Modified Gross Lease

A modified gross lease is a type of lease, also referred to as a modified net lease. It stands somewhere between a gross lease and a net lease.

Gross Lease

In a gross lease, the landlord takes up the entire responsibility of paying all associated expenses of the building or the property. These expenses usually include insurance, property and local taxes, and common area maintenance (CAM). It is in addition to all external repairs and maintenance.

Net Lease

A net lease is at the opposite end of the spectrum from a gross lease. Here, the tenant/lessee bears all of the expenses of the building or property. Net leases are usually preferrable where a single tenant occupies a premise, like a retail store or a restaurant chain.

But, in a modified lease, along with the base rent, the tenant also pays some of the building or property expenses while the landlord takes up to pay the remaining costs. Both parties divide the responsibility between them for payment. And no single party remains responsible for all the operating costs. For example, in a typical modified gross lease, the tenant may pay CAM (Common Area Maintenance) costs while the landlord pays taxes and insurance.

When is Modified Gross Lease Used?

Where multiple tenants occupy a property or building, a modified gross lease is a preferable type of commercial real estate lease agreement. Single bills amongst the tenants could be divided in different ways. For example, let’s say the total water utility bill of a building with five tenants is $5,000 a year. If there are no separate meters to measure usage, the tenants may pay either an equal amount of $1,000 each or proportional to the area they occupy.

Advantages of Modified Gross Lease

Advantages to the Tenant

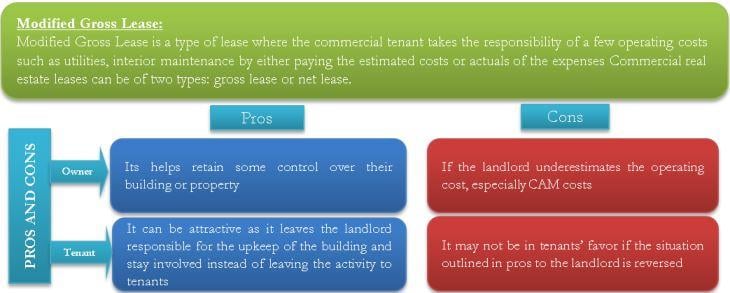

For a tenant, a modified gross lease can be attractive as it leaves the landlord responsible for the upkeep of the building. Thus tenants can concentrate on their business rather than deploying resources for maintenance. Further, tenants get more control over whichever cost they are responsible for paying, given the lease terms.

Advantages to the Landlord

A modified gross lease helps a landlord retain some control over their building or property. Here the landlord has no worries about how his property is being taken care of, is proper and regular maintenance is happening in a manner desirable. Also, insurance and property tax payments are happening timely.

Disadvantages of Modified Gross Lease

Disadvantages to the Tenant

A modified gross lease may not be in the tenants’ favor if the landlord is lazy or has little interest or indifference to the upkeep of the property. For instance, the landlord, who is responsible for taking care of the repairs and maintenance of the exterior of the property, may not do so as per the desired standard. It may be detrimental to occupants for whom a pleasing surface is crucial to increase their appeal and sales to clients.

Also Read: Triple Net Lease (NNN)

Disadvantages to the Landlord

If the landlord underestimates the operating cost, especially CAM costs, it may result in a poorly maintained interior of the building. It can significantly add to maintenance and upkeep costs for the landlord once a tenant leaves.

This classification of the type of lease as a net lease, gross lease, or modified gross lease is a broad one. And a more in-depth study of the rental agreement is essential to ensure that one completely understands the terms laid down in it and their implications.

Frequently Asked Questions (FAQs)

Where multiple tenants occupy a property or building, it is a preferable type of commercial real estate lease agreement. Tenants can divide single bills amongst themselves in different ways.

The main difference between the two types of leases is the allocation of operating expenses. In a modified gross lease, the landlord and tenant share the cost of operating the property, whereas in a triple net lease, the tenant is responsible for paying all of the operating expensesalong with the base rent.