Do you know that when people around you go to buy their dream car, they use what is known as a negotiable instrument? Imagine yourself going to buy a car. You do not have that much cash at home. Even if you have, you will not take a car’s value of cash with you. You will simply pay the car dealer in check. You used a negotiable instrument for this transaction.

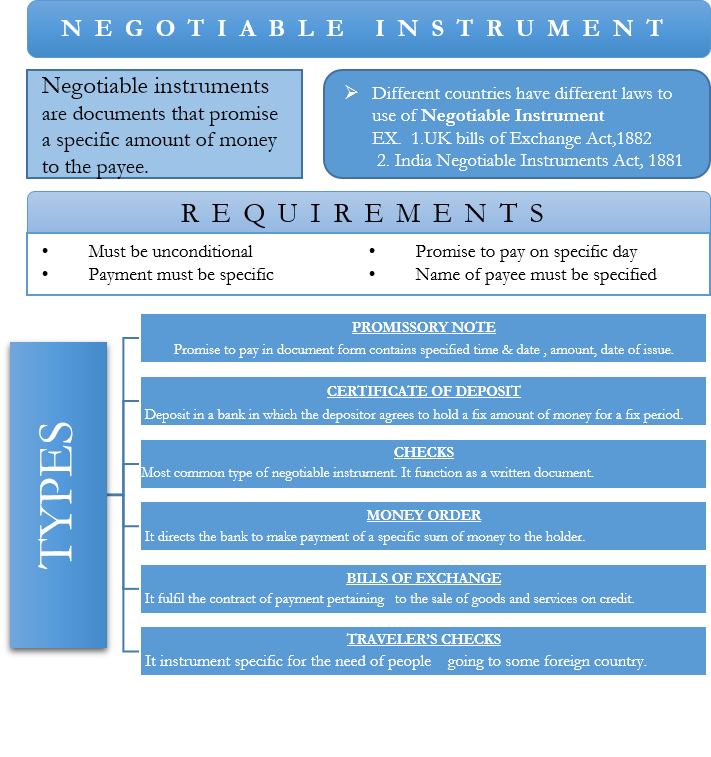

Negotiable instruments are instruments of the money market that promise a specific amount of money to the payee. The document includes the payee’s name as well as the amount to be discharged to him. The date of the payment can be set while signing the document or when the payee demands. Among others, the key feature of negotiable instruments is that they are transferrable in nature. This means that the payee or the assignee of a negotiable instrument can transfer it in favor of a third party. The third party then obtains the full legal right of the negotiable instrument. Often, payees do this by ‘endorsing’ the negotiable instrument.

Negotiable Instrument: The Uniform Commercial Code

Different countries have different laws codifying the use of negotiable instruments. For example, the UK has the Bills of Exchange Act, 1882; in India, there is a Negotiable Instruments Act, 1881. In the US, we have the Uniform Commercial Code to govern the issue and transfer of these transferable instruments. According to this law, a negotiable instrument to be legal must observe the following requirements:

- The agreement or guarantee to make the payment must be unconditional, which means that no supplementary or extra condition can be set for the payee to fulfill.

- The amount of the payment must be specific, and this amount can include interest.

- The name of the payee must be specified.

- The promise to pay either on-demand on a specific date

- The promisor must not be required to perform any other act other than paying the amount specified

Types of Negotiable Instrument

Promissory Note

A promissory note is a promise of payment in a document form, of course. When you put your signature on this note, you are legally obliged to make payment to the payee. A promissory note is not just a random note on a paper promising a specific amount. It contains a specific date, a specific amount, a date of issue, a specific rate of interest, and any other fee. In short, it contains all the terms of the agreement between the two parties. The credibility of the person issuing a promissory note is of great consequence. If the payee doubts the credibility of the person issuing the promissory note, he will not accept it.

Certificate of Deposit

A certificate of deposit is a type of deposit in a bank in which the depositor agrees to hold a fixed amount of money with the bank and for a fixed period.

When we open a savings account with a bank, we deposit our surplus income or savings in that account. In exchange, the bank pays us a rate of interest on the amount we deposit. The bank then lends our money to those in need in the form of home loans, education loans, etc. Banks charge a higher rate of interest on these loans than the rate of interest they offer us on our savings account deposits. Out of the difference in these two rates of interest, banks make their profits.

But the problem with this model is that banks can not predict when their depositors will come to withdraw money from their savings accounts. As a result, banks cannot loan or advance every single penny they receive from deposits. But to keep the deposit money idle will not earn the banks anything. To reduce this uncertainty, banks offer certificates of deposit. These negotiable instruments are for a fixed period, typically for 6 months and 12 months. In return for this promise by the depositor to keep the deposit for a fixed period, they earn a higher interest rate on the certificate of deposits.

Checks

Checks are the most common types of negotiable instruments. They function as a written document in the specific format of the bank, which directs the bank to pay a certain sum of money to the holder. People use a check as a way of making cashless payments, typically when the payment involves a large sum of money. The person issuing the check must have deposits made with the bank out of which to pay the holder. There is no specific date mention of date on a check which means the banker must make the payment upon the holder’s demand. With online baking, however, the usage of checks is declining since they are primarily a cashless way of doing transactions. The person holding the check does not get immediate payment as it takes some time for the bank to process the payment.

Also Read: Time Draft

Money Order

A money order is a similar form of a negotiable instrument as a check. As in the case of checks, a money order directs the bank to make payment of a specific sum of money to the holder. The major difference is that the person making the payment does not need to have a bank account to issue a money order. You pay for the money order in cash and send it to the payee. The payee then exchanges it for cash from his end.

Unlike checks, money orders have a limit on the maximum value, usually- $1000. Those who want to make greater payments through money orders have to purchase multiple of them.

Traditionally, money orders come into use when the payor and the payee live apart in different places. International money orders are also common as you don’t have to cash them in the nation of origin.

Bills of Exchange

Bills of exchange are a means to fulfill the contract of payment pertaining to the sale of goods and services on credit. A bill of exchange has three parties. The drawer (who owns the money, can be someone who purchases goods on credit), the drawee (the person whom the drawer directs to make the payment, can be a bank), and the payee (the person who will receive the money, typically seller). It is also known as bills receivable or bills payable. The date of payment in the case of a bill of exchange is most of the time specified. Sellers use bills of exchange to make their credit sales legally binding upon the buyer.

Traveler’s Checks

Traveler’s Checks are another form of negotiable instrument specific to the need of people going to some foreign country. People use them as an alternative to foreign currency. Only financial institutions can issue this negotiable instrument. Traveler’s checks have a serial number, and they are for the fixed and prepaid amounts. They necessitate two signatures for the transaction to happen: one at the time of purchasing the check and the other at the time of cashing it. The two signatures must match.

They provide a great source of safety to people going on abroad for vacation or for business, as they do not have to carry a large amount of foreign currency with them.

Commercial Papers

Commercial papers are issued by large corporations to meet their short-term liabilities.