Letter of Credit Vs. Buyer’s Credit is a common confusion for many. Letter of credit and buyer’s credit are products offered by banks to facilitate international trade. Even though both facilitate international trade, both are completely different products. People often confuse between the two because of the similarity in the nature of each product. Still, today’s post intends to clarify the basic differences between the letter of credit vs buyers credit.

Difference between Letter of Credit Vs Buyers Credit

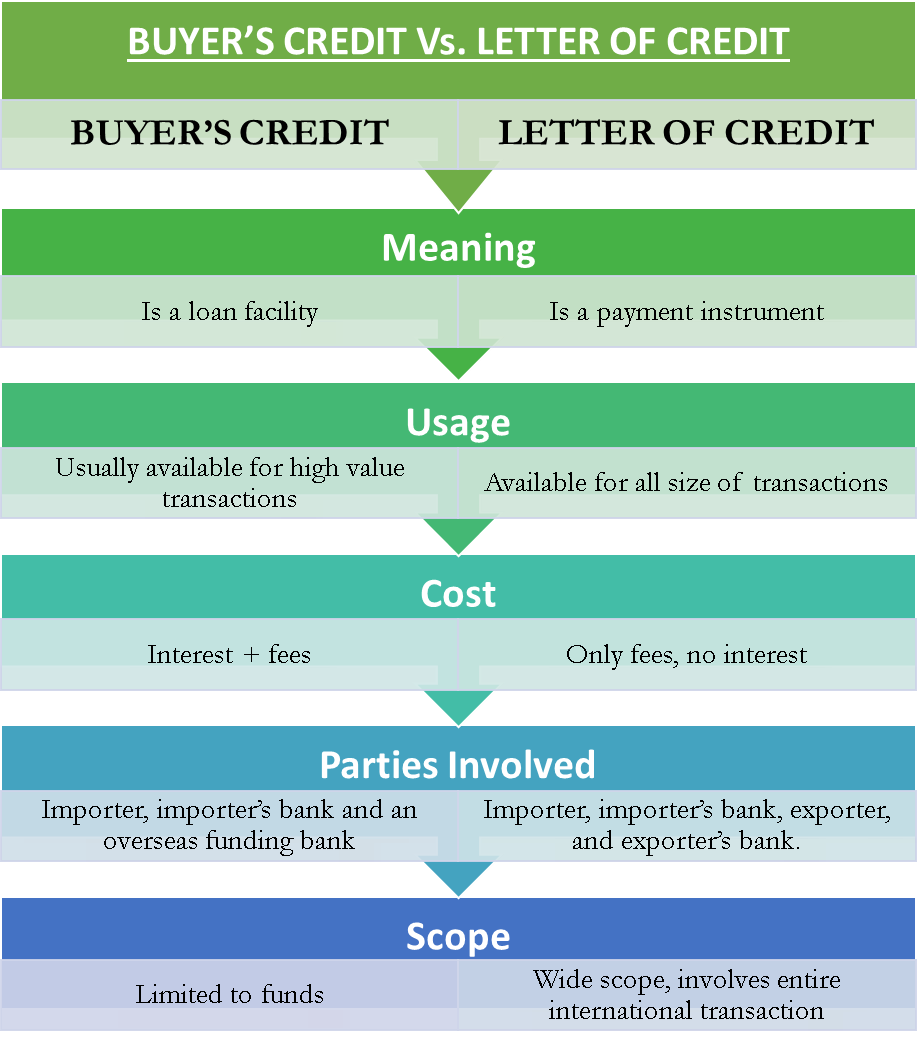

Meaning

Buyer’s credit is a loan facility available to importers from an overseas lender. The overseas lender is usually a bank or financial institution from the exporter’s country. One of the main advantages of using a buyer’s credit instead of a regular funding facility is that the borrower can choose the funding currency (USD, GBP, EURO, INR, etc.). Thus the importer can pay the exporter on time and in the currency of the exporter’s country.

A letter of credit is a payment instrument that guarantees that the seller, i.e., the exporter, will receive payment on time and for the correct amount from the buyer, i.e., the importer, if he fulfills his obligation as agreed upon.

It is important to note that, in practice, a buyer’s credit can be issued on the basis of a letter of credit. This indicates that structurally both the products are completely different.

Also Read: Letter of Credit Example

Product Differentiation

We can concur that a letter of credit is a payment mechanism in an international transaction from the above definition. However, a buyer’s credit is a loan or a credit facility to support the importer.

Usage

Buyer’s credit is usually available only for very high-value export transactions—the general minimum amount of such transactions may be a few million dollars.

On the other hand, a letter of credit is available for the smallest to the biggest export transactions.

Cost

The cost of buyer’s credit involves a rate of interest on the amount borrowed plus other processing fees.

A letter of credit does not carry a rate of interest as there is no fund borrowing involved. Banks only charge nominal fees from the buyer to issue a letter of credit.

Parties Involved

The parties involved in instrumenting a buyer’s credit are – The importer, i.e., the buyer, the importer’s bank, and an overseas bank that is funding the transaction.

The parties involved in a letter of credit transaction are – The importer, i.e., the buyer, the importer’s bank, the exporter, i.e., the seller, and the exporter’s bank.

Scope

In a buyer’s credit, there is only the movement of money. In contrast, there is a movement of goods between the buyer and the seller in a letter of credit and a movement of documents and money between all four parties involved. Thus we can conclude that the scope of the buyer’s credit is limited to funds, whereas the scope of the letter of credit is wide and covers all aspects of an international transaction.

Obligation

The obligation or the liability pertaining to the buyer’s credit falls on the part of the importer availing of the facility. In contrast, the obligation of the letter of credit falls on both the buyer and the seller. So both the buyer and the seller must fulfill the obligation on their part to instrument the letter of credit.

Thank you Mr. Sanjay Burad for very valuable and easily understandable financial transaction terms & conditions. Its a really great scholarly achievement,