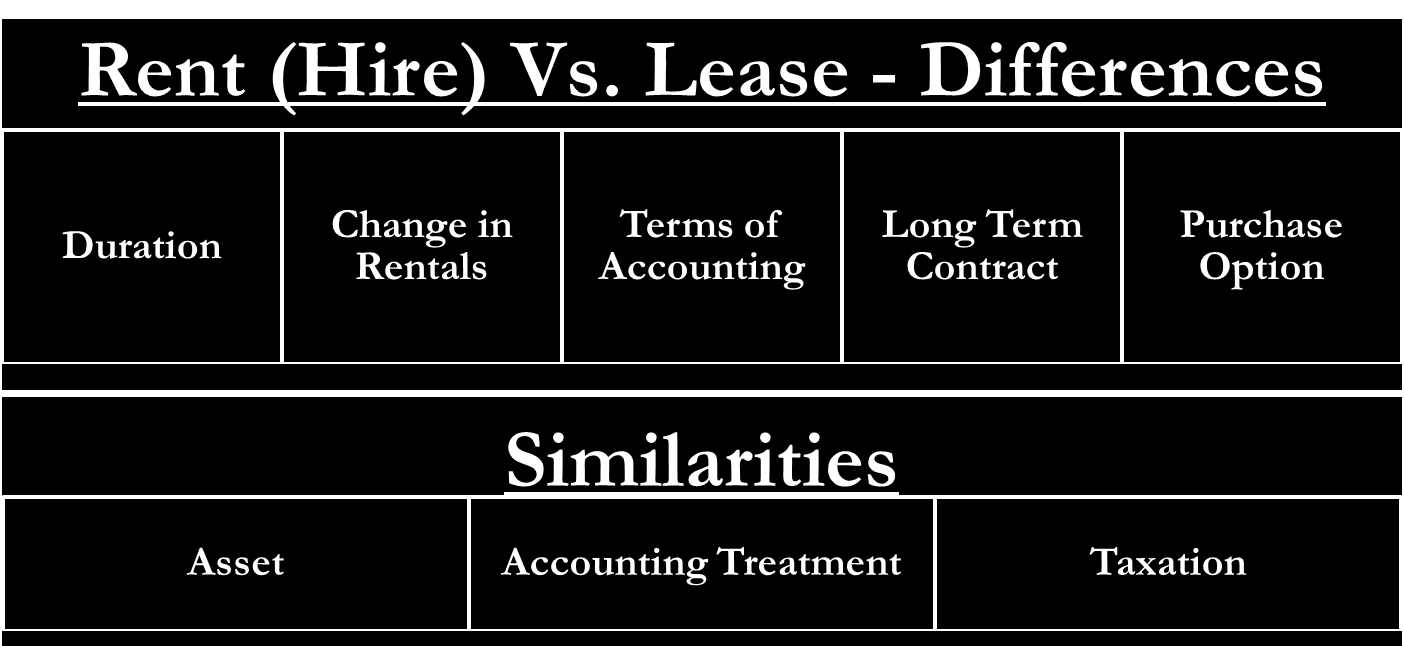

Lease and rent both relate to utilizing an asset belonging to a third party to generate returns. However, leasing is different from renting. They differ from each other with respect to duration, change in rentals, terms of the agreement, and purchase option. Let us see in detail about lease vs. rent.

Rent is a part of leasing. Usually, lease contracts are fixed for a duration and terminate after the contract term is over. Renting is very commonly used in real estate, whereas leases are more popular in industrial and transportation sectors, where heavy machinery or high-cost tools are utilized.

Lease vs. Rent: Similarities

Key similarities between renting and leasing are stated below:

Asset

Leasing and renting are related to an asset that is not owned by the business. Here, an asset is anything possessing a monetary value that another firm or individual owns.

Accounting Treatment

Rents are treated as operating expenses under the profit and loss statement. Operating lease rental is also treated as an operating expense. Capital lease payments usually have two components: lease expense and interest on the outstanding lease amount. Lease expenses are classified as operating expenses, whereas interest expense is recorded in the interest line. In a hire-purchase transaction, the hirer can claim depreciation, and in leasing, the lessor is allowed to claim depreciation.

Taxation

Tax treatments for rental (hiring) and lease expenses (for operating and finance leases, including the interest expense) are similar. These expenses are considered to be operating expenses and hence are tax-deductible. Tax is calculated on operating profit after interest (PBT). Such expenses appear in the balance sheet above the PBT and hence are tax-deductible.

Lease vs Rent: Differences

Key Points of Difference between Renting and Leasing

| Points of Differences | Renting (Hiring) | Leasing |

Duration | Rental agreements have no set period or term and, as such, do not necessarily require one to enter into a contract. | Lease agreements are usually contracts and have set terms and duration. |

Change in Rentals | Rental payments can differ from month to month. | Lease payments are fixed for the entire duration of the lease and are usually decided at the beginning of a lease period. |

Terms of Agreement | Either party to a rental agreement can change the terms of the agreement, at the end of any month, in most asset cases. | Unlike renting, under leasing, none of the parties can change the terms of the agreement during the lease period as lease terms are fixed while entering into the lease agreement. |

Long-Term Contract | Renting is usually used in cases when an asset is required for a short duration, and entering into a long-term contract is financially unviable and not required. | Suppose a business needs an asset for a longer duration (say 10 to 100 years) and is ready for the financial commitment. In that case, it is advisable to enter into a fixed term, longer duration contract. This also helps in the budgeting process. |

Purchase Option | At the end of a rental contract, the person renting out an asset has to return the asset to its owner. | At the end of a lease contract, the lessee has an option to extend the lease, return the asset or purchase it for its salvage value. |

I do enjoy reading, will read more. Cheers!