Corporate Restructuring

Corporate restructuring becomes a buzzword during economic downturns. A company going through a tough financial scenario needs to thoroughly understand the corporate restructuring process. Although restructuring is a generic word for any changes in the company, this word is generally associated with financial troubles.

What is Corporate Restructuring?

Corporate restructuring is a corporate action taken to significantly modify the structure or the operations of the company. This usually happens when a company faces significant problems and is in financial jeopardy. Corporate restructuring is essential to eliminate all possible financial troubles and improve the performance of the company.

- What is Corporate Restructuring?

- Reasons for Corporate Restructuring

- Types of Corporate Restructuring

- Corporate Restructuring Strategies

- Mergers and Acquisitions

- Amalgamation

- Demerger

- Reverse Merger

- Takeover

- Joint Venture

- Strategic Alliance

- Slump Sale

- Divestitures

- Leveraged Buyout

- Master Limited Partnership

- Employees Stock Option Plan (ESOP)

- Corporate Buyouts

- Recapitalization

- Diversification

- Franchising

- Business Process Reengineering

- Internal Startup

- Management Buyout

- Financial Engineering

- Liquidation

- Final Words

The troubled company’s management hires legal and financial experts to assist and advise them in the negotiations and the transactional deals. The company can go as far as appointing a new CEO specifically for making the controversial and difficult decisions to save or restructure the company. Generally, the company may look at debt financing, reduction in operations, and sale of the company’s portions to interested investors.

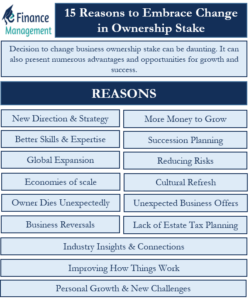

Reasons for Corporate Restructuring

Corporate restructuring is implemented under the following scenarios:

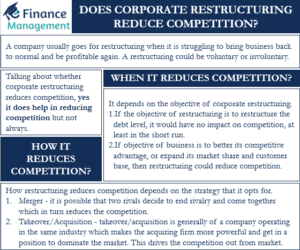

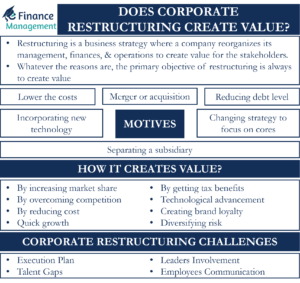

Change in the Strategy

The management of the troubled company attempts to improve the company’s performance by eliminating certain subsidiaries or divisions that do not align with the company’s core focus. The division may not seem to fit strategically with the company’s long-term vision. Thus, the company decides to focus on its core strategy and sell such assets to buyers that can use them more effectively. Corporate restructuring also focuses on reducing competition by creating a change in its strategy.

Lack of Profits

The division may not be profitable enough to cover the firm’s cost of capital and cause economic losses to the firm. The poor performance of the division may be the result of the management making the wrong decision to start the division. Hence the business can increase its profit with the help of restructuring strategies. Profits are necessary for a business as they in turn help in maximizing wealth and lead to value creation for the shareholders.

Reverse Synergy

This concept is in contrast to the M&A principles of synergy, where a combined unit is worth more than the individual parts together. According to reverse synergy, the individual parts may be worth more than the combined unit. This is common reasoning for divesting the assets. The company may decide that more value can be unlocked from a division by divesting it off to a third party rather than owning it.

Cash Flow Requirement

A sale of the division can help create a considerable cash inflow for the company. If the company is facing some difficulty in obtaining finance, selling an asset is a quick approach to raising money and reducing debt.

Types of Corporate Restructuring

Following are the types of corporate restructuring:

Financial Restructuring

Companies usually go for this type of restructuring when experiencing a significant drop in overall sales due to adverse economic conditions. In such a restructuring, a company could change its equity pattern, equity holdings, and cross-holding pattern. The primary objective of such restructuring is to sustain the market and profitability.

Organizational Restructuring

Such a restructuring leads to a change in a company’s organizational structure. This change could mean reducing the hierarchy level, altering reporting relationships, and more. The primary objective of such restructuring is to lower operating costs.

Debt Restructuring

Such a restructuring allows a company to pay off a debt. Under such a restructuring, an entity may restructure its business, divest a subsidiary, or raise more capital to pay an existing debt. Generally, in such a restructuring, the parties forge a contract to bind the firm’s debtors.

Corporate Restructuring Strategies

We will now talk about the corporate restructuring strategies that an entity can use to execute the above types of corporate restructuring:

Mergers and Acquisitions

In mergers and acquisitions, two or more companies merge. Or one company acquires control over the other. It could be in the form of absorption or amalgamation, or creating a new entity. Usually, the entities go for a merger by exchanging securities. There could be different types of mergers, such as horizontal, vertical, conglomerate, and cash mergers.

Amalgamation

In amalgamation, the assets and liabilities of two or more entities are vested in another entity. The existing shareholders don’t get proportional ownership of the acquiring firm. Generally, the amalgamating companies lose their identity, and a new entity comes up.

Demerger

In demerger, a company usually transfers one or more of its undertakings to another entity. The primary objective of such restructuring is to benefit from the synergies arising from restructuring.

Reverse Merger

A reverse merger is a strategy that allows a private company to become a listed public company without going for an IPO (Initial Public offer). It does so by acquiring the majority shares of a public company. This saves the private company from going through the entire process of becoming a public company.

