The dictionary meaning of Chattel is a piece of personal property that is moveable and generally does not includes land and buildings. Therefore, Chattel Mortgage is a loan given against or relates to a personal movable piece of property. Hence, under such a mortgage arrangement, the loan is sanctioned to an individual or business for acquiring the chattel-a movable property. And this property relating to a loan can be for personal or commercial use. And this chattel serves as collateral or security for the loan. In other words, a mortgage arrangement over the assets which are yet to be acquired from the sanctioned loans.

The movable personal property could be a car, mobile home, modular home, machinery, truck, trailers, and more. This type of mortgage is also perfect for Mobile Homes. This is because mobile homes are situated on leased lands. So, mobile homes don’t qualify for a traditional mortgage.

The listing of such loan arrangements happens in the public registry. This ensures that borrowers can not use the same vehicle or asset to get another loan or sell the asset without notifying the lender. Thus, the listing avoids duplicate financing on the same asset.

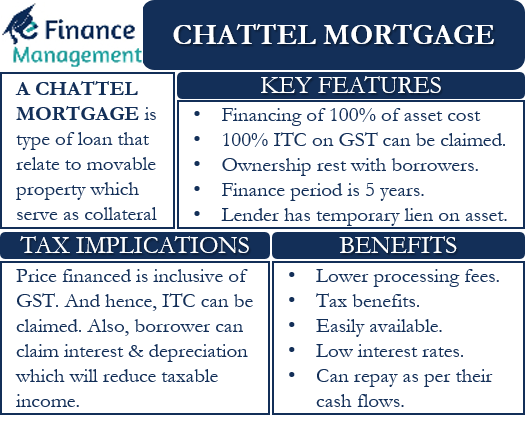

Key Features of Chattel Mortgage

Following are the key features of a Chattel Mortgage

- A borrower can get financing equal to 100% of the asset cost, including the GST amount.

- Borrowers can claim 100% of the GST amount as the input tax credit.

- The borrower continues to remain the owner of such financed assets. But, lenders have a temporary lien on the asset till the loan is repaid.

- The finance period is generally up to five years.

- A borrower can use this financing for both new and used movable assets.

- Such financing gives borrowers the flexibility in structuring the balloon repayment.

- Borrowers also get the flexibility in structuring the monthly payments.

Benefits of Chattel Mortgage

Following are the benefits of Chattel Mortgage:

- A borrower has options when it comes to structuring the repayment. Usually, such financing is for 2 to 5 years.

- The borrower also has the option to pay back the same amount every month. Or, they can structure the repayment as per their cash flows.

- Interest rates on such loans are generally less than the traditional loans. And the interest rates can be fixed as well as variable.

- Since borrower gets the ownership of the asset up-front, they can show it as an asset on their balance sheet. They can claim depreciation. And both these expenses will be debited to the Profit and Loss Account, thereby availing Income Tax Benefits.

- The borrower has the flexibility under such an arrangement to decide and propose a balloon or residual payment towards the end of the loan period. This helps to lower the monthly payments. A balloon payment is an amount that is not paid until the end of the agreement. This means that the more the balloon payment, the less will be the monthly repayments. However, a higher balloon payment may raise the interest payment you make over the loan period. This is because you will not be repaying a sizable portion of the principal amount with the monthly payments. So, the overall interest cost and cash flow need to be considered while deciding.

- Such type of financing is more easily available than a conventional loan, including for borrowers with a bad credit history.

- Borrowers can get certain tax benefits with this type of financing.

- Such loans usually have lower processing fees than traditional loans.

How it’s Different from Traditional Loans?

Such types of loans are very different from traditional loans.

In a traditional loan, a bank or a financial institution extends a loan on the basis of collateral that the borrower deposits. The collateral is usually land, house, etc. However, in a Chattel Mortgage, the loan is secured by ‘chattel,’ which is the movable property, and that very asset remains the asset on which financing is done.

The bank or the financial institution extending the loan holds a lien on chattel until the borrower pays back the full amount. Further, generally in such loans, the interest rates are also comparatively lower than that of traditional loans.

Chattel Mortgage and Lenders

Until the borrower pays off the mortgage, the movable property, though it belongs to the owner, the lender continues to have a lien over the property. And while the borrower is free to use the asset, but can not exercise its ownership rights with regard to disposal, etc. However, the lien for the lender is not permanent. This means once the borrower pays the loan in full, the property belongs to the borrower, and the lender can not take it back or resell it.

Of course, the lender has all the rights to seize the property and dispose of it to recover his outstanding loan if the borrower defaults on regular payment of installments. Such a type of mortgage is advantageous for the lenders as well. Since the security is movable, they can easily sell it in case of a default.

Tax implications

In a chattel mortgage, the price of a vehicle or movable property that is financed is inclusive of the goods and services tax (GST). So, the borrower can claim an input tax credit up-front.

Moreover, the borrower will also be free to claim the interest and depreciation costs if the asset qualifies for such costs. This would help borrowers to lower their taxable income.

Chattel Mortgage vs Leasing – Which is Better?

A lease is simply a long-term agreement for the use of the movable property. In a lease, one pays a monthly rent, depending on the lease period and asset type. The lease payment includes the operating costs of that asset. In the case of a vehicle, these costs could include tyres, servicing, and registration. The asset goes back to the Lessor or the owner once the lease term is over.

In Chattel Mortgage, the borrower is the owner of the asset. Thus, the borrower needs to bear all the risks (such as the risk for the resale value) and costs. The monthly payment that the borrower makes covers only the finance or loan part. Therefore, the operating cost is borne by the borrower. Secondly, since the ownership remains with the borrower, the asset (Chattel) continues to remain with the borrower even after the loan term and payments are over, unlike in a lease arrangement.

Final Words

A Chattel loan could be the best option if you are looking to buy a mobile home or a movable piece of equipment. To get the best out of the Chattel Mortgage, it is crucial that you have all the information that matters. The information here means how long you plan to use the asset, cash-flow expectations, and the effective life of the asset. Clarity on this key information will help one to negotiate a better loan deal in accordance with your requirements.