Equipment Leasing

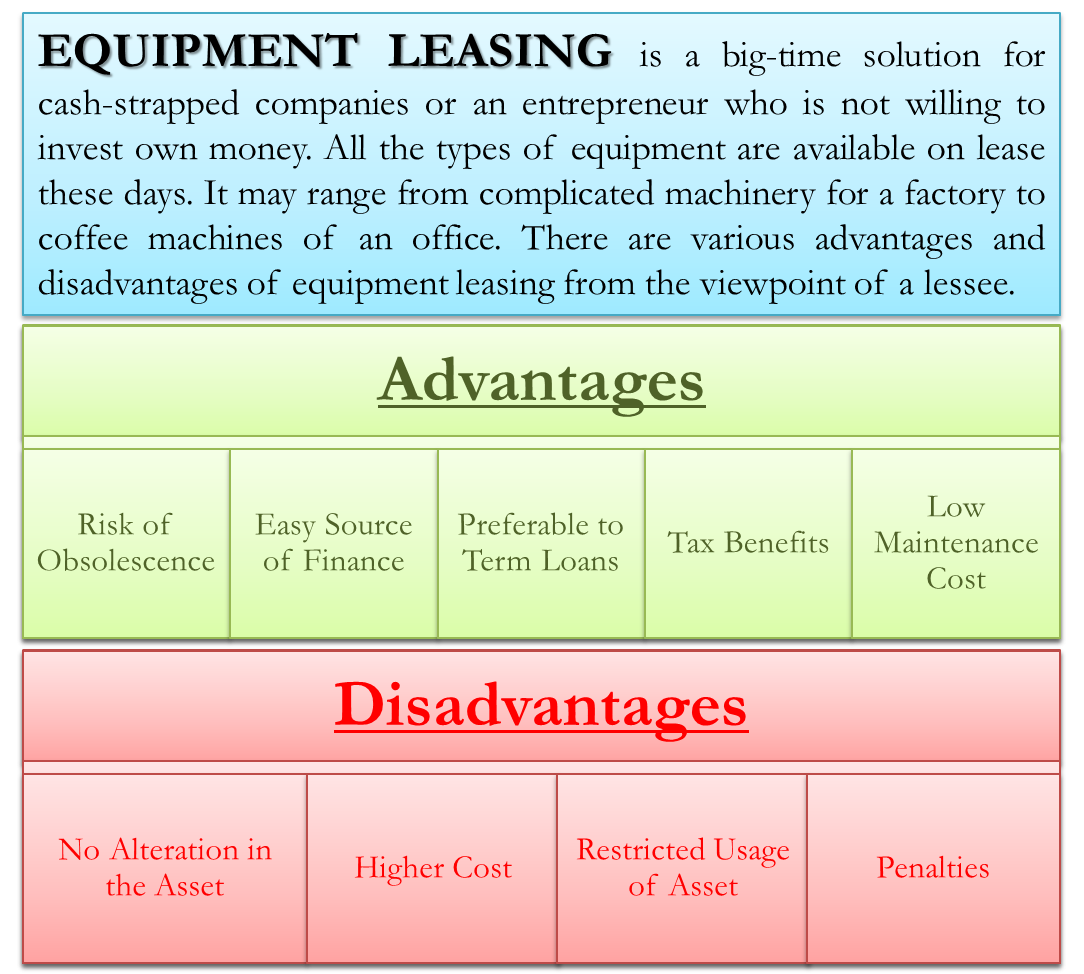

Equipment leasing is a big-time solution for cash-strapped companies or an entrepreneur who is not willing to invest their own money. All the types of equipment are available on lease these days. It may range from complicated machinery for a factory to coffee machines for an office. There are various advantages and disadvantages of equipment leasing from the viewpoint of a lessee, which we will discuss below:

Advantages of Equipment Leasing

A company generally has three ways to get the equipment it needs for the business. It can purchase the equipment with cash or borrow money/take a loan from the bank to purchase or lease the equipment. Equipment leasing provides a great opportunity for a business to upgrade itself without incurring too much upfront cost. The following are the reasons for “why do companies opt for equipment lease”.

Risk of Obsolescence

A business (lessee) can obtain equipment/machinery on a lease, especially those which are regularly upgraded. This will enable the lessee to make use of the latest technology, and a lease can be obtained for a shorter period also. The lessee can obtain new machinery/equipment on lease from time to time instead of purchasing it. This way, the lessee can get away from the risk of obsolescence.

Easy Source of Finance

The process of leasing does not provide ownership to the lessee, which is why there are fewer complexities for the lessee. Leasing is an easy source of medium and long-term finance, plus the initial cash outlay is also less than purchasing. This also helps in improving the flow of working capital.

Also Read: Advantages and Disadvantages of Leasing

Preferable to a Term Loan

Equipment Leasing Companies usually take less time in processing a lease contract. Usually, this time is lesser than the time involved in processing a term loan. Thus, leasing is a preferable source of finance over a term loan.

Tax Benefits

The periodic rentals paid by the lessee are treated as revenue expenses while calculating taxable profits. This acts as an advantage for the lessee as he can minimize his tax liabilities.

Low Maintenance Cost

Sometimes, as per the agreement of lease, the lessor can provide specialized services to the lessee. Here, the lessee can avail of these services for the maintenance of the leased asset. The lessor usually charges for such specialized services through increased rentals.

Also, read about Types of Equipment Leases.

Disadvantages of Equipment Leasing

No Alteration in the Asset

Since the lessee is not the owner of the asset, he cannot make any changes to the asset. In the purchase of an asset, the buyer can make alterations or modify the asset according to his requirements.

Also Read: Types of Equipment Leases

Higher Cost

The lessee pays periodic rentals to the lessor, and these rentals include a margin for the lessor. It is because there is a risk of obsolescence of the leased asset. Thus, equipment financing is often considered high-cost financing.

Restricted Usage of Asset

In an Equipment Lease Agreement, there is a risk that the lessor may restrict the utilization of the leased asset for the lessee. In such a case, the lessee may be deprived of full utilization of equipment/assets. Such a situation may occur when the financial position of the lessor is weakening or in the event of winding up of the lessor’s company.

Penalties

Usually, the lessee is required to pay a sum to the lessor if he terminates the contact of Equipment Lease before the expiry of the lease tenure. This payment of the penalty is a disadvantage for the lessee.

Continue reading about various other Types of Leases.