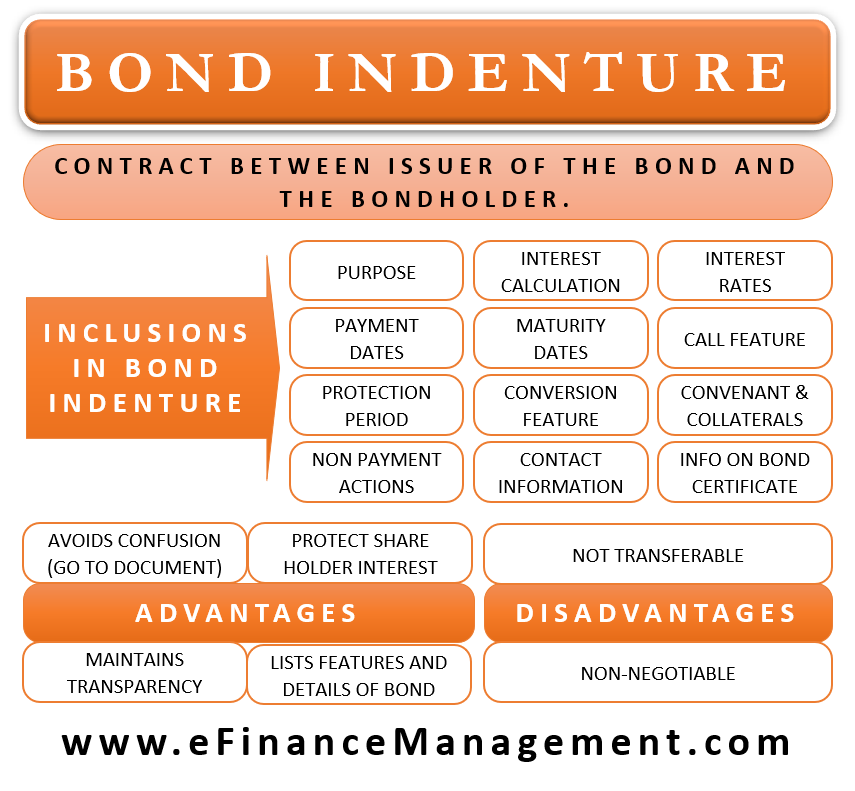

A Bond Indenture (or bond resolution) is basically a contract between the issuer of the bond and the bondholder. In a nutshell, it carries the responsibility of the bond issuer and the benefits available to the bondholder.

It includes all details that you can expect any contract to include. For instance, it carries the features of the bond, restriction (if any) on the issuer, maturity, repayment terms, actions in case the issuer is unable to honor the payment terms, etc.

Since it is a legal document, the indenture comes into the scene when there is a disagreement regarding the terms and conditions of the issue of bonds. A bond indenture has three stakeholders – the issuer, bondholders, and a trustee.

Bond Indenture – What it Includes?

Indenture contracts may differ from case to case. Generally, an indenture would include the following details:

Purpose

The contract details the reasons why the issuer is issuing the bond.

Interest Rate

The indenture mentions the rate of interest or coupon rate applicable to the bonds and their payment frequency. This interest rate is given on the face of the bond. The bondholder ultimately gets the regular interest on this rate.

Also Read: Bonds and their Types

Interest Calculation

This includes the calculation and the method of calculation, or its description, of the interest that the bondholder would get.

Payment Dates

It carries the dates when the bondholders will get the interest payments.

Maturity Date

It indicates the date when the bond will mature. Or, we can say it is the date when the bondholders get back the face amount of the bond.

Call Features

It details the provisions when the issuer can buy back or call back (call provision) the bond before the expiry date.

Call Protection Period

It is the minimum period until which the issuer can not replace, call back, or redeem the bond.

Conversion Features

These are the extra features of a bond. Or, it details the scenario or options when the holder can convert the bond into the common stock. It also details the conversion multiple.

Covenants

It lists the covenants that the issuer faces until the bonds are due. Additionally, it also lists how the contract calculates these covenants. These covenants help to protect the interest of the issuer and the holder.

Covenants could be restrictive (restrictive debt covenants), i.e., they limit the issuer from performing certain activities that may make it difficult for the issuer to honor the bond terms. These restrictions could be on paying a dividend, buying a property, or more.

