Meaning and Similarities of Time Draft and Sight Draft

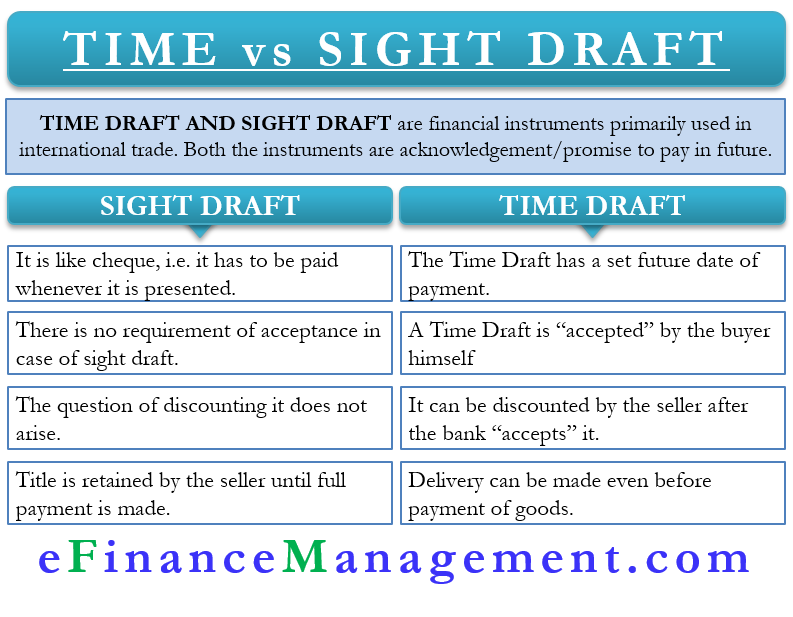

Time Draft and Sight Draft are financial instruments primarily used in international trade. Both the instruments are promissory and acknowledge that the buyer will make payment to the seller of the goods. In the majority of cases of business across borders, the seller and buyer are not known well to each other. These instruments reduce or mitigate the risks arising out of such a situation where the buyer might not pay after receiving the consignment. Though both the instruments have similar characteristics, they differ in the following ways:

Key Differences between Time Draft and Sight Draft

Immediate Payment vs Deferred Payment

A Sight Draft is as good as a cheque, i.e., it has to be paid whenever it is presented. Being said so, it does not necessarily guarantee that the payment will be immediate. Generally, it takes a few working days for the Bank involved to check the genuineness of the transaction and the documents presented along with. Verification of the Bill of Lading, Letter of Credit, and any other document as the Bank feels appropriate is done. After being fully satisfied, the Bank will process the payment to the presenter.

On the other hand, a Time Draft has a set future date of payment. It is a sort of short-term credit facility provided by the seller to the buyer. For example, the terms of the agreement can state that the buyer will make payment after 60 days of shipping of the goods. In some cases, the buyer may even make the payment after taking delivery of the consignment and checking the goods received. Therefore a Time Draft is preferable from a buyer’s point of view and vice-versa.

No Acceptance of Sight Draft

A Time Draft is “accepted” by the buyer himself, i.e., the buyer vouches for making the payment at the said date. In case the exporter is not willing to rely upon the importer, the exporter may want to involve a Bank in between. The Bank would then “accept” to make the payment to the seller, which is called a Banker’s Acceptance. It will take the payment from the buyer immediately or at a later date, as per its relationship with the buyer. It does this in exchange for a fee or commission. The Bank becomes liable to make the payment at the said date, and thus, the exporter gets assured of payment.

Also Read: Time Draft

A Sight Draft cannot be “accepted” because it is an instrument for payment at presentation. There is no time lag in between and hence, no requirement of acceptance.

Discounting of Time Draft

The seller can discount a Time Draft after the bank “accepts” it and sends it back to him. He can sell it at a discount either in a secondary market or at its present value to a bank. This way, the seller receives the amount of the draft immediately and can use the money. The third party buying the draft will get the full value at the maturity date.

Because a Sight Draft is payable instantly at total value when presented, the question of discounting it does not arise.

Transfer of Title

In the case of the Time Draft, the importer can take the delivery of goods even before paying for it. He can check and ascertain the quality and quantity of the products received as per the contract and make the payment at the maturity date. Hence ownership and title to the goods can be transferred to the buyer even before the payment is made.

Whereas in the case of Sight Draft, the exporter generally retains the title to the goods until he gets the full payment. The exporter would immediately present the instrument for payment and avoid default risk, if any.

I have a really huge project that I’m working on and in need a bank relationship who understands sight drafts and too works in the crypto currency space.

Do you have a few bank you can recommend please?