letter of credit. The usual documents required are – a commercial invoice, packing list, transport document (bill of lading or airway bill), and insurance policy. Some banks require additional documents, but these are necessary.

Step 5: Document Submission and Verification

Mr. Ram submits the documents to the Bank of India. Bank of India checks all documents to confirm whether they comply with the instructions of the letter of credit. After that, the Bank of India sends the documents to Bank of America and asks for payment.

Step 6: Confirmation and Payment

Bank of America again checks the documents for compliance. If all the documents are in place, it debits Mr. Tom’s account of USD 10,000.00 + letter of credit fees and pays USD 10,000.00 to Bank of India, who further deducts its own fees and deposits the remaining amount in Mr. Ram’s account.

As the banks are involved in the transaction, both parties are secure that the other will fulfill its obligation; otherwise, the bank will intervene.

There are many different types of letters of credit, but that is a story for another day.

Pros

Ease in International Trade

One of the best usages of a commercial letter of credit is the ease of undertaking international trade. It ensures the seller about the payment risk of a buyer sitting at some corner of the world and thus develops trust and relationship. An importer should be able to convince the issuing bank about his capability, which makes the bank issue the credit to the seller. This is a conditional trust which has to be earned by the buyer. From the viewpoint of the seller, issuance of the credit is an indication to undertake the shipment of the goods to the buyer.

Transfer of Creditworthiness

The overall liquidity of the importer increases as the banker takes over the obligations of the buyer. This can help the buyer enter into transactions more than the expected limit due to its business size. It even helps the seller in the worst case where the importer might turn bankrupt. The probability of forged international transactions has gone down to an extent due to the rise in the use of these customizable letters of credit. Suppose there is any dispute in the execution of the transaction. In that case, the seller has an option to withdraw his consent on the transaction, which is otherwise not possible in a usual course of business. The certainty of the amount, better planning of the cash flows, and reduced risk of bad debts are a few of the benefits of the evolvement of a commercial letter of credit in the usual course of business.

Cons

Increase in the Administration Cost

The cost being paid to the banks for managing the letter is an additional cost for the business. It is of a significant amount to a regular businessman with the import-export business. Next is the changing regulation rules, and the requirement to comply with the same has added to the daily routine jobs and has made it difficult from a compliance perspective.

Material Fraud

Even though the issuance of the letter is based upon the shipping documents, what is being ignored is the quality of goods which isn’t something the banker is aware of. The buyer can indeed end up getting something different than the promised goods in the letter. Other than this, the other risks involved are the exposure to forex fluctuation, expiry of the letter before the execution of the sale of goods, and the chances of defaulting/bankruptcy of the issuing bank being ignored here.

its nice keep it up ……..

I’m wondering if the steps of setting up LC change from one type of LC to another or not? Thanks In Advance.

To receive the application from issuing bank and to ensure and signify the payment to a seller

What are the roles of the corresponding bank in commerical LC?

Thanks In Advance