Imagine a scenario where a company needs a piece of machinery, equipment, or even office space for its operations. Instead of purchasing it outright, the company might decide to lease the asset. Leasing offers flexibility, avoids large upfront costs, and allows the company to use the asset without assuming full ownership. This is where the concept of the Bargain Purchase Option comes into play.

What is a Bargain Purchase Option (BPO)?

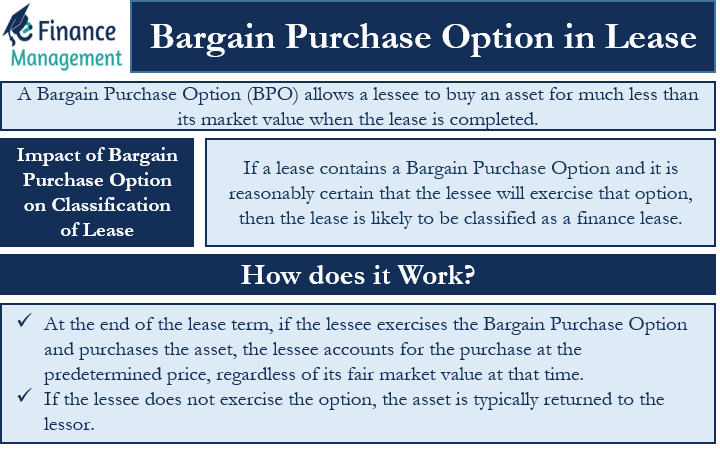

A Bargain Purchase Option (BPO) is a term commonly used in accounting and finance to refer to an arrangement where a lessee (the entity leasing an asset) is granted the option to purchase an asset at a price significantly lower than its fair market value at the time the option becomes exercisable. This option is often associated with lease accounting, specifically under the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) used in the United States.

Why is it Called a bargain Purchase Option?

At its core, a Bargain Purchase Option (BPO) is an arrangement within a lease agreement that grants the lessee (the one leasing the asset) a unique opportunity: the option to purchase the leased asset at a significantly reduced price compared to its fair market value at the time the option becomes available. In other words, it’s a “bargain” opportunity to buy the asset at a bargain price.

The term “bargain” in this context refers to a favorable and advantageous opportunity for the lessee. It implies that the lessee is getting a good deal or a purchase option that provides them with a substantial financial benefit. The lessee is essentially given the chance to buy the asset for much less than what it might typically cost on the open market.

Also Read: Types of Lease

Impact of Bargain Purchase Option on Classification of Lease

The presence of a Bargain Purchase Option in a lease agreement can significantly impact the classification of the lease as either a finance lease or an operating lease, which in turn affects how the lease is accounted for in the lessee’s financial statements.

If a lease contains a Bargain Purchase Option and it is reasonably certain that the lessee will exercise that option, then the lease is likely to be classified as a finance lease. This means the lessee would recognize both an asset and a liability on their balance sheet, reflecting the leased asset’s value and the present value of future lease payments. On the other hand, if the Bargain Purchase Option is not reasonably certain to be exercised, the lease might be classified as an operating lease, and the lessee would primarily record lease payments as operating expenses.

How does it Work?

The inclusion of a Bargain Purchase Option impacts the lease liability calculation at the beginning of the lease term, as the minimum lease payments include the expected exercise price of the option.

The presence of a Bargain Purchase Option has the effect of turning what might otherwise be considered an operating lease into a finance lease. This is because the option provides the lessee with the ability to acquire ownership of the asset for a price that is significantly lower than its expected fair value at the end of the lease term.

Also Read: Types of Equipment Leases

- At the end of the lease term, if the lessee exercises the Bargain Purchase Option and purchases the asset, the lessee accounts for the purchase at the predetermined price, regardless of its fair market value at that time.

- If the lessee does not exercise the option, the asset is typically returned to the lessor.

Two Scenario for Bargain Purchase Option

Scenario 1

When the bargain purchase option is $10,000 and the market price of the equipment at the end of the lease period is $12,000, the lessee chooses to exercise the bargain purchase option and buy the asset for $10,000.

Scenario 2

When the bargain purchase option is $10,000 and the market price of the equipment at the end of the lease period is $8,000, then the lessee chooses not to exercise the bargain purchase option, and the leased asset is typically returned to the lessor.

Frequently Asked Questions (FAQs)

Under both the International Financial Reporting Standards (IFRS 16) and the U.S. Generally Accepted Accounting Principles (ASC 842), the presence of a Bargain Purchase Option generally leads to the lease being classified as a finance lease. This is because the criteria for classifying a lease as a finance lease are more likely to be met when there’s a clear economic incentive for the lessee to eventually acquire the asset.

At the commencement of the lease, the lessee records the leased asset and lease liability on the balance sheet. The liability is typically calculated as the present value of the minimum lease payments, including the present value of the exercise price of the Bargain Purchase Option.

For comprehensive guidance on lease accounting standards, you can refer to the official websites of the International Accounting Standards Board (IASB) for IFRS 16 and the Financial Accounting Standards Board (FASB) for ASC 842.