What is the Combination Lease?

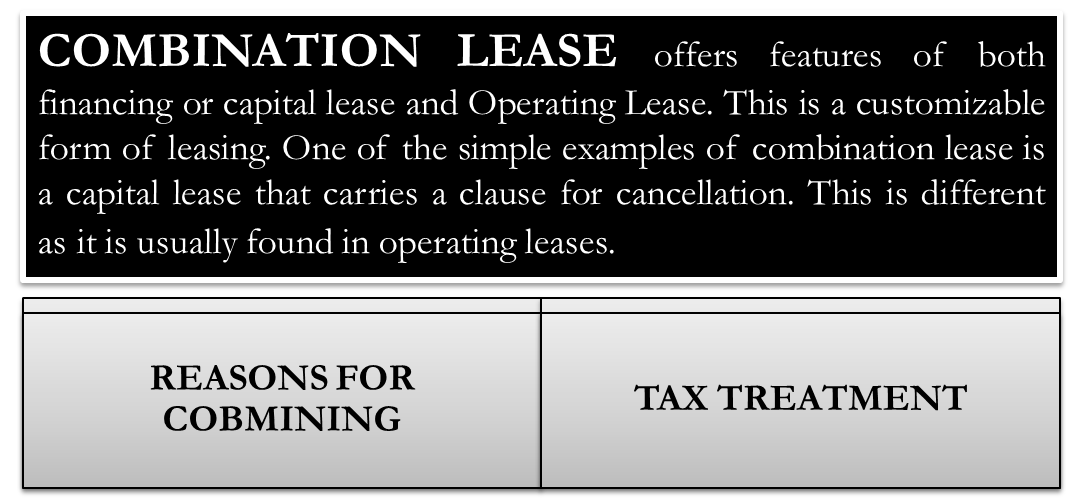

A combination lease offers features of both financings (or capital lease) and Operating Lease. It is a customizable form of leasing. One of the simple examples of a combination lease is a capital lease that carries a clause for cancellation. It is different as the cancellation clause usually stays in operating leases.

An operating lease is a service lease where the contract term is short. The short and long time (period) of the lease depends on the life of the underlying asset. Under this type of lease, the lessor (the owner of the asset) provides for maintenance and financing. Cancellation of such types of a lease is easy and done anytime. On the contrary, a financial lease is usually fully amortized. It merely means that a lease can be the entire life of the asset, and cancellation in between is not possible. Even the sale and leaseback of assets (such as airplanes) is one type of financial lease.

Need for Combination Lease

Combined leases are created to have different types of obligations from suppliers. The combinations can include components of the lease and even non-lease components. Such leases have some specific conditions, which are not part of a simple lease, and thus create different components.

An example is the first lease of an industrial area. It, in turn, has the lease of land, buildings, equipment, or contract for car lease combined with maintenance.

Also Read: Types of Lease

It happens in large projects where many contracts require signing off with the same counterparty. All these lease contracts are usually executed simultaneously as the various contracts remain interlinked/dependent on the other agreements. Here, for conducting work of one contract under execution, the next contract has to be in place. By law, under IFRS (International Financial Reporting Standards), an entity needs to combine contracts with leases under specific conditions. If the assets involved are a single lease component, the arrangements are negotiated as a package, keeping in view the overall commercial objective.

Tax Treatment

Under the United States tax laws, IFRS 16 is the all-encompassing statute for all lease-related agreements and issues. However, the non-lease components of a combined lease are covered by the respective standards. Hence, combined leases remain very complex for tax treatments. Therefore, a thorough clarity and understanding must be there while executing such leases to avoid unnecessary tax complications later on.

Conclusion

Combination leases are a smart way for companies to integrate different project requirements under the umbrella of a single lease. Under normal circumstances, these majority components would classify and qualify as a finance lease or operating lease. The substance of the lease determines this distinction rather than the form of the contract. A combined lease requires this distinction to be expressed and inked clearly between operating and financial leases. It is to ensure the right tax treatment without any ambiguity. These steps are essential to record the income correctly for the lessor and also for the lessee to record the lease rentals accurately. Leases are now part of the financial statements and do affect the cash flow and financial standing in a significant way. Hence, proper categorization and classification are essential for the benefit of all the parties to the lease.

please explain ifrs 16 leases completely