Also Read: Plain Vanilla Bonds

Covenants could also be Affirmative, which requires the issuer to meet certain criteria. These could be the requirement of cash reserves, financial ratios, financial statements, and more.

Collaterals

If there are collaterals backing the bond, then the indenture would detail it. Such bonds are secured bonds.

Non-payment Actions

It details the possible actions available to the bondholder in case the issuer is unable to make a timely payment. These actions could include raising the interest rate, extending the maturity date, establishing a cumulative interest liability, and more.

Contact Information

The indenture carries information on whom the bondholders need to contact if the bond is called. It also details the process for the bondholder to tender their certificate and get the compensation.

Information on Bond Certificate

An indenture describes how a bond certificate would look like and what language it would be in.

Example of Bond Indenture

To better understand the indenture, let us take an example. Suppose Company A wants to issue bonds worth $1 million. In such a case, some of the common points that the indenture would include are:

- The interest or coupon rate would be 4% per annum.

- Interest payments would be made semi-annually or after every 6 months.

- The face value of the bond would be $100.

- Principal amount would be paid back at the end of 5 years from the date of issuance. This is the maturity date.

Bond Indenture – How it Works?

At the time of the bond issuing process, the issuer creates this indenture. This means the indenture is created before the issue of the bonds. Once the issuer gets approval from the state and federal government for the amount and other things, the issuer needs to contract an indenture.

A point to note is that the issuer does not issue the indenture to individual bondholders. It would be quite a time-consuming and complex exercise if the issuer of bonds has to enter into a contract with all the bondholders individually. To overcome this, the issuer issues the indenture to a third party or a trustee representing the bondholders. Generally, the trustee is a bank or a financial establishment.

In case the issuer breach the terms of the indenture, then the trustee has the right to sue to the issuer on behalf of the bondholders. Also, bondholders can report any valid issue to the trustee, following which the trustee can take apt legal actions.

It is the bond issuer who generally appoints this trustee, who then acts on behalf of the bondholders. This trustee is called the Indenture Trustee. The Trust Indenture Act of 1939 requires the need of a trustee for any bonds issue that is regulated by the U.S. SEC (Security and Exchange Commission).

The trustee ensures that holders get interest on time, the issuer is following the covenants, giving certificates to holders, and more. Moreover, the trustee is also responsible for maintaining and holding all records and documentation on behalf of the holders.

Advantages and Disadvantages of Bond Indenture

Following are the advantages of a bond indenture:

- It is a legal document that clearly defines the role and responsibilities of all the stakeholders. Thus, it helps to avoid confusion.

- It helps to protect the stakeholders’ interests, as well as lower the chances of default.

- The indenture lists all the features and details of a bond.

- It ensures that the stakeholders know all the covenants and thus helps maintain transparency.

- It is a go-to document in case of any dispute.

Following are the disadvantages of an indenture:

- A major drawback of indenture is that they are non-transferable. So, a holder has fewer options to exit the contract.

- An indenture is not renegotiable once the stakeholders agree and sign it.

Bond Indenture, Debenture, and Prospectus

People often confuse the terms indenture and debenture. Both are entirely different things. A debenture is a source of funds or an unsecured bond. The indenture, on the other hand, is a contract between the bond issuer and the holder. The prospectus is basically a summary of the provisions of the issue.

Read more on Bonds vs. Debenture.

Other Types of Indenture

Apart from the bond indenture, there are other types of indenture as well. These are:

Real Estate Indenture

It is a contract between two parties to carry out their obligations. For example, one party is responsible for maintaining a property, while the other is responsible for making payments.

Bankruptcy Indenture

In bankruptcy, an indenture is basically proof of the claim on the property. An indenture, in such a case, details about the property.

Credit Indentures

It details all the provisions of a credit offering contract. In the case of unsecured and uncollateralized bond offerings, such indentures may also be called as debentures.

Final Words

A bond indenture is as significant as the bond itself. It creates legal obligations for both – the issuer and the holders. It lays down all the rights and responsibilities of the stakeholders and serves as a legal binding as well. In case of any dispute or default, the stakeholders need to refer to this document to decide the way forward.