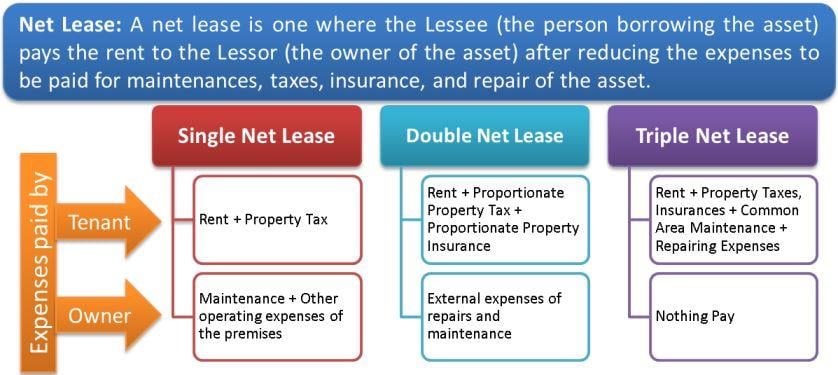

Net Lease is an interesting area to understand due to various nuances falling under it. A net lease is one where the Lessee (the person borrowing the asset) pays the rent to the Lessor (the owner of the asset) after reducing the expenses to be paid for maintenances, taxes, insurance, and repair of the asset. Thus, the net lease rental is usually lower than the “Gross Lease,” where the expenses for the heads of these three categories – Insurance, Property Taxes, and Maintenance are included in the rent paid.

One of the aspects of a net lease is “Triple Net Lease,” also commonly known as “NNN Lease.” First, let us understand “Single Net Lease” and “Double Net Lease.”

Single Net Lease

Net leases are usually done in commercial agreements for real estate where the tenant pays the property taxes and the rent. The property owner will only look after the maintenance and other operating expenses of the premises. A single net lease is not very commonly used. If the commercial space is shared, each tenant pays tax in proportion to the total building spaces leased by him. Utility and janitorial services also come under the tenant.

Double Net Lease

These are net leases where the tenant also pays the rent, proportionate property tax, and proportionate property insurance. The owner would be looking after the external expenses of repairs and maintenance.

Also Read: Lease Vs Rent

Triple Net Lease (NNN Lease)

This is the most commonly used type of lease for commercial and even some residential estates. Here the tenant will pay for everything from rent, property taxes, insurance, and common area maintenance and repair expenses. These are also known as CAMS – Common Area Maintenance Items. Hiring regular staff and maintenance help can also be part of this – e.g., receptionist, lobby attendant, etc.

Advantages and Disadvantages of Triple Net Lease

Advantages to the Tenant

The biggest pro for tenants under such an agreement is the consistency of operating expenses. The tenant can take care of the most essential like insurance and taxes and then manage the maintenance and repairs from their own valued parties. Thus the expenses are transparent for the tenant, and he can make better decisions on how to optimize such expenses.

The second benefit to the tenant is that the amount charged by the landlord is certainly lower than in the case of a Gross Lease. Also, in some cases, the tenant is a known company or brand, and the capitalization rate for the lease amount is lower due to the creditworthiness.

Advantages to the Landlord

This is the easiest way for a landlord to be free of issues of maintenance and repair and can look at the rental amount as a steady income. The hassles of employing people and managing between different expense heads are passed on to the tenant.

This is the best source of finance and steady income for an establishment with high-value commercial property to rent out. These can be built with a 10 to 15 years contract with an escalation clause on rent.

Disadvantages to the Tenant

The tenant should carefully review the agreement details and the limits on each of the expense heads. There should be clarity on the frequency of increasing these expenses under these heads.

Disadvantages to the landlord

The landlord has to be more systematic and organized in maintaining the expense to charge the tenant appropriately. Thus for him, higher time and effort of transparency are required.

Triple Net Lease Properties

These are large commercial estates owned by businesses and individuals who are willing to rent out shopping and office space. The U.S. law allows REITs (Real Estate Investment Trusts) to invest in triple net lease properties as they support the steady inflow of income. Investors can aim to get full properties without concern about the quality of management.

U.S. credit rating agencies – Standard and Poor’s, Fitch, and Moody’s rate tenants just like companies, and those with a rating of BBB- and higher (S&P scale) are considered “investment grade.” grades tenants. Companies with high tenant ratings command high valuations – Walgreens (A+/Stable), CVS (A-/Stable), Wal-Mart (AA/Stable), and Home Depot (AA/Stable).

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!