The Modigliani and Miller approach to capital theory, devised in the 1950s, advocates the capital structure irrelevancy theory. This suggests that the valuation of a firm is irrelevant to a company’s capital structure. Whether a firm is high on leverage or has a lower debt component has no bearing on its market value. Instead, the market value of a firm is solely dependent on the operating profits of the company.

A company’s capital structure is the way a company finances its assets. A company can finance its operations by either equity or different combinations of debt and equity. A company’s capital structure can have a majority of the debt component. Or a majority of equity or an even mix of debt and equity. Each approach has its own set of advantages and disadvantages. There are various capital structure theories that attempt to establish a relationship between the financial leverage of a company (the proportion of debt in the company’s capital structure) with its market value. One such approach is the Modigliani and Miller Approach.

Modigliani and Miller’s Approach

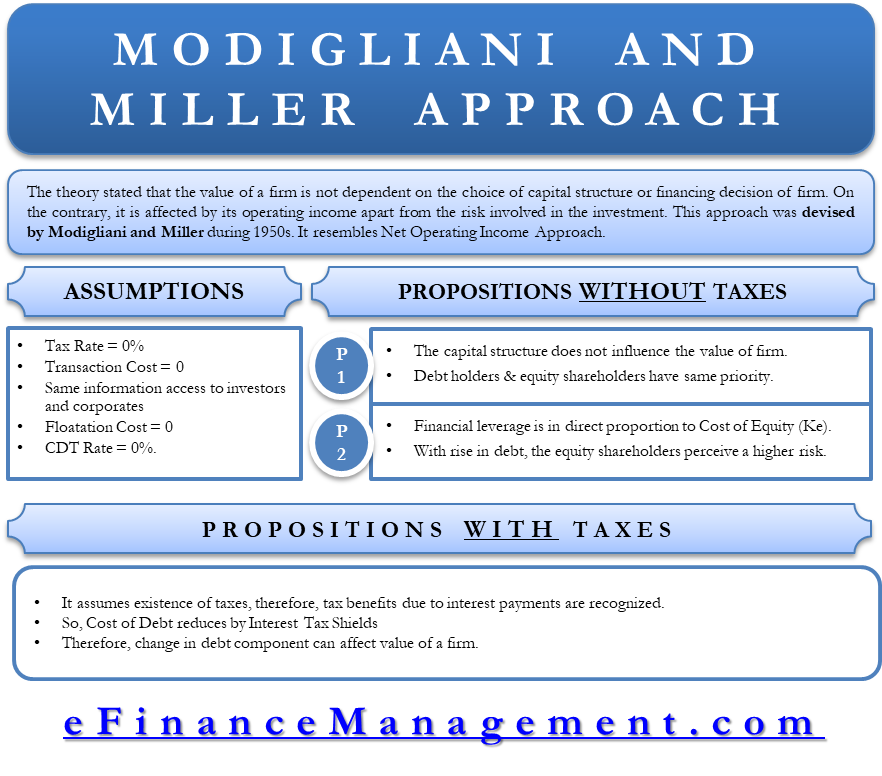

Modigliani and Miller devised this approach during the 1950s. The fundamentals of the Modigliani and Miller Approach resemble that of the Net Operating Income Approach. Modigliani and Miller advocate capital structure irrelevancy theory, which suggests that the valuation of a firm is irrelevant to a company’s capital structure. Whether a firm is high on leverage or has a lower debt component in the financing mix has no bearing on the value of a firm.

The Modigliani and Miller Approach further state that the operating income affects the firm’s market value, apart from the risk involved in the investment. The theory states that the firm’s value is not dependent on the choice of capital structure or financing decisions of the firm.

Also Read: Capital Structure Analysis

Assumptions of Modigliani and Miller Approach

- There are no taxes.

- Transaction cost for buying and selling securities, as well as the bankruptcy cost, is nil.

- There is a symmetry of information. This means that an investor will have access to the same information that a corporation would, and investors will thus behave rationally.

- The cost of borrowing is the same for investors and companies.

- There is no floatation cost, such as an underwriting commission, payment to merchant bankers, advertisement expenses, etc.

- There is no corporate dividend tax.

The Modigliani and Miller Approach indicates that the value of a leveraged firm (a firm that has a mix of debt and equity) is the same as the value of an unleveraged firm (a firm wholly financed by equity). Suppose the operating profits and future prospects are the same. If an investor purchases shares of a leveraged firm, it would cost him the same as buying the shares of an unleveraged firm.

