Working capital management techniques such as the intersection of carrying cost and shortage cost, working capital financing policy, cash budgeting, EOQ, and JIT are applied to manage different components of working capital like cash, inventories, debtors, etc. These effective techniques mainly manage different elements of current assets. There are several techniques for finding the optimal level of working capital, and let us look at them.

Working Capital Management Techniques

Working capital management techniques are very effective tools in achieving the objective of working capital management. The working capital is the difference between current assets and the current liabilities of a business. The primary focus is on current assets because current liabilities arise due to current assets only. Therefore, controlling the current assets can automatically control the current liabilities. Current assets include inventories, sundry debtors or receivables, loans and advances, cash, and bank balance.

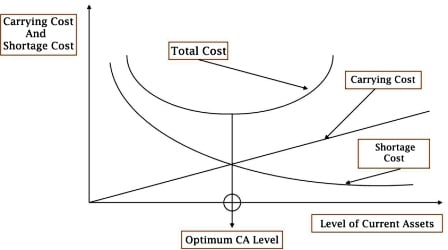

All working capital management techniques attempt to find the optimum level of working capital because both excess and shortage of working capital involve a cost to the business. Excess working capital carries the ‘carrying cost’ or ‘interest cost’ on the unutilized capital. Shortage of working capital has ‘shortage cost,’ which includes disturbance in the production plan, loss in revenue, etc. Finding the optimum level of working capital is the main goal or winning situation for any business manager.

There are certain techniques that helps in finding optimal level of working capital or managing different items of working capital.

Intersection of Carrying Cost and Shortage Cost

One of the important methods of finding the optimum level of working capital is the point of intersection of carrying cost and shortage cost in a graphical representation. The total carrying and shortage cost is minimum at this point.

Also Read: Working Capital Management

Here, the levels of current assets are optimum at the point where the shortage and carrying costs are meeting or intersecting. At this point, the total cost, as we can see, is minimum, and this is why that level of current assets is considered to be optimal.

Working Capital Financing Policy

Working capital can be group into two viz. Permanent and Temporary. Permanent working capital is the level of working capital that one always requires and maintains. Temporary working capital is the part of working capital that keeps on fluctuating. It is high in good seasons and low in bad seasons. There are two types of financing available to finance the working capital i.e., long-term financing and short-term financing. There are three strategies possible concerning to the financing of working capital, they are:

- Long-term financing is used for both permanent and temporary WC.

- Long-term financing is used for permanent and some part of temporary WC. The remaining portion of the temporary WC is financed through short-term financing as and when required.

- Long-term financing is used for permanent and short-term financing for temporary WC.

One should select these strategies to match the source of finance’s maturity with the asset’s maturity. As efficient financing of working capital reduces the carrying cost of capital.

Cash Budgeting

Cash budgeting is another important technique for working capital management that helps keep an optimum level of cash in the business. It involves estimating cash requirements by assessing all the fore-coming receipts and payments. For effective management, a balance is must between excess and shortage of cash, because both ends are costly. Speeding up a collection and getting flexible credit terms from the creditors can reduce the cash requirements.

Also Read: Objectives of Working Capital Management

Inventory Management

Inventory is an important component of working capital or current assets. An optimum level of inventory can save on costs heavily.

EOQ

Economic Order Quantity (EOQ) model is a famous model for managing inventories. It helps the inventory manager know how to find the right quantity to order considering other factors like ordering cost, carrying costs, purchase price, and annual sales. The formula used for finding EOQ is as follows:

EOQ = √{ (2 * A * O) / (P * C)}

A – Annual Sales

O – Cost per Order

P – Purchase price per unit

C – Carrying Cost

Just-in-Time

Just-in-time is another very important technique that brought about the paradigm shift in the management of inventories. It does not reduces the inventory cost, but abolishes it completely. Just-in-time means acquiring raw materials or manufacturing products at the time when the customer requires them. This strategy is very difficult to implement but can bring down inventory costs to minimum levels if implemented.

Conclusion

We have discussed some of the important techniques above. They are very effective in managing working capital. Managing working capital means managing current assets. Current assets like cash can be managed using cash budgeting; inventory using inventory techniques like EOQ and JIT. etc, and debtors and financing of working capital using appropriate source of finance.

Also, read Factors Determining Working Capital Requirement

RELATED POSTS

- Advantages and Disadvantages of Working Capital Management

- Permanent or Fixed Working Capital

- Types of Working Capital – Gross and Net, Temporary and Permanent

- Methods for Estimating Working Capital Requirement

- Factors Determining Working Capital Requirement

- A Comparison between 3 Strategies of Working Capital Financing