A company is raising funds from different sources, and it includes debentures, preference shares, and equity shares. Payment to debenture holders and preference shareholders is at a fixed rate. No commitment is made to equity shareholders in terms of return. If there is a loss, then no payment will be made to them. However, if there is a profit, then the company needs to decide whether to pay dividends or not. If the dividend is to be paid, then what amount to be paid is required to be decided. Again, the company will take this dividend decision so that it maximizes the wealth of shareholders. There are various types of dividend policies – regular, stable, constant, and irregular. In this post, we will discuss various factors affecting dividend policy.

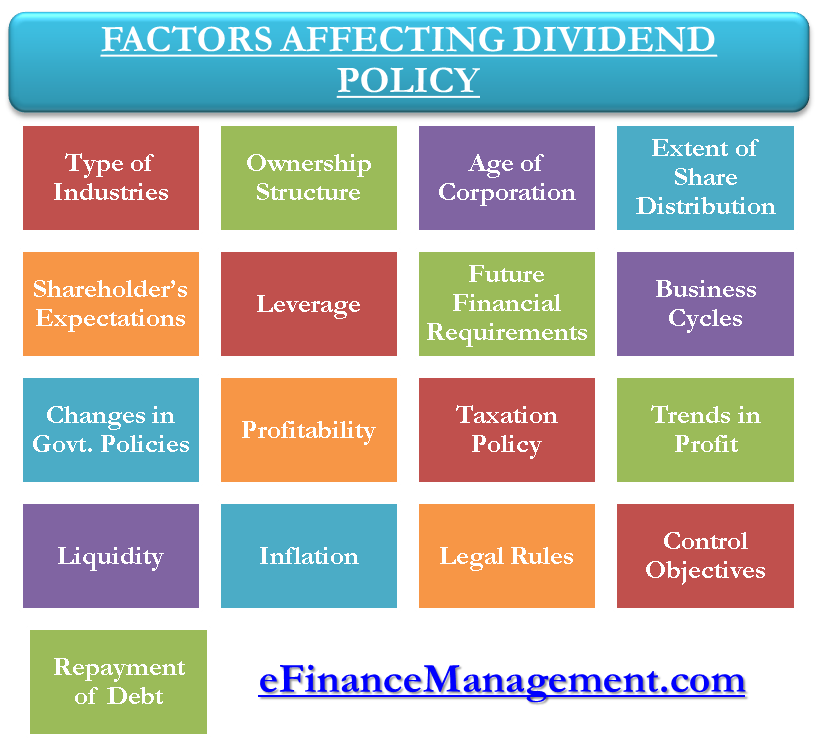

Factors affecting Dividend Policy

Before framing its dividend payout policy, a company needs to analyze certain factors affecting dividend policy.

- Factors affecting Dividend Policy

- Type of Industry

- Ownership Structure

- Age of Corporation

- The Extent of Share Distribution

- Different Shareholders’ Expectations

- Leverage

- Future Financial Requirements / Reinvestment Opportunity

- Business Cycles

- Changes in Government Policies

- Profitability

- Taxation Policy

- Trends of Profits

- Liquidity

- Legal Rules

- Inflation

- Control Objectives

- Repayment of Debt

The following are the various factors/determinants that impact the dividend policy of a company:

Type of Industry

The nature of the industry to which the company belongs has an important effect on the dividend policy. Industries where earnings are stable may adopt a consistent dividend policy as opposed to the industries where earnings are uncertain and uneven. They are better off having a conservative approach to dividend payout.

Ownership Structure

The ownership structure of a company also impacts the policy. A company with a higher promoter’s holdings will prefer a low dividend payout as paying out dividends may cause a decline in the value of the stock. Whereas high institutional ownership will favor a high dividend payout as it helps them increase control over the management.

Age of Corporation

Newly formed companies will have to retain a major part of their earnings for further growth and expansion. Thus, unlike established companies, they have to follow a conservative policy that can pay higher dividends from their reserves.

Also Read: Dividend Policies

The Extent of Share Distribution

A company with a large number of shareholders will have a difficult time getting them to agree to a conservative policy. On the other hand, a closely held company has more chances of succeeding in finalizing conservative dividend payouts.

