Hypothecation: Meaning

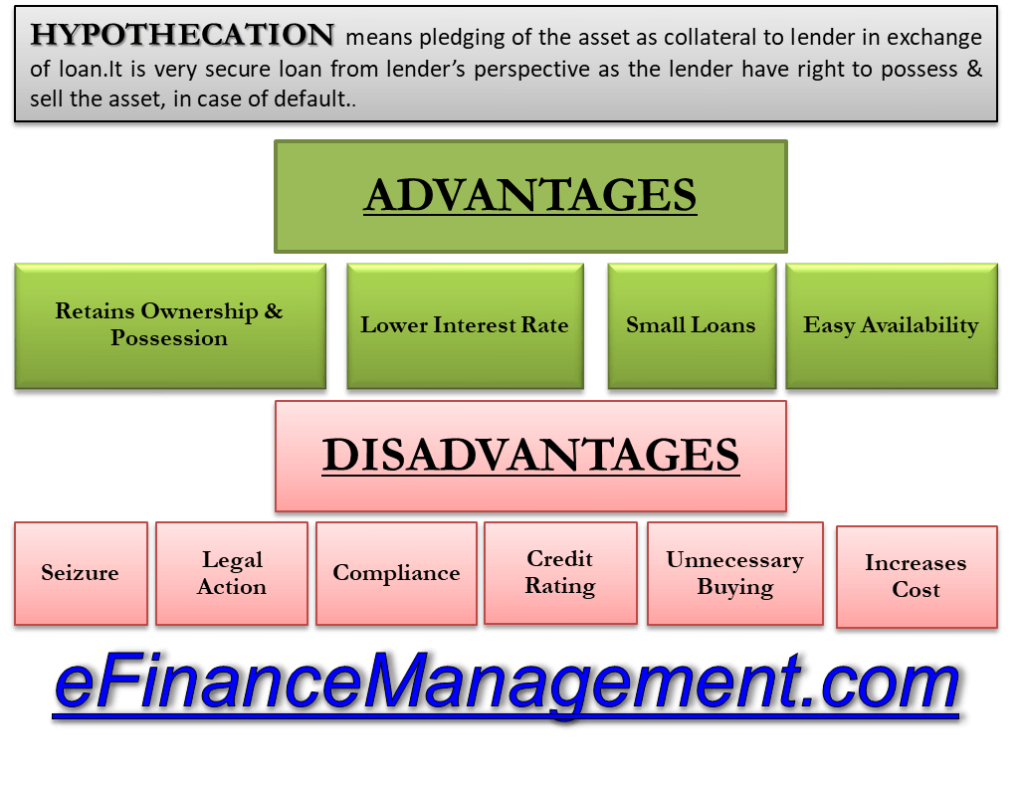

Hypothecation means pledging the asset as collateral to the lender in exchange for a loan. It is a very secure loan from the lender’s perspective as the lender has the right to possess & sell the asset in case of default. There are some advantages & disadvantages of hypothecation.

No title transfer, possession, or ownership transfer takes place in hypothecation. However, the lender can seize the asset & sell it if the terms of the agreements are not met.

For Example, you buy a car on loan. You pledge a car as collateral to the bank. Now you know you are the owner of the car & you use it & possess it. No title transfer, possession, or ownership transfer takes place.

Advantages of Hypothecation

Retains Ownership & Possession

Unlike pledging & mortgage, ownership & possession remains with the borrower in hypothecation. No title transfer, ownership transfer, or possession transfer takes place. However, the lender has the right to possess & sell the asset in case of default by the borrower or violation of terms of the hypothecation agreement.

Also Read: Hypothecation

Lower Interest Rate

As the lender has an asset as collateral, the loan is considered more secure. Consequently, more lenders are available for such a loan. Due to high competition between lenders, interest on such a loan is lower compared to an unsecured loan.

Small Loans

Unlike a mortgage, this is done for a small number of loans. As a result, it is easy to use & payoff. Generally, hypothecation is done for small loans like car loans and home appliance loans.

Easy Availability

This is a major benefit of hypothecation. An asset secures a loan, and therefore there is cut-throat competition in the market. We know the competition is beneficial for customers, more the suppliers, easy the availability.

Disadvantages of Hypothecation

Seizure

If the borrower is not able to pay installments/EMI, then the lender has the right to seize the asset & sell it. The lender may also seize the asset if terms & conditions of hypothecation are not met. Suppose the borrower has paid all installments except the last 3 or 4, then also the lender may seize the asset.

Legal Action

The lender may take legal action if the lender is not able to recover all dues even after selling the seized asset. Therefore the borrower has to face legal consequences, including a penalty or imprisonment.

Compliance

The borrower has to comply with the terms & conditions from time to time. e.g., submitting stock statements every month while taking cash credit. If you fail to comply, you will be liable for a penalty. This may become a headache for the borrower.

Credit Rating

If you default in repayment of a loan, it may affect your credit rating score. If your credit rating score is low, then further borrowing may become difficult for you.

Unnecessary Buying

As the loans are available easily at a lower interest rate, you may buy the asset even if it is unnecessary.

Increases Cost

The borrower makes payments in installments. Installments include interest which increases the amount to be repaid on the asset. Generally, the cash price is lower than the asset bought in installments.