Modigliani and Miller Approach: Two Propositions without Taxes

Proposition 1

With the above assumptions of “no taxes,” the capital structure does not influence the valuation of a firm. In other words, leveraging the company does not increase the company’s market value. It also suggests that debt holders in the company and equity shareholders have the same priority, i.e., earnings are equally split amongst them.

Proposition 2

It says that financial leverage is directly proportional to the cost of equity. With an increase in the debt component, the equity shareholders perceive a higher risk to the company. Hence, in return, the shareholders expect a higher return, thereby increasing the cost of equity. A key distinction here is that Proposition 2 assumes that debt shareholders have the upper hand as far as the claim on earnings is concerned. Thus, the cost of debt reduces.

Modigliani and Miller Approach: Propositions with Taxes (The Trade-Off Theory of Leverage)

The Modigliani and Miller Approach assumes that there are no taxes, but in the real world, this is far from the truth. Most countries, if not all, tax companies. This theory recognizes the tax benefits accrued by interest payments. The interest paid on borrowed funds is tax-deductible. However, the same is not the case with dividends paid on equity. In other words, the actual cost of debt is less than the nominal cost of debt due to tax benefits. The trade-off theory advocates that a company can capitalize on its requirements with debts as long as the cost of distress, i.e., the cost of bankruptcy, exceeds the value of the tax benefits. Thus, until a given threshold value, the increased debts will add value to a company.

This approach with corporate taxes does acknowledge tax savings and thus infers that a change in the debt-equity ratio affects the WACC (Weighted Average Cost of Capital). This means that the higher the debt, the lower the WACC. The Modigliani and Miller approach is one of the modern approaches of Capital Structure Theory.

Read Capital Structure & its Theories to know more about what is capital structure and what are its different theories. Let us now look at the first approach.

Frequently Asked Questions (FAQs)

The MM theory of capital structure suggests that the capital structure of a business is irrelevant to the valuation of the firm. High or low debt in the financing mix doesn’t affect the value of the firm. It states that operating income affects the market value of the firm

a) No taxes.

b) Nil transaction cost.

c) No corporate dividend tax.

d) No flotation costs such as underwriting commission, advertisement expenses, etc.

e) Both investors and corporations have the same access to the information.

f) The cost of borrowing is the same for both investors and corporates.

The MM approach assumptions are unrealistic. It assumes there are perfect capital markets that don’t exist. It ignores the corporate tax and personal taxes that is not practically viable as shareholders pay taxes on the capital gain. This theory assumes there are no floatation and transaction costs which is not true.

This is a very good model. Keep it it up.

I found this so helpful in understanding the M&M theory, beforehand I struggled to grasp it, Thanks for putting it up 🙂

I really want to appreciate on your beautiful efforts specially on whole finance management concepts and its theory’s, you have presented in scientific manner and in your presentation I recognised whole financial map, finally it is very helpful for me… Specially I want to mention over here since 3 years, I am fighting with financial concepts finally I am satisfied….. Thanks lot….keep posting…

Thanks for making the concepts so easy. Very helpful.Keep posting.

Thanks. I really appreciate your contribution in this area. My M.Sc thesis is purely on Capital Structure

I am confused that for calculation of value of firm why we add value of equity and debt*tax rate

I have been using your site for research and found it helpful and easy to understand. Keep it up for job well done.

Your explaining is perfect it made me understand it. Besides, you flow of information is so smooth which allow the reader to fully understand. Thanks

Thank you. Well explained

Thanks so much …..before it i was nt considering bt to read it i have understood properly wt is m&m …..

This is superb keep it up

Well explained really understandable

Easy to understand no doubt but sir ur good self needs to explain more , juz in the MM Approach there is a concept of arbitrage process but here it’s not explained. Rest it’s really helpful as it is easy to understand.

thank you for give me a easy concept of mm approach

Beautiful and simple wording..

Great effort thank you sir

Is MM approach applicable in India?

this mm approach is the best for learning

but..not numerically explained this approach. ..

No MM is not applicable where Corporate taxes are a part of any Corporate world; they have a bearing in the market valuation besides making Capital decisions. Such assumptions are highly un-real. Good for theory & studies.

the content was limited and easy to understand.

I love it when people come together and share opinions, great blog, keep it up.

Contents and concepts presented in a simple and understandalbe Manner

Thanks

Gave me a tough time in college but it opened my eyes to the world of investment and finance

So interesting, well spelt out.! I’m thinking if I could forget the lectures and make do with this cause it’s well explained. Thanks for this.

Well informative and i have benefited from this material on my Financial management study

Modigliani and Miller concept well explained, be blessed.

Thank God i found this website. Your team is doing a great job. Thank you so much

quite insightful and easy to understand.