Takeover

In this, one company takes control of another company through a takeover.

Corporate Takeovers

In this, a firm attempts to get the controlling interest in another company. Usually, corporate takeovers involve bigger entities acquiring smaller entities, either voluntary or forcefully. Corporate takeovers are also known as hostile takeovers.

Joint Venture

In this, two or more entities come together for a common financial goal. The new entity resulting from combining the exiting entities is the Joint Venture. The exiting entities agree to contribute, as well as share the expenses and revenue. Basically, it is an agreement to work together for a specific period where each entity contributes with the hope gain from the total activity.

Strategic Alliance

In a strategic alliance, two or more firms forge an agreement to work together. The primary objective is to achieve the common objective while still operating as an independent organization.

Slump Sale

In slump sale, a company transfers one or more of its undertakings for a lump sum without taking into account the values of the assets or liabilities of the undertaking.

Divestitures

Under divestitures, a company sells, liquidates, or spins off a subsidiary or a division. The entity directly sells the assets or division to an outside company in exchange for cash or securities and transfers the control of the division to the new buyer. This results in the contraction of the selling entity and expansion of the purchasing entity.

Equity Carve-Outs

A parent company offers some of its shares in subsidiaries to the general public in equity carveouts. The objective is to raise the money without giving up control. Another objective could be to lower exposure to riskier businesses, as well as boost shareholders’ value.

Spin-off

It is a strategy to get rid of the underperforming or non-core segments. A company uses such a strategy if it feels carrying forward with these units could lower its profits. The segment that a company’s spin-offs become a separate company. Such a strategy involves no money transactions. This is because shares of the new entity are given to the shareholders of the parent company shareholders.

Split-offs

Under split-offs, the shareholders receive new stocks of the subsidiary of the company in trade for their existing stocks in the company. The reasoning here is that the shareholders are letting go of their ownership in the company to receive the stocks of the new subsidiary.

Leveraged Buyout

Under leveraged buyout, an individual, a group of individuals, or an entity purchases a controlling stake in another entity. The buyers get control of another company’s assets. They also get the right to use another company’s trademarks, service marks, and other registered copyrights. Buyers also get to use the name and reputation of the company.

Master Limited Partnership

Master limited partnership is a type of limited partnership but with shares that are traded publicly. In such a strategy, the company divides its limited partnership interests into units, which are then traded like common stocks. The primary benefit of MLP is that it brings together the tax benefits of a limited partnership and the liquidity of a public company.

Employees Stock Option Plan (ESOP)

It is also a corporate restructuring strategy that offers tax benefits. ESOPs have basically defined contribution benefit plans, where employees get the company’s shares. Such programs usually come with a vesting period. Employees can only sell the shares they get after the vesting period is over.

Corporate Buyouts

In this, a company buys a controlling interest in another firm. Generally, the buying company acquires over 50% of another entity to get the controlling interest. The target companies are usually undervalued or underperforming firms.

Recapitalization

In a recapitalization strategy, a company tries to stable its capital structure by swapping one type of financing for another. For instance, an entity can swap the preference or common shares with debt. Generally, a company goes for such a strategy when it faces a hostile takeover or prevents itself from bankruptcy. Taking on more debt can make a target company less attractive to the acquiring company.

Diversification

It is a business strategy that enables firms to manage risk. A company does so by moving into new markets or developing a new product. The idea behind diversification is to develop business activities that are somewhat immune to the economic downturns facing the current business activity. This way, a business can continue with its operations even if one of its markets or products isn’t performing well.

Franchising

Franchising is an arrangement between franchisor and franchisee, where the former allows the latter to use its trademark and brand to sell its products, goods, and services. The franchisee, in return, pays a commission or some revenue to the franchisor. It is a popular business strategy for expanding business.

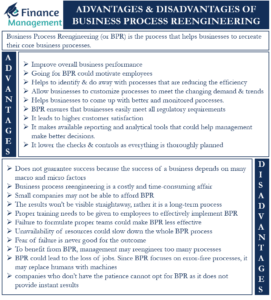

Business Process Reengineering

The business process reengineering (BPR) strategy involves radical redesigning of business processes to get significant improvements in the product and operations. The improvement can be in the form of quality, cost, and speed.

Internal Startup

Internal startups are startups initiated by already existing companies. They create a separate division for their new innovative product.

Management Buyout

In a management buyout, the management of a company purchases the company itself. Employees may join the management in acquiring the company. However, such a strategy may come into question if the management has any unfair advantages in negotiations, such as manipulating the value to lower the buy price. This type of buyout is a management buyout. Similarly, there is management buy-in. In this, an incoming management team purchases the business.

Financial Engineering

Financial engineering involves the use of mathematical techniques to address the financial issues that a company faces. The mathematical techniques that a firm uses involve statistics, economics, computer science, and economics. Along with addressing financial issues, a company can also use these techniques to come up with new and innovative financial products.

Liquidation

Liquidation is the process of ending a business and then distributing all its remaining assets to the creditors and debt holders. A company liquidates when it is unable to meet its obligations. A company can also sell its inventory at a big discount in liquidation.

Final Words

The corporate restructuring allows the company to continue to operate in some way. The management of the company tries all the possible measures to keep the entity going on. Even when the worst happens and the company is forced to pieces because of financial troubles, the hope remains that the divested pieces can function well enough for a buyer to acquire the diminished company and take it back to profitability. And, therefore, the company should also examine the implications of corporate restructuring well before implementing any strategy.