Different Shareholders’ Expectations

Another factor that impacts the policy is the diversity in the type of shareholders a company has. A different group of shareholders will have different expectations. A retired shareholder will have a different requirement vis-a-vis a wealthy investor. The company needs to clearly understand the different expectations and formulate a successful dividend policy. Psychologically, a cash dividend will give more satisfaction to shareholders in comparison to capital appreciation.

Leverage

A company having more leverage in its financial structure and, consequently, more interest payments may decide on a low dividend payout to increase its net worth and to make sure that it can make payment of financial charges even in case of earnings of the company are falling. Whereas a company utilizing more of its own financing will prefer high dividends.

Future Financial Requirements / Reinvestment Opportunity

The dividend payout will also depend on the future requirements for the additional capital. A company having profitable investment opportunities is justified in retaining its earnings. However, a company with no capital requirements should opt for a higher dividend.

Also Read: How to Determine Dividend?

Business Cycles

When the company experiences a boom, it is prudent to save up and make reserves for dips. Such reserves will help a company to maintain dividends even in depressing markets to plow back and attract more shareholders.

Changes in Government Policies

There could be a change in a company’s dividend policy due to the imposed changes by the government. The Indian government had put temporary restrictions on companies to pay dividends during 1974-75.

Profitability

The net profit ratio and the ratio of profit to total assets reflect a firm’s profitability. A highly profitable company has the capacity to pay higher dividends, and a company with less profits will adopt a conservative dividend policy.

Taxation Policy

Corporate taxes will affect dividend policy, either directly or indirectly. The taxes directly reduce the residual earnings after-tax available for the shareholders. If dividend income is taxable in the hands of investors and capital gain is exempt, the company may retain its earnings to increase the price per share, which ultimately gives a higher return to investors and vice versa. Further, if it is possible that bifurcate all shareholders into a high tax bracket or low tax bracket, accordingly dividend policy can be framed. Finally, the objective is to give maximum return to shareholders.

Trends of Profits

Even if the company has been profitable over the years, the trend should be properly analyzed to find the company’s average earnings. This average number should then be studied in relation to the general economic conditions. This will help in opting for a conservative policy if depression is approaching.

Liquidity

Liquidity has a direct relation with the dividend policy. Often, a company with high profit may have a majority of profit blocked in working capital, or it may acquire assets. In that case, its liquidity is poor. In that case, a company should pay less dividend. High dividend payment is possible only if a company has good earnings and sound liquidity.

Legal Rules

There are certain legal restrictions on the companies for dividend payments. It is legal to pay a dividend only if the capital is not reduced post payment. These rules are in place to protect creditors’ interests. Most importantly, providing depreciation is mandatory before making payment of dividends. Depreciation is to be provided at minimum rates provided. Providing depreciation is very important because with that company is able to retain an amount of profit for the replacement of fixed assets in the future.

Inflation

Inflationary environments compel companies to retain a major part of their earnings and indulge in lower dividends. As the prices rise, the companies need to increase their capital reserves to purchase fixed assets. In the case of an inflationary situation, the same quantity of closing stock will have more valuation, so payment of tax also increases.

Control Objectives

The firms aiming for more control in the hands of current shareholders prefer a conservative dividend payout policy. It is imperative to pay fewer dividends to retain more control and the company’s earnings.

In a nutshell, a company’s management is completely free to frame the required dividend policy. It does not require adhering to any obligations. So, the company needs to judiciously weigh all the above-mentioned factors and formulate a balanced dividend policy. A dividend policy can also be revised in the wake of changes in any of the factors affecting dividend policy.

Repayment of Debt

If a substantial amount of debt is required to pay, in that case, even though the company has a high amount of earnings, it may pay less dividend.

Liked the content very much. Thank you for sharing this post.

First off I would like to say awesome blog! I had a quick question which I’d like to ask if you do not mind. I was interested to find out how you centre yourself and clear your head prior to writing. I have had a hard time clearing my mind in getting my thoughts out. I do enjoy writing however it just seems like the first 10 to 15 minutes are generally lost simply just trying to figure out how to begin. Any ideas or tips?

Appreciate it!

Thanks you very much ive learnt a lot

Great. I like it

thank you very much…i ave learnt a lot too

Well understood.

Good overview of the determinants of dividend policy. kudos.

Thank you so much for giving all points in detail . It was helpful for me .

Good Explanation Thank you so much .

Very informative and understood a lot about this