Sale and Leaseback – Definition

Sale and Leaseback is a simple financial transaction that allows a person to lease an asset to himself after selling it. Under the transaction, an asset previously owned by the seller is sold to someone else and is leased back to the first owner for a long term. The transaction thus allows a person to be able to use the asset and not own it. One usually makes a leaseback transaction for high-value fixed assets such as real estate and goods like airplanes and trains. Sale and leaseback are shortly called leaseback.

For example, X owns the land. Under the leaseback transaction, X will sell the land to Y and will get a lease on the same land from Y for the long term.

A company usually enters a leaseback transaction for accounting and taxation purposes. For example, a company may transfer its asset to the holding company but still will be able to use it. Also, transferring to a holding company will allow the parent company to track the assets’ worth and profitability. Another example is that in case of financial distress or when a company needs money for some purpose, a company can sell the asset instead of getting a loan or raising money from outside. The buyer of the asset is someone who is only interested in securing a long-term investment and will lease the asset back to the company. This way, the company gets the cash influx and will still be able to use the asset.

Sale and Leaseback transactions are common in the Real estate investment trusts (REITs) and Aviation industry.

The person who buys the assets and lets them out on lease is called the investor or landlord. The seller of the asset is also the lessee.

Also Read: Types of Lease

Example of Sale and Leaseback

A safe deposit vault given by banks is a classic example to quote. Here banks that initially are the owners of the vaults sell the vaults to a leasing company at a market price that is substantially higher than the book value. Subsequently, the leasing company will offer back these vaults to the same banks on a long-term basis. The banks will then sub-lease these vaults to their customers.

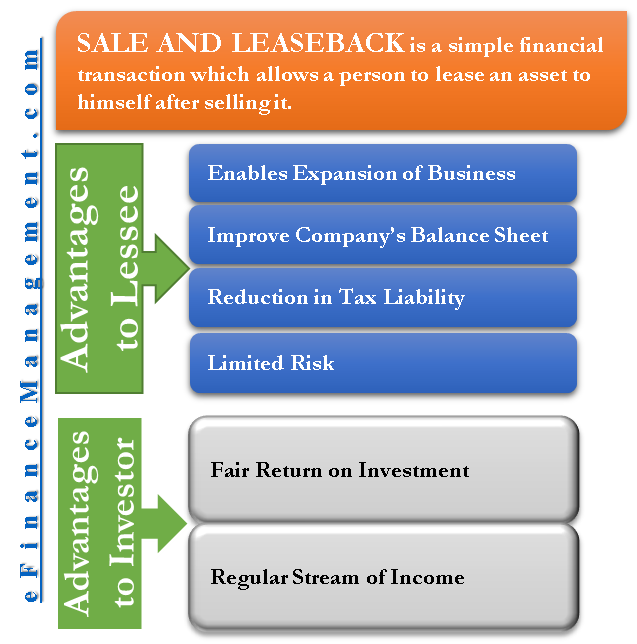

Advantages to the Lessee

Enables Expansion of the Business

If a company doesn’t have the funds to own the asset, it can purchase the asset and enter a leaseback transaction. This way, the company can get back 100% of the investment and still be able to use the asset. Similarly, in the case when a company already owns an asset but wants some cash for expansion or even regular business use, the leaseback agreement will allow the company to get a cash influx. This will also enable the company to use the asset as before by paying rent under the lease agreement.

Improve Company’s Balance Sheet

An asset purchased on debt affects the company’s balance sheet. The company can reduce its debt and improve balance sheet health by entering a leaseback transaction. This will improve the balance sheet in three ways. First, the liability on the balance sheet will reduce. Second, there will be an increase in current assets in the form of cash and lease agreements. Third, the asset turnover of the company will improve. The asset turnover will improve as the fixed assets will reduce, but the revenue-generating capability of the asset will still be in the hands of the company.

Reduction in Tax Liability

This works in two ways, the company, which has now sold the asset and has it on a lease, does not have to pay tax on any appreciation of the asset, and also the rent outlet will reduce the profit in the profit and loss (p&l) account which will, in turn, reduce the tax liability. A depreciation charge on the asset would have a similar impact on the p&l account. However, the depreciation amount will be lower than the lease amount. Also, there is no depreciation charge on real estate assets like land.

Also Read: Lease Finance vs. Installment Sale

One can avoid paying tax on the sale of an asset by reinvesting the sale proceeds in the business or buying another asset.

Limited Risk

Once sold, the company is free from the asset’s volatility risks that have to be borne in case of cyclical market variations.

Advantages to the Investor

Fair Return on Investment

The investor is buying an asset that the seller will be using in the future. The buyer’s interest will ensure that the asset is a fair investment, providing a decent return on the investment.

Regular Stream of Income

The buyer does not have to worry about the return, as they have a reliable tenant for the long term. This ensures that the investment earns a fixed return on the property and has a continuous cash flow stream.

Read more about various other Types of Lease.

There is an on-going study on built-to-hire concept for local marine vessels conducted by an oil&gas company here in Malaysia. These are for the offshore supply vessels (OSV) required to replace aging vessels in service. Is the sales and leaseback model feasible and has this model been used before?

residential sale and leaseback

This is the answer to a lot of retirees problems

Being Asset rich and cash poor is the problem

Sale and leaseback is better than reverse mortgage especially if the transaction is conducted among family members who are the heirs to the estate