What is a Letter of Credit Financing?

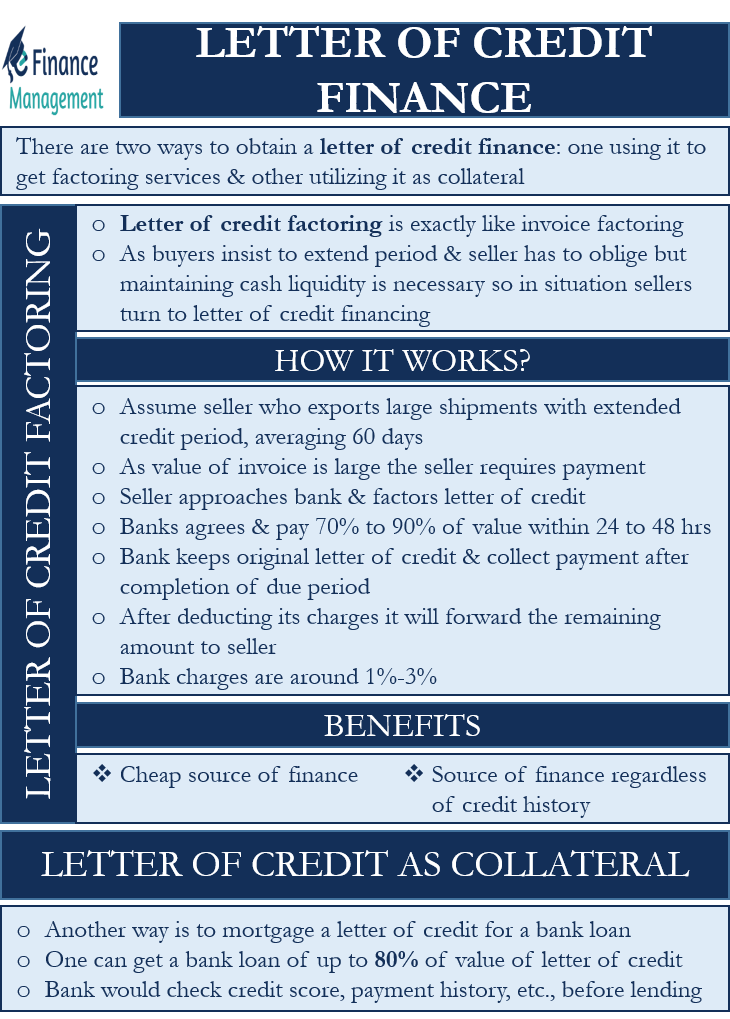

It is common knowledge that a letter of credit is a payment instrument for international trade, but not many people know that one can obtain finance through a letter of credit. There are two ways to obtain a letter of credit finance: one using a letter of credit to get factoring services and the other utilizing it as collateral.

Ways to get a Letter of Credit Finance

Letter of Credit Factoring

A seller can avail of a letter of credit finance in the form of factoring. As the name suggests, the letter of credit factoring is exactly like invoice factoring. Most buyers insist that suppliers extend a credit period of, say, 30, 60, or 90 days in recent times. As most markets have become buyer markets, it has become necessary for the sellers to oblige. However, the seller also has to keep his cash cycle liquid, and the extended credit period may not be viable. In such situations where it becomes important both abide by client expectations and maintain liquidity, the seller can turn to instruments such as the letter of credit factoring.

How does Letter of Credit Factoring Work?

Let’s try to understand this in the simplest manner. Let’s assume that you are a seller who exports large shipments with an extended credit period, usually averaging 60 days. You ask the buyer to use a letter of credit as your payment instrument. As the value of each invoice is large, you need the payment faster than the extended credit period. So you approach your bank and ask them to factor your letter of credit. Your bank agrees and starts the process. Once the process is started, you will get an upfront payment of 70% to 90% of your invoice value within 24 to 48 hours from the bank. The bank will keep your original letter of credit. After completion of 60 days, the bank will collect the payment from your buyer, deduct its charges and forward the remaining payment to you.

The bank charges on a letter of credit factoring are anywhere between 1% and 3%. Thus eventually, you will end up getting 97% to 99% of your invoice value but much before its scheduled due date.

Also Read: Letter of Credit Example

Benefits of Letter of Credit Factoring

Cheap Source of Finance

Factoring, be it receivables, invoices, or letters of credit, is a very cheap source of working capital finance. This is because banks don’t charge interest on factoring. They only deduct a percentage of invoice value which is again very cheap. Let’s understand it better with an example. Suppose you have a letter of credit worth USD 10,000.00 which you will recover after 60 days. If you need the money and use your overdraft facility, it will cost a minimum 7% interest rate. This means you are paying approximately USD 115.00 (10,000 X .07 X 60/365) as the interest rate. On the other hand, say if you are factoring that letter of credit and the bank decides to charge 1% of the value of the letter of credit, then you pay USD 100.00. And let’s not forget that we have calculated the bank interest with the minimum market interest rate; the interest rate is usually higher.

Source of Finance regardless of Credit History

When factoring a letter of credit, banks do not look at your credit history. This is because factoring is not a loan, and you are not supposed to repay anything. It is a one-time transaction, and the bank is not concerned about how you performed in the past. It will only check if the letter of credit is recoverable. So if one has a bad credit history, factoring in a letter of credit can be a very good method to obtain short-term finance.

Letter of Credit as Collateral

Another very common method to obtain a letter of credit finance is to mortgage a letter of credit for a bank loan. From a banker’s perspective, letters of credit are very strong collateral as the recovery rate is almost 100%. Therefore banks lend generously against a letter of credit. One can get a bank loan of up to 80% of the value of the letter of credit. The bank would check your credit score, payment history, etc., before lending. However, all things equal, a letter of credit acts as very good collateral, even better than real estate.

Where would I be able to finance a Letter of Credit issued by one of the USA states and a major bank?

Valuable acknowledgement but Documentary Letter of credits can only be paid once the term of LC is due. So how can a bank be sure of seller/applicant that the commodity/service will absolutely be provided to buyer at the end of the term stated in LC? What if applicant would go away after getting cash from the bank without delivering any product and so LC is not released by issuing bank.?

Yes, this hypothetical situation can be there. And of course, such a situation can be in any form of lending. The most important factor to be considered is the experience of the banker in such types of transactions coupled with industry experience and feedback. Bankers are in the field of financing and extending loans etc. And they have the mechanism to assess the extent of non-performance and how to take care of that aspect. Still, once in a blue moon any such instance may come up. That does not mean the bankers will stop financing or funding. So this game of probability is countered by the other fallback mechanism by the bankers.