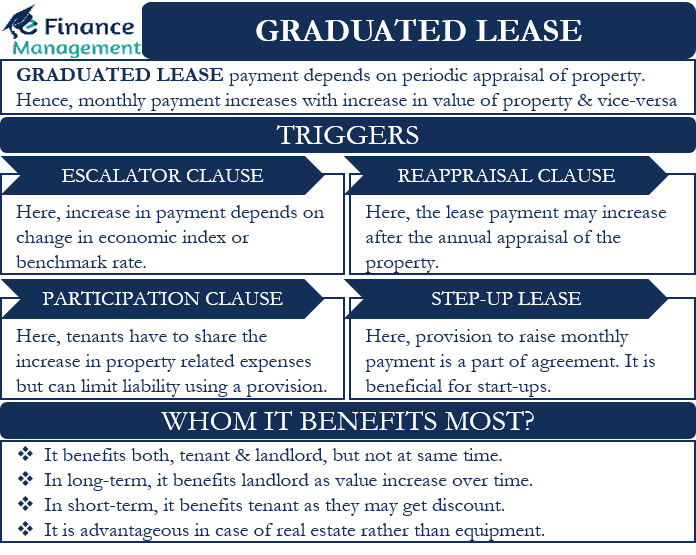

Generally speaking, when we talk about lease payments, this means a fixed amount as a lease rate. However, in the Graduated Lease, the payment is variable or depends on periodic appraisals of the property. Or both parties agree to adjust the monthly payment periodically. So, if the value of the property increases after the appraisal, the landlord can increase the monthly payment.

The increase in payment may also depend on a change in the reference interest rate, such as the CPI (Consumer Price Index). We can also say that in this lease, the tenant agrees to make adjusted monthly payments, such as lease payments for a showroom, depending on market conditions, sales turnover, property value, etc.

This type of lease is common in long-term leases, and we call this type of lease the graded lease.

Trigger for Graduated Lease

The two parties may decide to adjust the monthly payments at one of the following trigger points:

Escalator Clause

An increase in the lease payment depends on a change in the economic index or a benchmark rate. For example, on CPI, 10-year U.S. Treasury Bond, or more. We call this clause an index clause.

Reappraisal Clause

In this case, the rental payment may increase after the annual appraisal of the property. Thus, if the property’s value increases, the rental payment also increases.

Also Read: Lease Payment

Participation Clause

In this case, the tenant may have to contribute to the increase in real estate-related expenses such as taxes, maintenance, and more. However, the tenant may limit his liability by an expense stop clause.

Step-up Lease

In this lease, the provision for increasing the monthly payment is part of the contract. In addition, such a clause can be used to increase the monthly payment for assets that depreciate in value, such as equipment. This type of lease is beneficial for a start-up as it could help the company avoid purchasing new equipment. In addition, the owner of the equipment is also fine, as he would receive more rent after a set period.

Graduated Lease – Whom it Benefits Most?

A graduated lease can benefit both the lessor (property owner) and the lessee (tenant), depending on their specific circumstances and objectives. However, the benefits may vary for each party. Here’s a breakdown of how each party can potentially benefit from a graduated lease.

Graduated Lease Benefits for the Lessor

Increased Rental Income

A graduated lease allows the lessor to gradually increase the rental payments over time. This can help the lessor keep up with inflation or rising property values, leading to higher rental income compared to a fixed lease.

Also Read: Types of Lease

Reflecting Market Conditions

Rent escalations in a graduated lease can be tied to factors such as the Consumer Price Index or cost-of-living index, which can reflect changes in the broader market conditions. This ensures that the lessor’s rental income keeps pace with economic trends.

Long-Term Stability

Graduated leases are often used for longer lease terms, providing the lessor with stability and predictable income over an extended period. By incorporating rent escalations, the lessor can mitigate the impact of changing market conditions or increased costs over time.

Graduated Lease Benefits for the Lessee

Budget Planning

Graduated leases provide lessees with the ability to anticipate and plan for future rent increases. By knowing the rent escalation schedule in advance, lessees can better manage their budgets and cash flow, ensuring they can meet their financial obligations throughout the lease term.

Lower Initial Costs

Graduated leases may offer lower initial rental payments compared to fixed leases. This can be beneficial for lessees who have budget constraints or need to allocate resources to other areas of their business in the early stages of the lease. Gradual rent increases allow lessees time to grow their business and generate more revenue before facing significant cost escalations.

Potential Cost Savings

Depending on the specific terms of the lease, the lessee may benefit from rent escalations tied to indexes like the CPI or cost-of-living index. If the actual increases in these indexes are lower than anticipated, the lessee may experience lower rent increases than originally projected, resulting in potential cost savings.

Conclusion

Graduated leases can provide benefits for both lessors and lessees in different ways. For lessors, it offers increased rental income over time, reflects market conditions, and provides long-term stability. On the other hand, lessees can benefit from better budget planning, flexibility, lower initial costs, and potential cost savings tied to indexes.

The graduated lease structure allows for rent escalations that can align with factors such as inflation, rising property values, or changes in market conditions. By incorporating predetermined triggers for rent increases, both parties can anticipate and plan for future adjustments, promoting transparency and reducing potential disputes.