Meaning of Convertible Debentures

These debentures can be termed debt security or loan. They can be converted into equity shares after a stipulated period. The conversion of debentures into equity shares is at the holder’s option. However, under special circumstances, the issuer holds such conversion rights.

About Convertible Debentures

Business firms issue such securities to avail of tax benefits. The company can get the advantage of the tax deduction on the interest paid to the investors. This reduces the cost of capital for the company. However, at the time of conversion, the company issues additional shares. This brings a decline in the value of the equity shares due to stock dilution. There are many types of debentures that a company can issue. Two popular types of them are:

Convertible Debentures

These are debentures in which the company requires an interest-bearing loan. Once the stipulated time passes, it can be converted into equity shares. The interest on these debentures is generally low. The debenture holders can opt for receiving the interest and principal amount at the time of maturity. Alternatively, they can opt for converting the debentures into equity shares. This is if they are interested in becoming a part-owner of the company.

Non-Convertible Debentures

Unlike convertible ones, these securities cannot be translated into equity shares. The interest rate on these debentures is usually high. The company issuing these has to make an arrangement with the bank by depositing a fixed amount and part of profits regularly.

Also Read: Types of Debentures

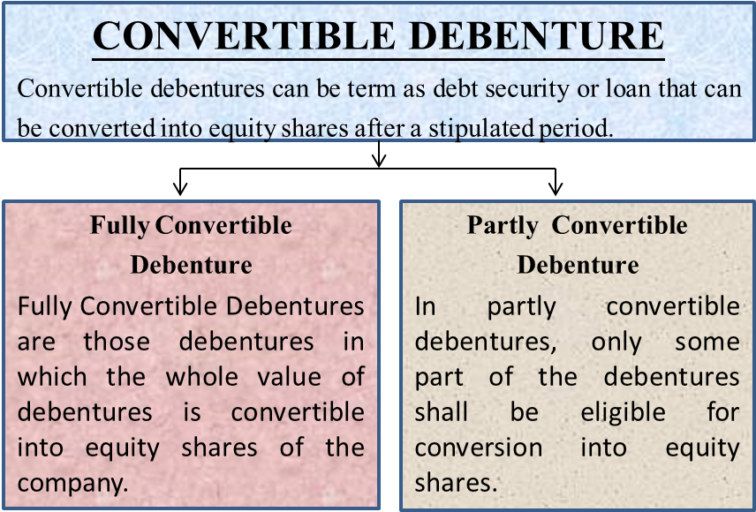

Business organizations can issue debenture of any type depending on their suitability. When the firm issues these, it has to select which type of convertible debenture it wants to issue. The following are the two types based on convertibility –

Types of Convertible Debentures

Fully Convertible Debentures

Under these securities, the whole value of debentures is convertible into equity shares of the company. The ratio of conversion is determined at the time of issue of these securities.

Partly Convertible Debentures

These securities differ from fully convertible ones. Under them, only some part of the debentures is eligible for conversion into equity shares. Again, the ratio of conversion is determined at the time of issuance of these securities. A part of the debt can be converted into equity shares after the approval of debt holders.

Conclusion

Convertible debentures are a quick and easy mode of finance for a business organization. The business can avail funds by issuing debentures and utilize them towards the growth of the business. These debentures give an opportunity to the investor to become a member of the company by converting them into equity shares at the time of maturity. To sum up, the additional benefit of taxes on these debentures also plays a significant role while selecting it as a source of finance for the business.