What is Equity Financing?

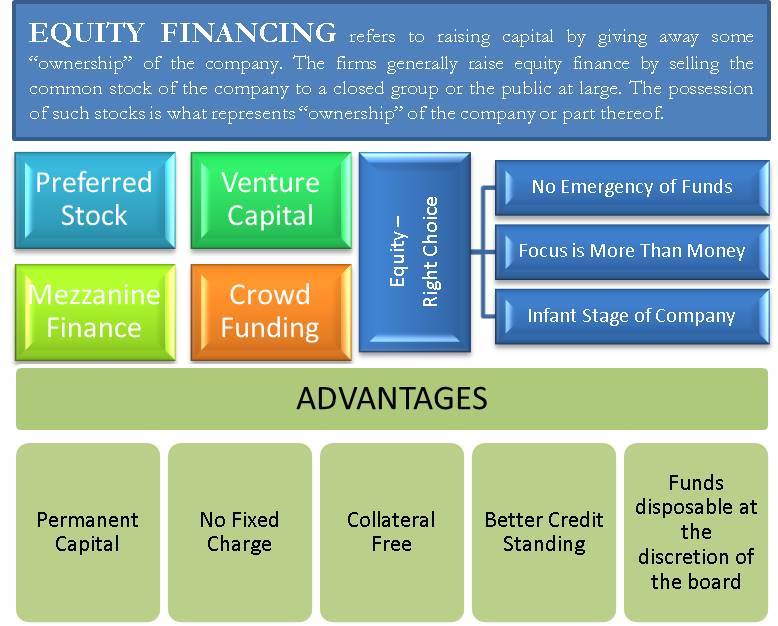

Equity financing refers to raising capital by giving away some “ownership” of the company. The companies raise equity finance by selling the common stock of the company to a closed group or the public at large. The possession of such stocks is what represents “ownership” in the company.

Various sources of equity financing include:

- Angel investors

- Venture capital

- Institutional investors

- Crowdfunding

- Corporate investors

- Initial public offer

When to Use Equity Financing?

Equity financing involves raising funds for a company by selling a portion of ownership in the company to investors. This means that investors will have a say in the company’s decision-making process. Therefore, companies should carefully consider the pros and cons of equity financing before deciding whether to pursue it. Let us look at the various reason why companies prefer equity financing.

Start-up with Limited Resources

Some startups and new ventures prefer giving away some ownership rather than attracting debt. Debt comes with an obligation of fixed interest payments. This may not be appealing to companies that are just starting with their cash flows. Equity financing enables infant firms to breathe and focus on their operations. They are not charged with any fixed obligations and are only expected to share profits as and when they arise.

Experience & Network of Investors

Equity financing means such as venture capital, and angel investors bring on board more than just finance. They are pursued because of their priceless expertise and contacts. Only handsome equity valuations and stakes therein can lure such investors. Simply sourcing debt cannot fetch such strategic partnerships.

High-risk Ventures

Equity financing is often used for high-risk ventures, such as those in the technology industry, where the potential for high returns may be offset by a higher likelihood of failure.

Expansion

If a company is looking to expand its operations, it may require a significant amount of capital. Equity financing can be an effective way to raise the funds needed for expansion.

Long-term Projects

Companies with long-term projects that require significant investment may choose to use equity financing, as the repayment terms can be more flexible than those of debt financing.

Lack of Collateral

If a company does not have sufficient assets to serve as collateral for a loan, equity financing can be a viable alternative.

No Urgent Requirement of Funds

Raising equity finance means bringing on board co-owners to run the show with. It requires pitching and making several presentations before the investor actually steps in. Even in the case of companies opting for an IPO, the process is time-consuming. There is a significant delay between the issue of securities in the primary market to the final receipt of funds.